Substance Over Form Business Definition

The doctrine of substance-over-form is one of the IRSs weapons of choice in attacking such transactions. A transaction is an instance of an event that could alter the financial status of a business entity.

Chapter 21 The Regulatory And Conceptual Framework

Chapter 21 The Regulatory And Conceptual Framework

Substance Over Form Substance over form is an accounting concept if said in a complete phrase from which this term is extracted then it will be something like this.

Substance over form business definition. Although the legal form of the relationship between the individual and the company is that of a client independent contractor relationship SARS. Generally the effect of the application of the doctrine is to produce a tax result that differs from the tax result that its form would otherwise demand. A transaction usually is a contract between a buyer and a seller which gives rise to an asset for one entity andor a liability for the other.

Substance over form is the concept that the financial statements and accompanying disclosures of a business should reflect the underlying realities of accounting transactions. What does SUBSTANCE OVER FORM mean. Conversely the information appearing in the financial statements should not merely comply with the legal form in which they appear.

The idea that a companys accounts should show what it has really earned in a particular period what it owns and owes etc rather than calculations that are formally or legally correct but do not describe. The Statute Case Law and Potential Penalties The IRC defines the economic substance doctrine as the common law doctrine under which. Economic substance refers to the underlying economic or commercial purpose of a business transaction apart from its legal or tax considerations.

Legal form refers to the clarification of transactions in accordance with the applicable law regulation or accounting standard. The idea that a companys accounts should show what it has really earned in a particular period what it owns and owes etc rather than calculations that are formally or legally correct but do not describe the situation accurately Want to learn more. Substance over form means the accounting record must reflect with the nature of transactions economic substance rather than the legal form.

Substance over form is an accounting concept which means that the economic substance of transactions and events must be recorded in the financial statements rather than just their legal form in order to present a true and fair view of the affairs of the entity. The concept substance over form means that the transactions recorded in the financial statements must reflect their economic substance rather than their legal form. SUBSTANCE OVER FORM meaning - SUBSTANCE OVER FORM d.

Substance over form concept entails the use of judgment on the part of the preparers of the financial statements in order for them to. Substance over form concept in accounting is defined as an accounting concept which demands that transaction and other events should be accounted for and presented in accordance with their substance and financial reality and not merely with their legal form. Whether or not formal.

Similar to the sham transaction analysis the so-called substance over form doctrine maintains that the substance rather than the form of a transaction is what governs the tax consequences of a transaction. Substance over form is an accounting principle which recognizes that business transactions should be accounted in accordance with their economic substance instead of their legal form. The substance over form concept allows that transactions and other events are accounted for and presented in accordance with their economic and commercial reality rather than their legal form so machinery should be recorded as non-current asset.

From Longman Business Dictionarysubstance over formˌsubstance over ˈformnoununcountableACCOUNTINGthe principlethat what actually happens or is actually done may be different from and sometimesmore importantthan the legalor technicalway that something is describedsubstance over form accounting standards. Substance over form is an accounting concept which requires transactions and other events to be accounted for according to their substance and not merely their legal form. Transaction s are not allowable if the transaction does not have economic substance or lacks a business purpose.

For Accounting purposes economic substance of the transaction will be preferred over the legal form of the transaction. The phrase substance over form is a short version of its original meaning In case of conflict between substance and form of a transaction the substance of transaction shall prevail over its form Let us understand the meanings of substance and form separately. Economic substance refers to the true intention behind the transactions.

Improve your vocabulary with English Vocabulary in. That doctrine holds that the substance rather than the technical form of a transaction governs its tax consequences.

