Form 2106 Commuting Miles

5 If you qualify you can claim this deduction as an employee business expense using Form 2106. The additional first-year limit on depreciation for vehicles acquired.

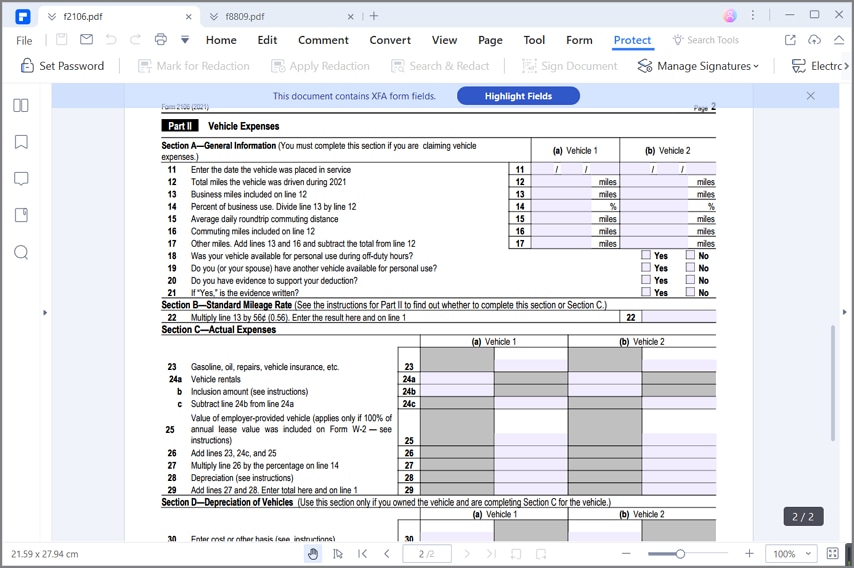

11 12 Total miles the vehicle was driven during 2011.

Form 2106 commuting miles. Regular commuting miles to and from work are not deductible however commuting miles may count as business use and deductible as employee business expenses on form 2106 if your home is your office if you are working out of a temporary location or if you work in two or more different places during the day. Employees must follow the same rules that business owners and other self-employed workers follow. Here are some examples.

Commuting miles included on line 12. If your employer reimburses you for miles driven you can only claim. The error message you are seeing is telling you that for the numbers that you entered there was nothing left over for personal miles.

