How Much Does It Cost To Register Your Business In Illinois

The minimum initial franchise tax is 25. How much does a DBA cost in Illinois.

Translation Pricing How Does It Work Gas Prices Illinois Price Sticker

Translation Pricing How Does It Work Gas Prices Illinois Price Sticker

The initial franchise tax is assessed at the rate of 15100 of 1 percent 150 per 1000 on the paid-in capital represented in Illinois.

How much does it cost to register your business in illinois. View up to date information on Illinois Covid-19 vaccine plan and vaccination eligibility from the State of Illinois Coronavirus Response Site Budget Address Reminder The Governors Budget address will be given at 12pm today. What are my responsibilities as an employer. If you live in Illinois or are moving to Illinois your vehicles must be registered with the Secretary of States SOS office.

Check with state offices to find out foreign qualification requirements and fees. Where Do I Start. What is a corporation.

8007856055 or Submit a Question and a staff member will assist you. Read our full guide on How to Form an LLC in Illinois or have a professional service form an LLC for you. 200 fee due every two years.

For more details please read on. How do I protect my invention. File state documents and fees In most cases the total cost to register your business will be less than 300 but fees vary depending on your state and business structure.

How much does a sales tax permit cost in Illinois. Annual fee of 75 per location. How long does it take to get an Illinois sales tax permit.

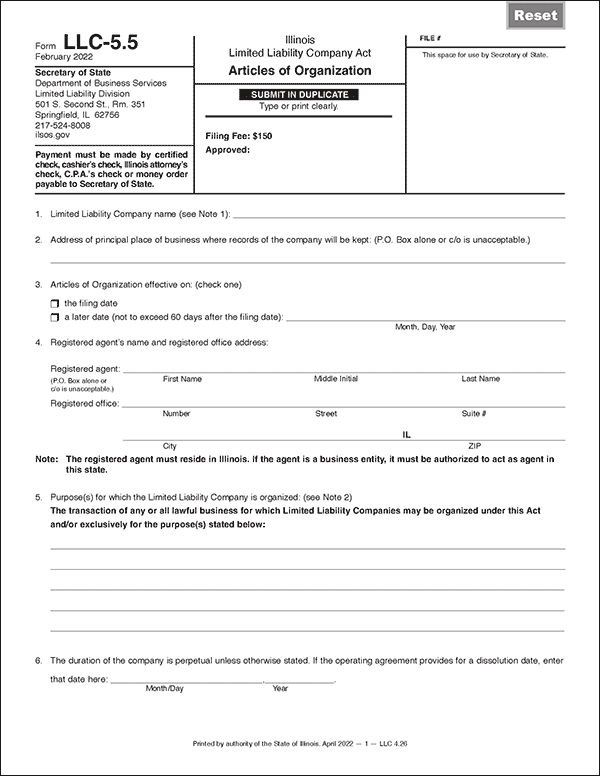

Electricity Excise Tax - self-assessor. The filing fee is 150 plus the franchise tax to the Secretary of State Department of Business Services 501 S. 7736 or complete the Business Services contact form.

Where do I register a business. Complete the Illinois business registration application. Original Title 150 Duplicate or Corrected Title 50 Junk Title 0 Original Duplicate or Corrected Title for an ATV or Off-Highway Motorcycle 30.

350 Springfield IL 62756. A cashiers check certified check money order or an Illinois attorneys or Certified Public Accountants check are acceptable forms of payment. Mail the form andor filing fee.

Electronically register through MyTax Illinois approximately one to two days to process. The filing fee to form a corporation in Illinois is at a minimum 175. Registration forms are also available.

There is no cost for a sales tax permit in Illinois. What ownership structure choices do I have. If you have any questions contact the First Stop Business Information Center at 8002522923 TTY.

To file your assumed business name you have to fill out the assumed business name certificate available from the county clerks office in the county where your business is located. The cost for a Sole proprietorship or partnership to register their Assumed Name varies by county but expect a filing fee of 20-50 to the County Clerk and 40-100 for the publication of the legal notice. Replacement Registration ID Card 3 Vehicle Title.

Pay between 151 and 164 for your registration fee 50 title fee and taxes. To register your business you must. The Articles of Incorporation must be filed with the Illinois Secretary of State.

Currently depending on the size of business the cost ranges between 190-380 to file a Design Patent application. The next step is to publish the assumed business name in a local newspaper for 3 consecutive weeks. The information youll need typically includes.

If you plan to hire employees manufacture goods or buy and sell products either retail or wholesale you must register your business. Annual fee of 75 per location. There are some license fees for businesses with tax responsibilities that include.

Design patents last 14 years from the date the patent was granted. For more information please contact the Department of Business Services Limited Liability Division at 217-524-8008 ext. Expect 2-3 business days to receive a sales tax permit when registering online through MyTaxIllinois or.

