Unreimbursed Employee Business Expenses California

The undersigned certify that as of June 22 2019 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California Government Code Sections 7405 and 11135 and the Web Content Accessibility Guidelines 21 or a subsequent version June 22 2019 published by the Web Accessibility. Oct 06 2020 The vast majority of W-2 workers cant deduct unreimbursed employee expenses in 2020.

Employee Paid Business Expenses The Cpa Journal

Employee Paid Business Expenses The Cpa Journal

In 2019 there were 3384 unreimbursed expense claims filed in California.

Unreimbursed employee business expenses california. This means the deductions claimed on your return must exceed the standard deduction which will. California is one of the states that allows you to claim itemized deductions even if you take the standard deduction on the federal return. Expenses you cant deduct.

Deductions for Unreimbursed Employee Expenses. You can still claim certain expenses as itemized deductions on Schedule A Form 1040 Schedule A 1040-NR or as an adjustment to income on Form 1040 or 1040-SR. Unreimbursed Expenses As a California employee it should not cost you anything to do your job.

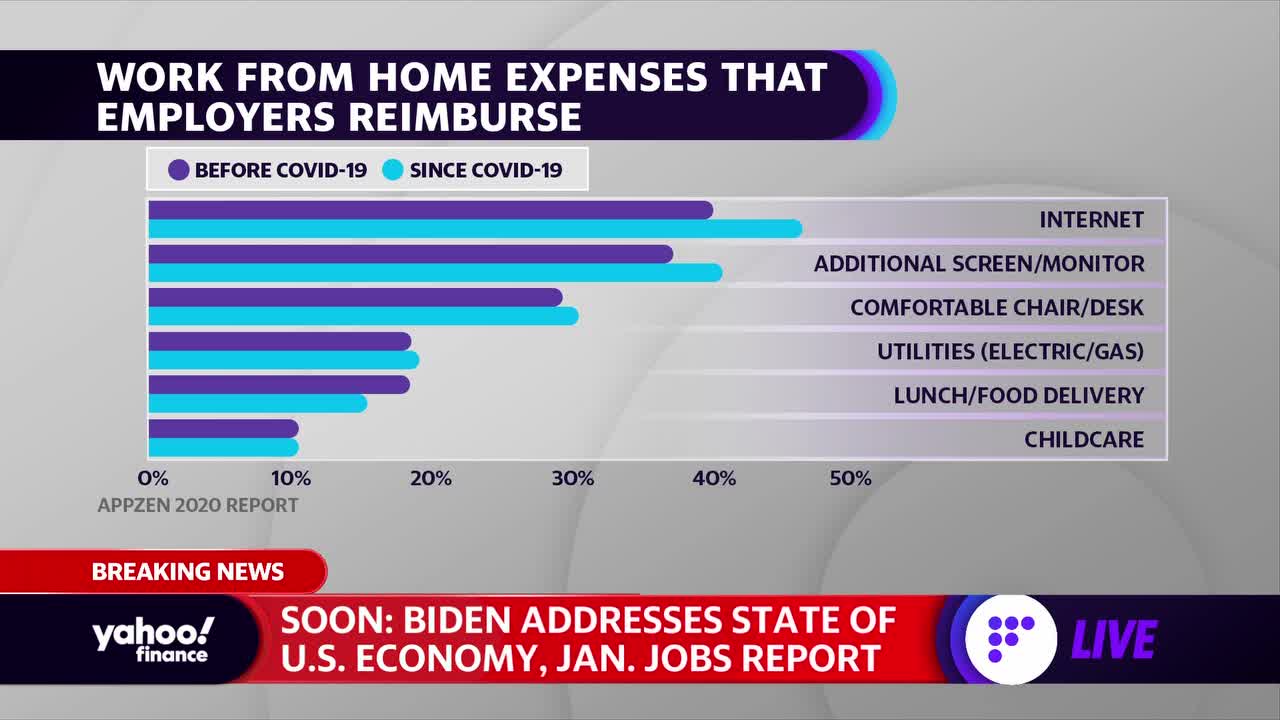

Jul 28 2020 If you spend more than 2 of your adjusted gross income on certain unreimbursed miscellaneous itemized expenses including home-office expenses you can itemize anything that goes over that 2. Jun 06 2019 California allows unreimbursed employee business expenses to be deducted on state returns unlike the Federal return that dropped the deduction with the new tax laws. The Tax Cuts and Jobs Act TCJA introduced many new changes to the tax law.