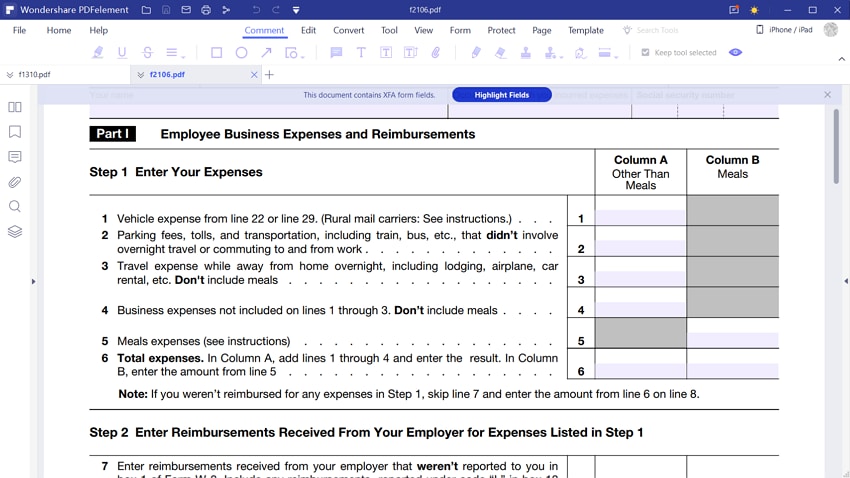

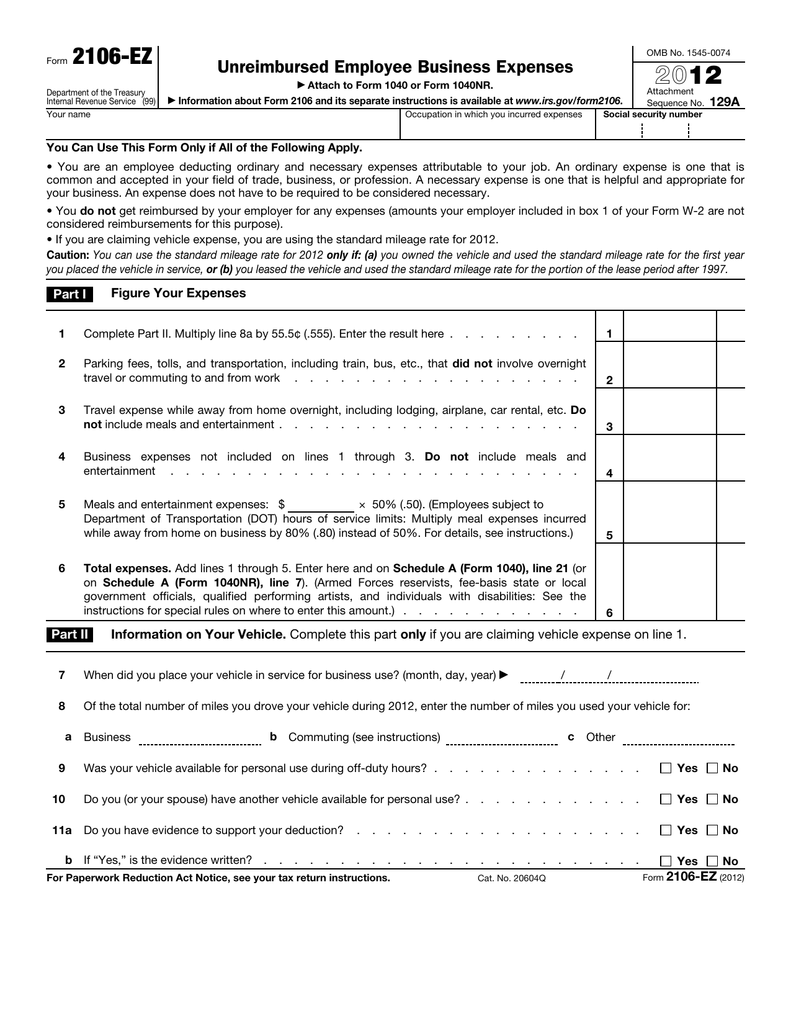

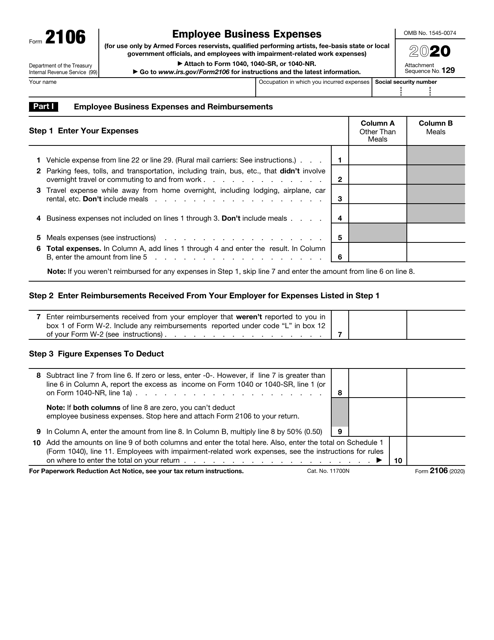