Accounting Concepts And Principles Made Easy

Accounting Concepts And Principles Made Easy

What Is A Substance Definition Types Examples Video Lesson Transcript Study Com

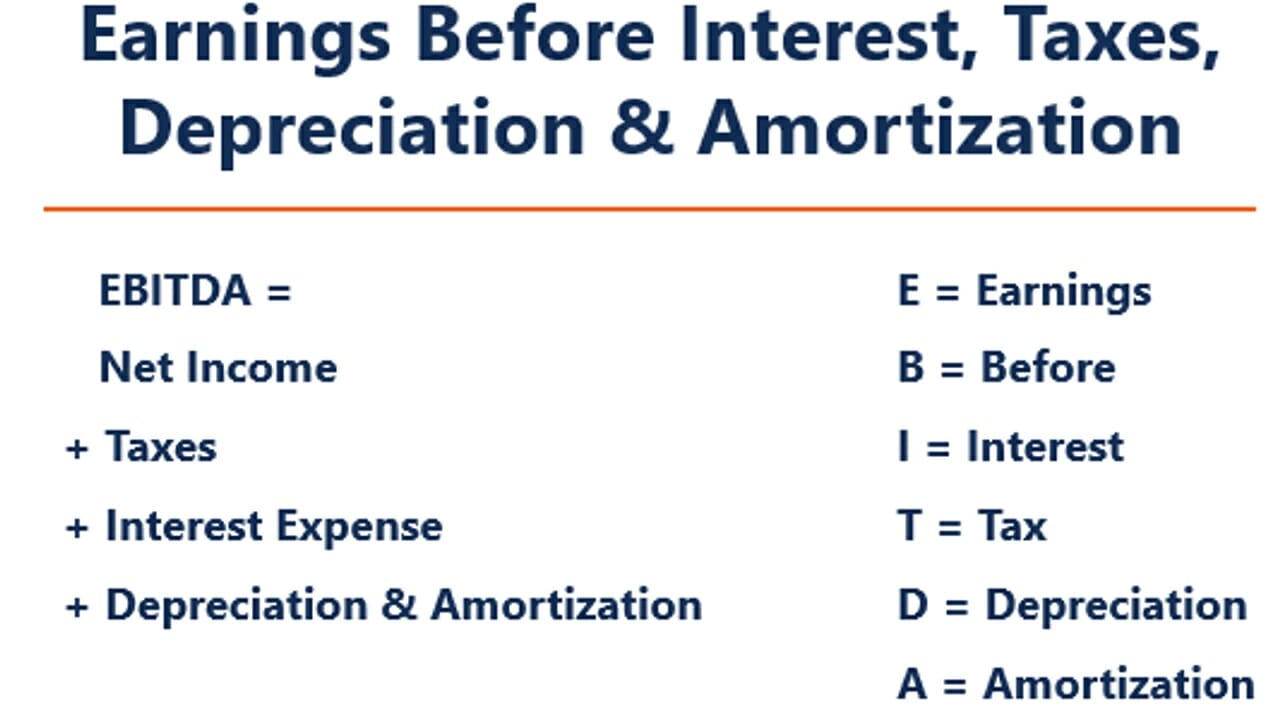

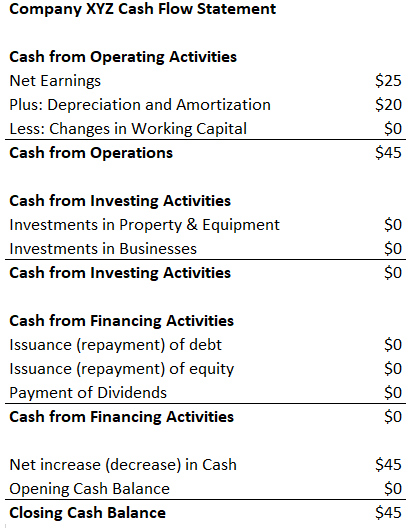

What Is Ebitda Formula Definition And Explanation

What Is Ebitda Formula Definition And Explanation

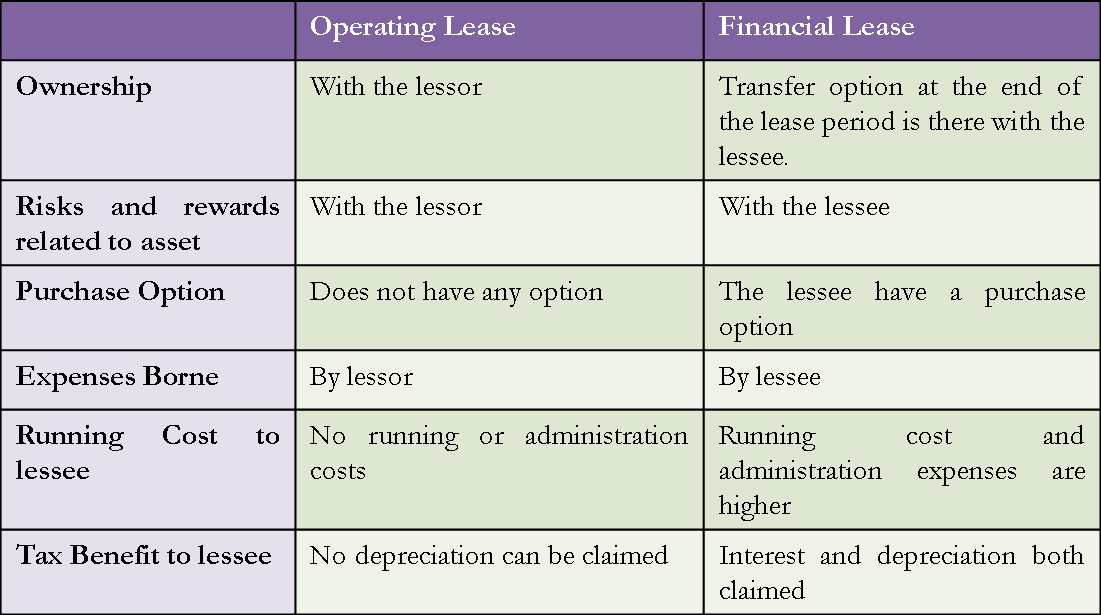

Difference Between Operating Versus Financial Capital Lease Efm

Difference Between Operating Versus Financial Capital Lease Efm

Accounting Concepts Completeness Neutrality Others Accounting Corner

Chapter 21 The Regulatory And Conceptual Framework

Chapter 21 The Regulatory And Conceptual Framework

Chapter 21 The Regulatory And Conceptual Framework

Chapter 21 The Regulatory And Conceptual Framework

What Is A Substance Definition Types Examples Video Lesson Transcript Study Com