Oct 19 2020 It used to be that employees who itemized deductions on their federal returns were allowed to include any unreimbursed work expenses as part of their miscellaneous deductions. Unreimbursed employee business expenses The Tax Cut and Jobs Act of 2017 makes it virtually impossible for taxpayers including church employees to deduct unreimbursed employee business expenses on Form 1040 income tax returns. Unreimbursed Business Expenses The law is simple.

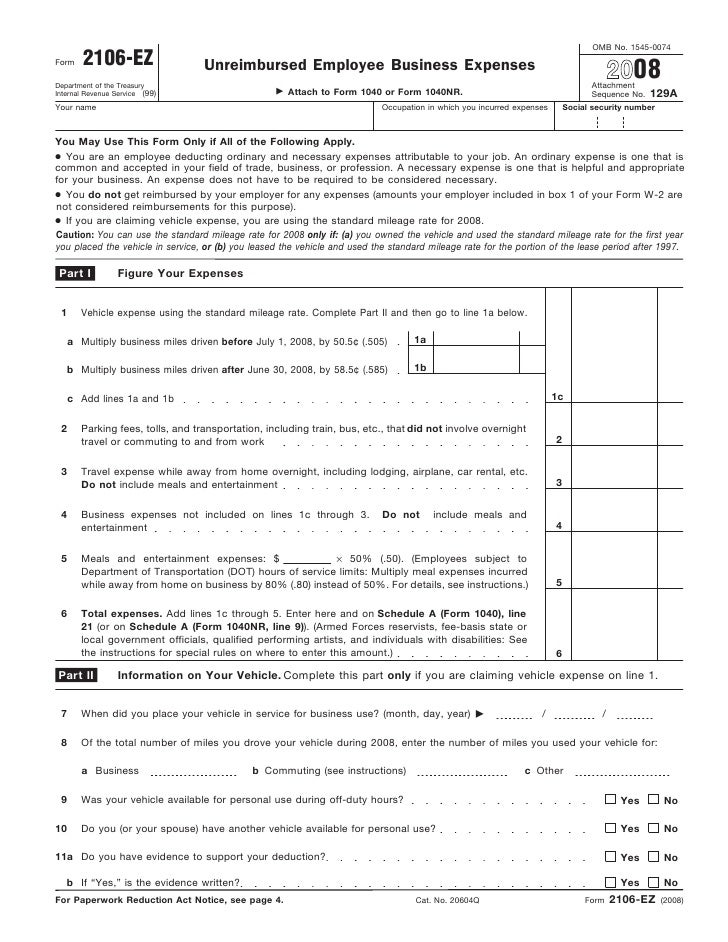

Enter the amount from line 10 of federal Form 2106 on line 19. The Tax Cut and Jobs Act TCJA eliminated unreimbursed employee expense deductions for all but a handful of. I was expecting Turbo Tax to walk me through it but no luck.

I do not know where to enter it on the state return nor do I know if the entire amount is deductible. One of these changes is that unreimbursed employee business-related expenses are no longer deductible as an itemized deduction on your Federal tax return. Other miscellaneous deductions broker fees tax preparation fees not deductible for Federal purposes allowed for State purposes subject to a 2 of AGI limitation.

California Labor Code section 2802 obliges an employer to reimburse an employee for all necessary expenditures or losses incurred by the employee in carrying out job duties or employer directives. An ordinary expense is one that is common and accepted in your industry. A necessary expense is one that is appropriate and helpful to your business.

Jun 17 2020 Typically unreimbursed employee expenses are an itemized deduction on state income tax returns. Most commonly this means that employers in California have to pay their employees for the mileage they incur in the furtherance of their duties. This publication covers the following topics.