This fee is subject to change annually on October 1 per the federal fiscal year. Other Tobacco Products Retailer. Once filed your business name will be reserved in Illinois for 90 days.

To file the Articles of Organization for an LLC in Illinois you must submit your formation documents to the Secretary of State online or by mail along with the 150 filing fee. The filing fee is 5. Complete and mail Form REG-1 Illinois Business Registration Application to us at the address on the form Form REG-1 is available on our web site as a fill-in and savable form.

Cigarette and Tobacco Products Retailer. You can file for an Illinois name reservation and any number of extensions by completing and mailing Form LLC-115 for LLCs or Form BCA 410 for corporations along with the 25 filing fee. To incorporate in Illinois the state charges a franchise tax at the time of incorporation.

Make checks payable to the Illinois Secretary of State. Cash is not accepted for filings with the Secretary of States office.

A Tax Attorney Illinois As The Name Says Comes With An Educational Background In Tax Law Economic Tax Attorney Income Tax Preparation Tax Preparation Services

A Tax Attorney Illinois As The Name Says Comes With An Educational Background In Tax Law Economic Tax Attorney Income Tax Preparation Tax Preparation Services

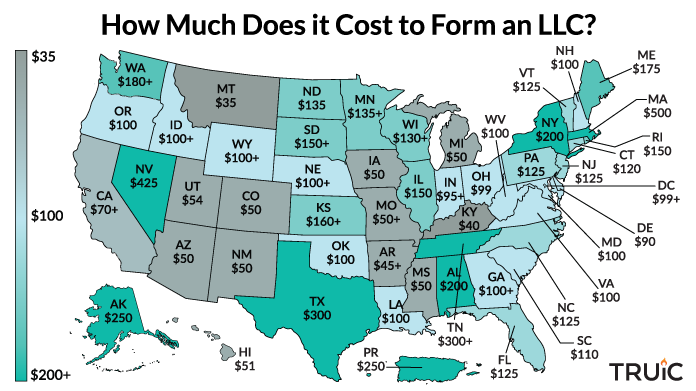

Llc Cost How Much Does It Cost To Start An Llc Truic

Llc Cost How Much Does It Cost To Start An Llc Truic

How To Register A Business Name

How To Register A Business Name

Llc Illinois How To Start An Llc In Illinois Truic Guides

Llc Illinois How To Start An Llc In Illinois Truic Guides

Llc Cost Illinois Cost To Form An Llc In Illinois

Llc Cost Illinois Cost To Form An Llc In Illinois

List Of All Cac Offices In Nigeria Nigeria Success Business Start Up Business

List Of All Cac Offices In Nigeria Nigeria Success Business Start Up Business

How To Search Available Business Names In Illinois Startingyourbusiness Com

How To Search Available Business Names In Illinois Startingyourbusiness Com

Llc Illinois How To Start An Llc In Illinois Truic Guides

Llc Illinois How To Start An Llc In Illinois Truic Guides

Raymond J Busch Ltd Now Serving You From Two Locations 13011 S 104th Ave Suite 200 Small Business Accounting Services Business Accounting Information

Raymond J Busch Ltd Now Serving You From Two Locations 13011 S 104th Ave Suite 200 Small Business Accounting Services Business Accounting Information

Faqs Employer Eligibility Number Pc 1 Public Contracts

Faqs Employer Eligibility Number Pc 1 Public Contracts

Https Www2 Illinois Gov Rev Forms Reg Documents Reg 1 Pdf

![]() Llc Illinois How To Start An Llc In Illinois Truic Guides

Llc Illinois How To Start An Llc In Illinois Truic Guides

Starting A Business In Illinois Simple Step By Step Guide

Starting A Business In Illinois Simple Step By Step Guide

How To Get A Certificate Of Resale In Illinois Startingyourbusiness Com

How To Get A Certificate Of Resale In Illinois Startingyourbusiness Com

How To Get An Illinois Certificate Of Good Standing

How To Get An Illinois Certificate Of Good Standing

P The Chicago Tribune Has A Map That Outlines Areas Of Chicago That Appear To Be Hardest Hit By A Average 13 Percent Property Property Tax Chicago Tribune Tax

P The Chicago Tribune Has A Map That Outlines Areas Of Chicago That Appear To Be Hardest Hit By A Average 13 Percent Property Property Tax Chicago Tribune Tax

What Is A Certificate Of Good Standing How Do I Get One Ask Gusto

What Is A Certificate Of Good Standing How Do I Get One Ask Gusto

Apply For Sellers Permit Or Resale Tax License 89 Permit How To Apply Resale

Apply For Sellers Permit Or Resale Tax License 89 Permit How To Apply Resale

Llc In Illinois How To Form An Llc In Illinois Nolo

Llc In Illinois How To Form An Llc In Illinois Nolo