What Is A Substance Definition Types Examples Video Lesson Transcript Study Com

What Is The Matching Principle Accounting Clarified

Chapter 21 The Regulatory And Conceptual Framework

Chapter 21 The Regulatory And Conceptual Framework

What Is A Business Combination Definition International Implications Video Lesson Transcript Study Com

Substance Over Form Concept Of Accounting Definition Explanation Use And Application Examples

What Is Ebitda Formula Definition And Explanation

What Is Ebitda Formula Definition And Explanation

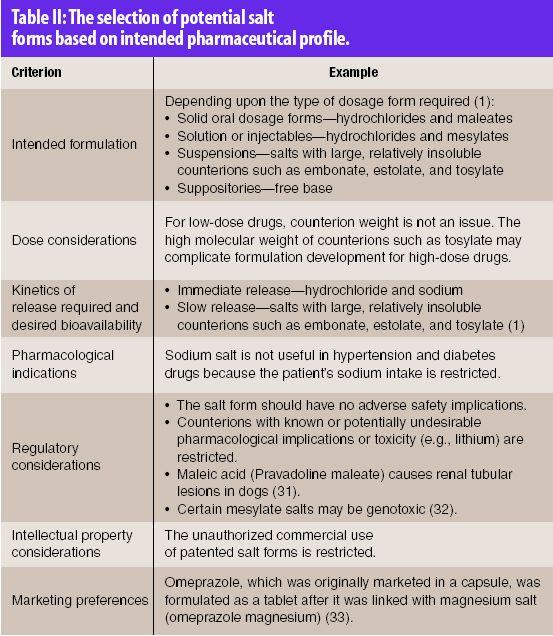

Salt Selection In Drug Development

Salt Selection In Drug Development

What Is Substance Over Form What Does Substance Over Form Mean Substance Over Form Meaning Youtube

What Is Substance Over Form What Does Substance Over Form Mean Substance Over Form Meaning Youtube