Jan 02 2020 Unreimbursed business expenses not deductible for Federal purposes allowed for State purposes subject to a 2 of AGI limitation. Before 2018 employees who incurred job-related expenses such as travel expenses and job-specific expenses were able to deduct itemized deductions on their federal tax returns. Line 19 - Unreimbursed Employee Expenses.

In 2018 The Tax Cuts and Jobs Act eliminated the deduction for unreimbursed employee expenses. Dont feel too bad though. Jun 05 2019 Yes.

This obligation cannot be waived by the employee. This has been a significant deduction for many of my clients in the past. If you are an employee who has incurred business-related expenses and not been reimbursed by your employer you should contact an experienced California.

Prepare federal Form 2106 reflecting your employee business expense using California amounts ie following California law. Include your entertainment expenses if any on line 5 of federal Form 2106 for California purposes. California did not comply with the new tax law so unreimbursed employee expense are still deductible on your state return.

But the 2017 tax overhaul eliminated that option said Nathan Rigney a lead tax research analyst for HR Blocks Tax Institute. Some costs that you may be able to deduct include. Aug 14 2018 Employers who fail to reimburse employees may not only be responsible for paying the employees out-of-pocket expenses but also responsible for attorneys fees and costs to collect the expense as well as interest from the date the employee incurred the expense.

You can only deduct unreimbursed expenses that are ordinary and necessary to your work as an employee. California employees must be reimbursed for necessary job expenses. Dec 07 2020 The state Department of Industrial Relations handles disputes involving employeeemployer reimbursable expenses.

Https Www 3iscorp Com School Wp Content Uploads Pdf Courses Self Study California Module 3 Study Text Pdf

Https Www 3iscorp Com School Wp Content Uploads Pdf Courses Self Study California Module 3 Study Text Pdf

Unreimbursed Work Expenses Turn To Pimentel Law For Help

Unreimbursed Work Expenses Turn To Pimentel Law For Help

Deducting Wfh Expenses There Are Fewer Tax Breaks Than You Might Expect

Deducting Wfh Expenses There Are Fewer Tax Breaks Than You Might Expect

Form 2106ez Unreimbursed Employee Business Expenses

Form 2106ez Unreimbursed Employee Business Expenses

Https Www 3iscorp Com School Wp Content Uploads Pdf Courses Self Study California Module 3 Study Text Pdf

Southern California Unreimbursed Business Expense Lawyer Jim Trush

Southern California Unreimbursed Business Expense Lawyer Jim Trush

Irs Audit Letter 566 Cg Sample 4

Tax Reform Suspends The Tax Deduction For Employee Business Expenses Cobb

Tax Reform Suspends The Tax Deduction For Employee Business Expenses Cobb

Southern California Unreimbursed Business Expense Lawyer Jim Trush

Southern California Unreimbursed Business Expense Lawyer Jim Trush

Can I Deduct Unreimbursed Employee Business Expenses In 2019

Can I Deduct Unreimbursed Employee Business Expenses In 2019

Https Www 3iscorp Com School Wp Content Uploads Pdf Courses Self Study California Module 3 Study Text Pdf

2019 Volunteer Mileage Rates And Irs Reimbursement Guidelines

2019 Volunteer Mileage Rates And Irs Reimbursement Guidelines

Https Www 3iscorp Com School Wp Content Uploads Pdf Courses Self Study California Module 3 Study Text Pdf

2106 Employee Business Expenses 2106 Schedule1

2106 Employee Business Expenses 2106 Schedule1

But What About My Expenses California Law On Unreimbursed Business Expenses

But What About My Expenses California Law On Unreimbursed Business Expenses

Dear Taxpayer State Cracks Down On Unreimbursed Business Expenses Pennlive Com

Dear Taxpayer State Cracks Down On Unreimbursed Business Expenses Pennlive Com

Customer Information Card Template Elegant Items Similar To Hairdresser Client Profile Cards Pack Client Profile Hairdresser Contact Card Template

Customer Information Card Template Elegant Items Similar To Hairdresser Client Profile Cards Pack Client Profile Hairdresser Contact Card Template