How To View My 1099 G Form Online

Select Unemployment Services and ViewPrint 1099-G. Federal Form 1099-G Certain Government Payments is filed with the Internal Revenue Service IRS by New York State for each recipient of a New York State income tax refund of 10 or more.

1099 Form Fileunemployment Org

1099 Form Fileunemployment Org

On January 28 2021 the Arizona Department of Economic Security DES began mailing 1099-G tax forms to claimants who received unemployment benefits in the state of Arizona in 2020.

How to view my 1099 g form online. Select Request Duplicate to request an official paper copy. To download the user-guide click here. Federal state or local governments file Form 1099-G if they made certain payments or if they received Commodity Credit Corporation loan payments.

Viewing your IRS 1099-G information over the Internet is fast easy and secure. Enter the security code displayed below and then select Continue. Form 1099-G reports the amount of income tax refunds including credits or offsets that we paid to you in a tax year if you itemized your.

Form 1099-G for New Jersey Income Tax refunds is only accessible online. Information about Form 1099-G Certain Government Payments Info Copy Only including recent updates related forms and instructions on how to file. The Internet is available 24 hours a day 7 days a week in English and Spanish.

Log on using your username and password then go to the Unemployment Services menu to access your 1099-G tax forms. To determine if you are required to report this information on a federal income tax return see the federal income tax instructions contact the IRS or contact your tax professional. The following security code is necessary to prevent unauthorized use of this web site.

The department is now providing Form 1099-G online instead of mailing them. Log in to Benefit Programs Online and select UI Online. Welcome to Arizona Department of Revenue 1099-G lookup service.

When viewing a 1099-G Tax form in CONNECT claimants should be sure to enable pop-ups on their web browser Pop-up blockers restrict claimants from viewing. This link will only appear if you received benefits from the EDD for that year. Log in to your UI Online account.

After logging in click View Correspondences in the left-hand navigation menu or in the hamburger menu at the top if youre on mobile. 1099-G Inquiry - Report any issues regarding your 1099-G form. All 1099Gs Issued by the Ohio Department of Taxation will be mailed by January 31st.

Log on to Unemployment Benefits Services. To view your. Select Print to print your Form 1099G information.

Sign up now to receive your 1099-G information online from our secure confidential web site. For more information about disputing your 1099-G you can download the user-guide here. Log in to your NYGov ID account.

You can elect to be removed from the next years mailing by signing up for email notification. To access a Form 1099-G electronically a taxpayer must first register for an e-signature account by establishing a User ID and Password. Click on View 1099-G and print the page.

Most claimants who received Pandemic Unemployment Assistance PUA benefits during 2020 can access their 1099-G form within the MyUI application. To view the video tutorial on how to access your 1099-G click here. Your 1099-G will be electronically available in your BEACON portal.

If you are using a screen reading program select listen to have the number announced. Select the link View IRS 1099-G Information and 3. Form 1099-G information is used when preparing your federal tax return.

If you have questions about your user name and password see our frequently asked questions for accessing online benefit services. You can opt to receive your 1099-G electronically by providing your consent through the BEACON portal or mobile app. To view and print your statement login below.

Taxpayers and practitioners can access an electronic version of Forms 1099-G via the Personal Income Tax e-Services Center. View Your 1099-G Information. 1099Gs are available to view and print online through our Individual Online Services.

Visit the Department of Labors website. Click on the down arrow to select the right year. Access your 1099-G by logging in to your account on your unemployment benefits portal.

You can view 1099-G forms for the past 6 years. The DEO also said. We do not mail these forms.

Select View next to the desired year. This will help save taxpayer dollars and allow you to do a small part in saving the environment. Click on View and request 1099-G on the left navigation bar.

