How To Register A Foreign Company For Vat

When you start a new company you or your tax agent must inform Revenue. Navigate to SARS Registered Details functionality.

Vat Registration For A Non Eu Based Company Maupard

A copy of the certificate of incorporation of your company.

How to register a foreign company for vat. There are no penalties for a delayed French VAT registration. The representative and company are jointly liable for the reporting and payment of VAT to the Norwegian authorities. In such case the foreign company does not have to register for local VAT.

Register for UK VAT as a foreign business. It was proposed in the budget speech that in order to curtail foreign businesses who supply goods and services essentially in cyber space from escaping the VAT net that all foreign business supplying digital goods and services will be required to register as VAT. To register for tax you must have a Companies Registration Office CRO number issued by the CRO.

Follow the easy steps below to register for VAT on eFiling. In order to register to VAT in Poland foreign company should. On the Tax Practitioner and Organisations eFiling profiles the SARS Registered Details functionality is under the.

Register for VAT Most businesses can register online - including partnerships and a group of companies registering under one VAT number. Submit the registration form to your local SARS branch within 21 days from date of exceeding R1 million. The subtleties of VAT.

If you only sell digital products in B2B transactions then you do not need to register for EU VAT. On the Individual portfolio select Home to find the SARS Registered Details functionality. Foreign companies registering for a French VAT number must submit their application with the Service des Impôts des Entreprises.

How to register for VAT on eFiling. French VAT registration for foreign companies. This is known as a Non-Established Taxable Person NETP registration.

If you import goods into a foreign country for the purpose of selling those goods you likely have a VAT obligation. Comply with UK VAT moving forward. If you are liable to pay VAT you do need to register with the Dutch Tax and Customs Administration.

However they must appoint a Norwegian VAT Representative. VAT is levied at a standard rate of 15 on the supply of goods and services by registered vendors. There are many benefits of obtaining a VAT number.

Registration for VAT Persons who are taxable must register online with the FTA in writing within 30 days of the commencement of their tax liability Startseite - Mehrwertsteuer - Dienstleistungen - Formulare - Online Dienstleistungen - Anmeldung bei der MWST. To register the overseas business should contact the Aberdeen VAT office at Ruby House 8 Ruby Place Aberdeen AB10 1ZP Tel. For non-EU businesses how to re-register with a new VAT MOSS.

By doing this youll register for VAT and create a VAT. Login to eFiling 2. A business may also register voluntarily if the income earned in the past 12-month period exceeded R50 000.

If your foreign company does not have a permanent establishment in the Netherlands you do not have to register with the Dutch Commercial Register. File applications for obtaining Polish NIP tax identification number file application for VAT EU VAT registration. A foreign company has a locally registered company and.

Provide detailed description why VAT registration in Poland is needed. How to register for tax as a new company. Wrap up 2020 with your current VAT MOSS.

A foreign company may register for VAT without the requirement to form a local company. This must be done within two weeks of the start of trading or passing the VAT registration threshold. VAT is an indirect tax on the consumption of goods and services in the economy.

Any proof that you are already carrying out or planning to do so your activity in France eg contract invoice. You may register in the Dutch Commercial Register voluntarily to comply with your. Importing goods for sale.

If your business ships goods to a warehouse in another country and retains control of those goods for the purpose of onward sale you may have an obligation to register for VAT. Attach foreign company documents extract from companies register Articles of Association with translation to Polish language. You must register your business for VAT with HM Revenue and Customs HMRC if its VAT taxable turnover is more than 85000.

When you register youll be sent a VAT registration certificate. If you ever sell digital products B2C in Europe even just once then you need to register and get your business a VAT number. If your company is represented by a tax agent they must submit an online registration application on your behalf through Revenue Online Service ROS.

Perhaps you have Dutch customers who ask for a KVK number. A copy of the Memorandum and Articles of association.

What Are The Documents Required For Setting Up A Private Limited Company In Singapore Find Here The A Private Limited Company Create A Company Limited Company

How To Register A Company In Kenya Winstar Technologies Company Business Names Limited Liability Partnership

Have You Got Your Company Vat Registered We Can Help You With Vat Setup And Its Compliance And Avoid All Penalties Vatrefund T Dubai Tax Free You Got This

Vat Registration In Georgia 2021 Procedure

Register For Vat In Canada Updated For 2021

3 Simple Ways To Find A Company S Vat Number Wikihow

How To Appeal For Vat Penalties In Uae In 2020 Dubai Vat In Uae Uae

Automatic Vat Validation For Eu Sap Blogs

3 Simple Ways To Find A Company S Vat Number Wikihow

Download Uae Vat Dual Currency Invoice Excel Template Exceldatapro Income Tax Excel Templates Job

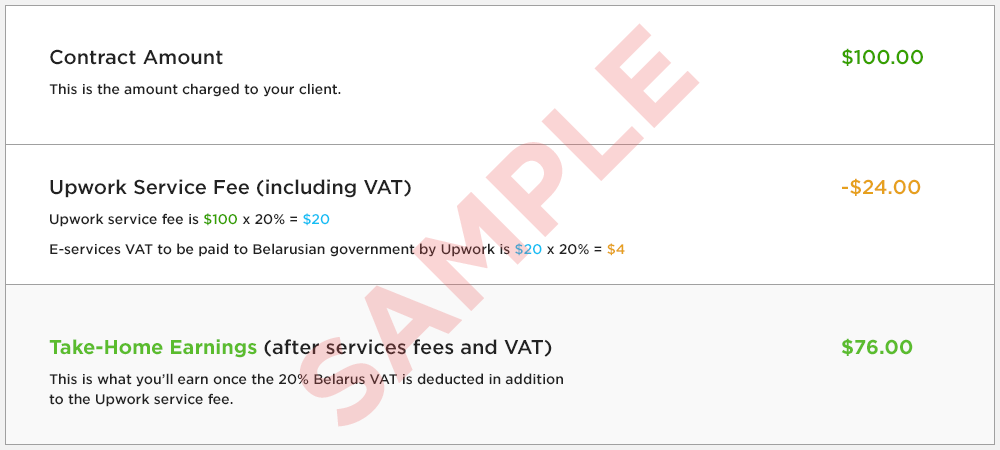

Value Added Tax Vat Upwork Customer Service Support Upwork Help Center

Does My Irish Company Need To Apply For Vat Registration

Business Setup In Uae Business Investors Business Abu Dhabi

Download Uk Vat Dual Currency Invoice Excel Template Exceldatapro Excel Templates Invoice Template Invoicing

Online Company Registration In India Clickntax Private Limited Company Limited Company Limited Liability Partnership

Step By Step Guide To Get Vat Number In Uae In 2020 Audit Services How To Get Earn Trust

Private Limited Company Registration By Vishnu Kumar Infogram Company Registration Hyderabad Private Limited Company Limited Company Registration