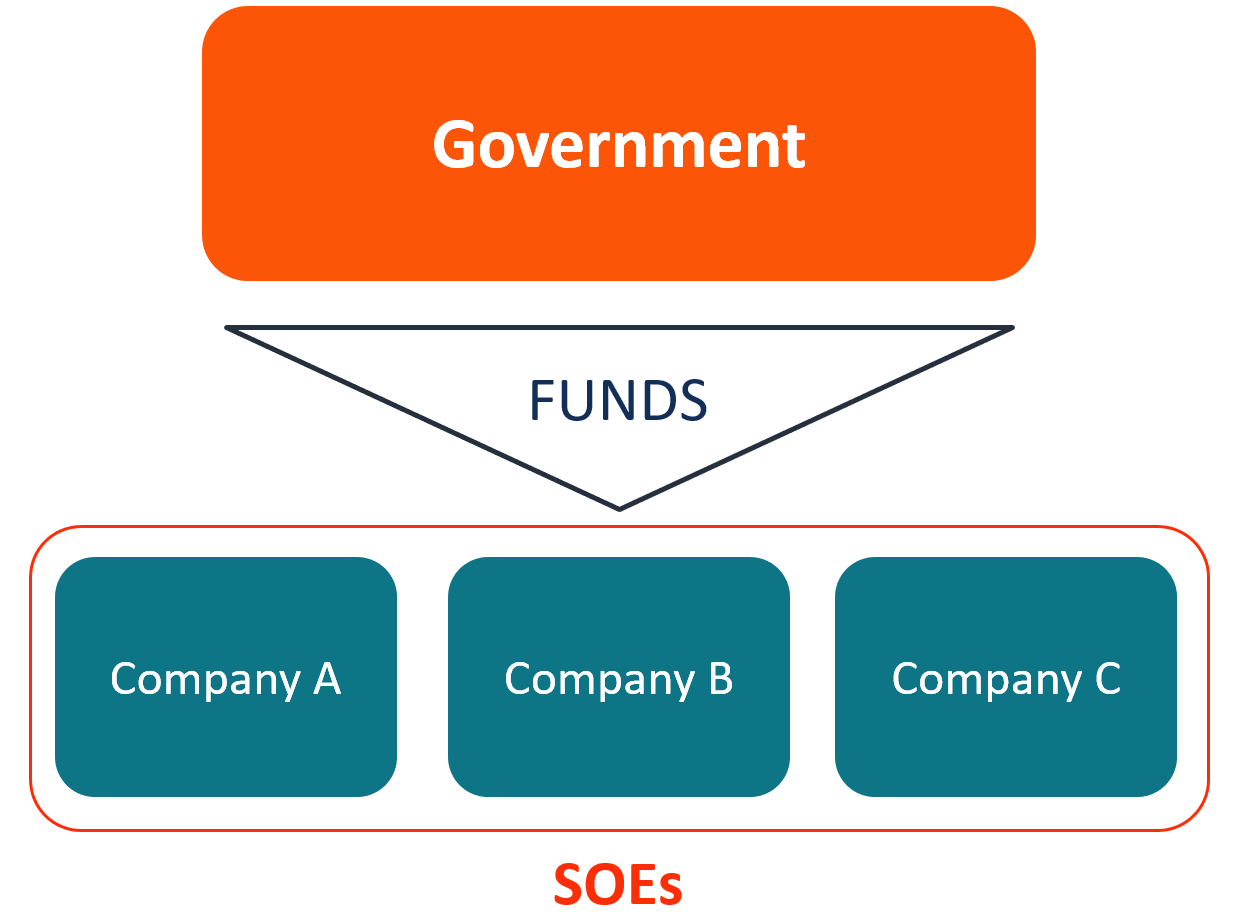

State Owned Enterprise Soe Overview Purpose And Examples

State Owned Enterprise Soe Overview Purpose And Examples

What Is Substance Over Form In Accounting Gocardless

What Is Substance Over Form In Accounting Gocardless

Accounting Concepts And Principles Made Easy

Accounting Concepts And Principles Made Easy

/GettyImages-709138923-43211cd4ab064f3e8c2f3dc8cca9a4d6.jpg)