Users Report Problems Accessing 1099 G Form On Florida S Unemployment Website

Users Report Problems Accessing 1099 G Form On Florida S Unemployment Website

Faqs Benefits Kansas Department Of Labor

Faqs Benefits Kansas Department Of Labor

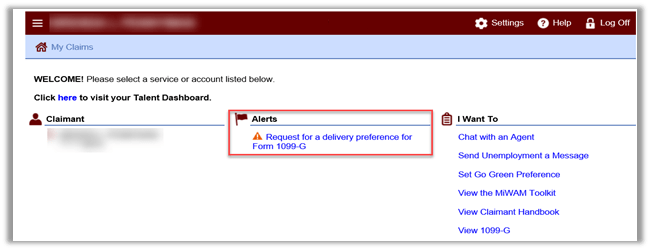

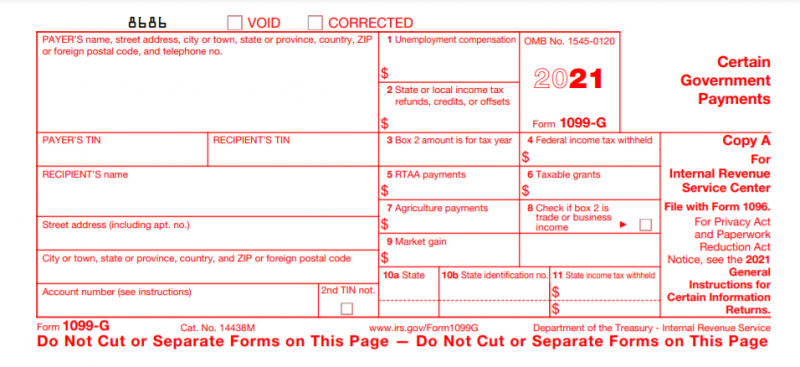

Labor And Economic Opportunity How To Request Your 1099 G

Labor And Economic Opportunity How To Request Your 1099 G

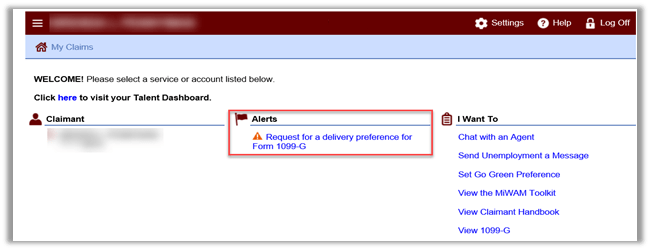

2020 Form Irs 1099 G Fill Online Printable Fillable Blank Pdffiller

2020 Form Irs 1099 G Fill Online Printable Fillable Blank Pdffiller

Unemployment Claimants To Receive 1099 G Tax Form By End Of Month Penbay Pilot

Unemployment Claimants To Receive 1099 G Tax Form By End Of Month Penbay Pilot

Labor And Economic Opportunity How To Request Your 1099 G

Labor And Economic Opportunity How To Request Your 1099 G

Arizona Form 1099 G Vincegray2014

Arizona Form 1099 G Vincegray2014

Florida Deo On Twitter From Now Until January 31 2020 1099 G Forms Are Being Issued To Claimants Who Received Reemployment Assistance Benefits During 2020 These Forms Will Be Issued Through Connect Or

Florida Deo On Twitter From Now Until January 31 2020 1099 G Forms Are Being Issued To Claimants Who Received Reemployment Assistance Benefits During 2020 These Forms Will Be Issued Through Connect Or

Unemployment Insurance Payments Are Taxable And 1099 Gs From The Feds Are In The Mail Mlive Com

Unemployment Insurance Payments Are Taxable And 1099 Gs From The Feds Are In The Mail Mlive Com

Fillable 1099 Form 2016 Understanding Your Tax Forms 2016 1099 G Certain Email Signature Templates Balance Sheet Template Statement Template

Fillable 1099 Form 2016 Understanding Your Tax Forms 2016 1099 G Certain Email Signature Templates Balance Sheet Template Statement Template

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

1099 G Scheduled To Be Mailed On Or Around Jan 27 Hawaii News And Island Information

1099 G Scheduled To Be Mailed On Or Around Jan 27 Hawaii News And Island Information

How To Find Your Unemployment Tax Documents For Filing Season

How To Find Your Unemployment Tax Documents For Filing Season

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

Unemployment Taxes Are Due Expect A Form To Arrive In The Mail Kvue Com

Unemployment Taxes Are Due Expect A Form To Arrive In The Mail Kvue Com

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

Users Report Problems Accessing 1099 G Form On Florida S Unemployment Website Youtube

Users Report Problems Accessing 1099 G Form On Florida S Unemployment Website Youtube

1099 G Tax Form Why It S Important

1099 G Tax Form Why It S Important