How To Get Military 1099 R Form

You can verify or change your mailing address by clicking on Profile in the menu and then clicking on the Communication tab. Scroll down to Retirement Plans and Social Security and click Show more Scroll down to IRA 401k Pension Plan Withdrawals 1099-R and click Start.

Con Artists Using Fake Military Documents To Swindle Money Using Soldier S Identities Guardian Of Valor Doctors Note Template Army Counseling Forms

DFAS recently announced the schedule that DFAS will release W2s and other military tax forms including Retiree Account Statements RAS Retiree 1099R and Annuitant 1099R forms Form 1095 health insurance verification forms and other related tax forms.

How to get military 1099 r form. On IRA 401 k Pension Plan Withdrawals 1099-R click the start or update button. 31 of the current year have questions about their 1099-R form or need to update their mailing address may contact DFAS by phone at. You can request your 1099R be sent either to your current address or to a new address using an online form.

Income in respect of a decedent is earned by a deceased person before death. Please follow these instructions to enter your Form 1099-R. Login to your TurboTax Account.

Regarding 1099-R distribution codes retirement account distributions on Form 1099-R Box 7 Code 4. Sign in to your account click on Documents in the menu and then click the 1099-R tile. Income - Select My Forms.

Annuitants who did not receive their 1099-R by Jan. So the income is taxable to the recipient in the year received. Retirees seeking their 1099R have two options.

Plus you can request prior year 1099Rs. Use Services Online Retirement Services to. 1099-R RRB-1099 RRB-1099-R SSA-1099 - Distributions from pensions annuities retirement IRAs social.

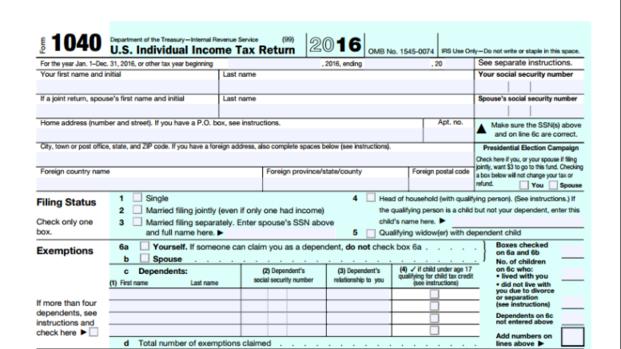

File Form 1099-R for each person to whom you have made a designated distribution or are treated as having made a distribution of 10 or more from. To enter Form 1099-R go to. Youll report amounts from Form 1099-R as income.

Request a duplicate tax-filing statement 1099R. To enter a form 1099-R -. If you are having a hard time finding your military or retirement W-2 or 1099R dont worry they are always available online on the Defense Finance and.

IRS Form 1099-R The TSP has mailed IRS Form 1099-R Distributions From Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc to participants who received a withdrawal up to December 27 2019 andor a taxable distribution of a loan up to December 31 2019. Youll generally receive one for distributions of 10 or more. Getting Your 1099-R.

Tax season is officially upon us all. Information about Form 1099-R Distributions From Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc. 2020 tax forms will.

Withdrawals processed on December 30 and 31 are taxable income for 2020. Report military retirement pay awarded as a property settlement to a former spouse under the name and TIN of the recipient not that of the military retiree. One for the IRS.

You will receive your 1099R in the mail in seven to ten business days. How do I obtain a 1099 form from VA. Therefore VA does not send out 1099 forms.

This is because its income in respect of a decedent. Change your Personal Identification Number PIN for accessing our automated systems. Members can also request additional copies of their 1099-R tax statements in several different ways.

Info Copy Only including recent updates related forms and instructions on how to file. The plan or account custodian completing the 1099-R must fill out three copies of every 1099-R they issue. Please note that 1099-R reissues requested through AskDFAS cannot be mailed prior to February 10 2021.

The federal tax filing deadline for individuals has been extended to. Click on Federal Taxes Personal using Home and Business Click on Wages and Income Personal Income using Home and Business Click on Ill choose what I work on if shown Scroll down to Retirement Plans and Social Security. Retrieve it from their MyPay account or call the DFAS Retiree and Annuitants customer service telephone line at 1.

A 1099-R is an IRS information form that reports potentially taxable distributions from certain types of accounts many of which are retirement savings accounts. Form 1099-R is used to report the distribution of retirement benefits such as pensions and annuities. Click Take Me To My Return Click Federal from the left side of your screen.

VA benefits are not taxable. However it wasnt paid to the person until after death. Click on any of the following links to learn more about your options on requesting a 1099-R.

Military retirees and annuitants receive a 1099-R tax statement either electronically via myPay or as a paper copy in the mail each year. The dates are staggered so we have a list below that covers the release dates. Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities.

Start change or stop Federal and State income tax withholdings. How to request your 1099-R tax form by mail. Well send your tax form to the address we have on file.

You should receive a copy of Form 1099-R or some variation if you received a distribution of 10 or more from your retirement plan. If you need a statement of benefits paid please contact your VA Regional Office.

Are Military Retirements Exempt From Taxes

Wait For Tax Statements Before You File Military Com

Reporting Tricare On Your Tax Return Military Com

Taxes 1099r Forms And W4 Forms

3 Reasons Not To File Your Tax Return Yet Military Com

Get A Replacement W 2 Or 1099r Military Com

Moaa Here S When You Can Get Your Military Retiree Or Annuitant Tax Statement

Suta Request Form Pdf Fill Out And Sign Printable Pdf Template Signnow

Military Registration Form Fill Online Printable Fillable Blank Pdffiller

27 Printable Military Form Templates Fillable Samples In Pdf Word To Download Pdffiller

Tax Statements For Separated Troops Military Com

Whiteman Air Force Base Community Tax Toolkit

Defense Finance And Accounting Service Dfas Military Retirees And Annuitants Facebook

Solved Military Scenario 2 Alfred Booker Interview Notes Chegg Com

Taxable Income From Retired Pay Military Com

Https Home Army Mil Carlisle Index Php Download File View 328 498