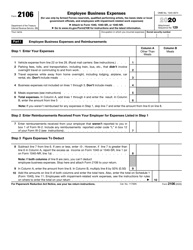

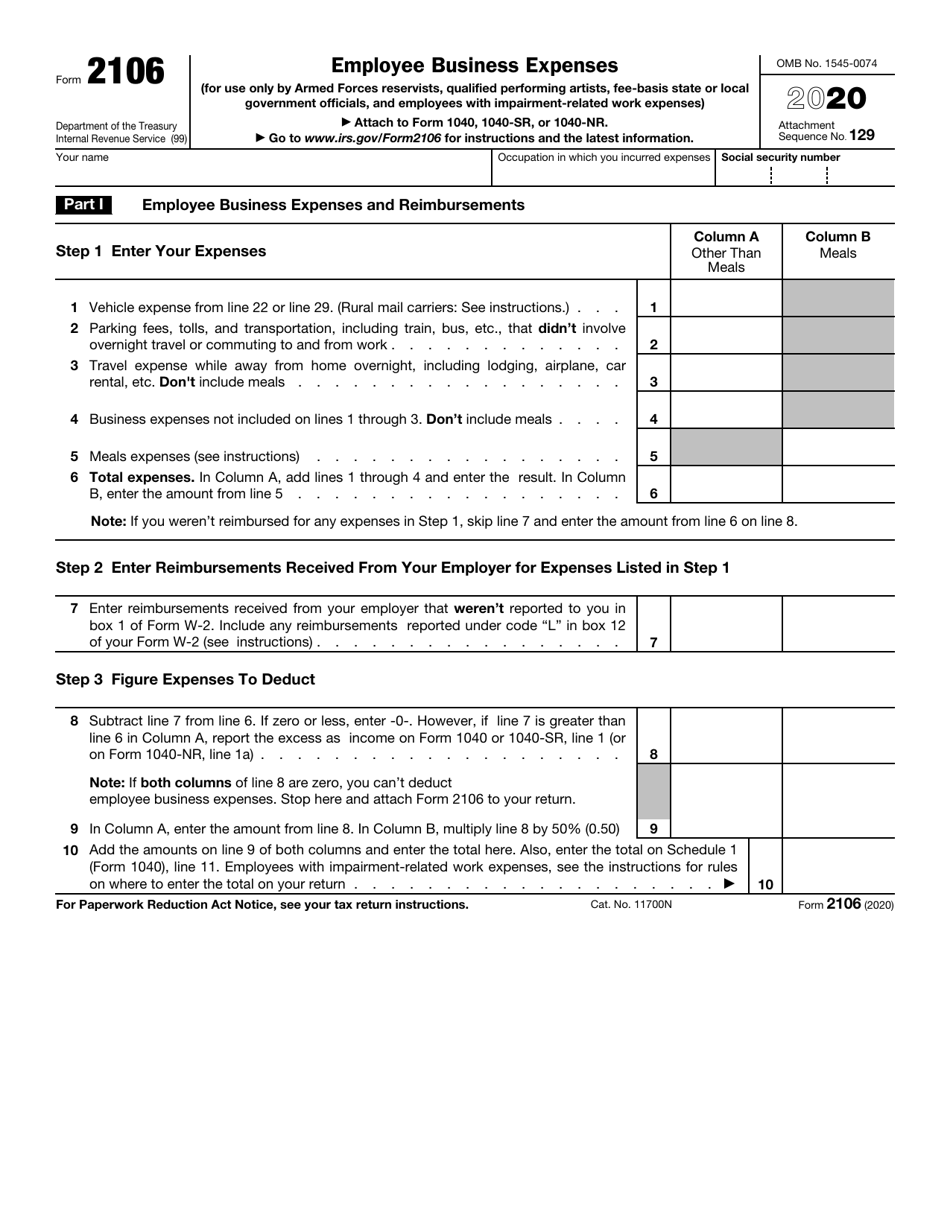

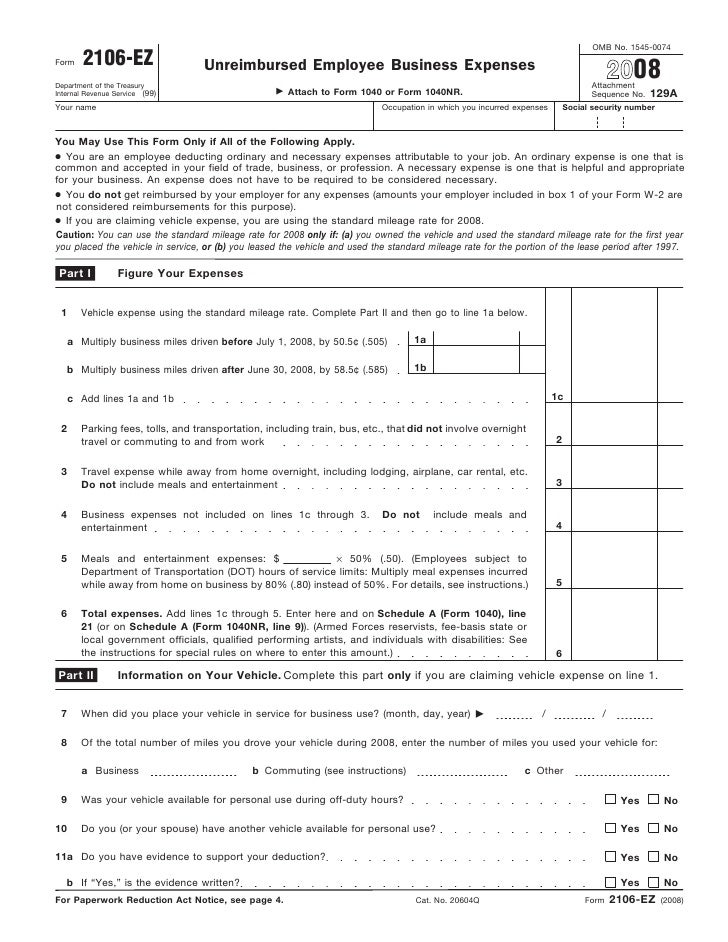

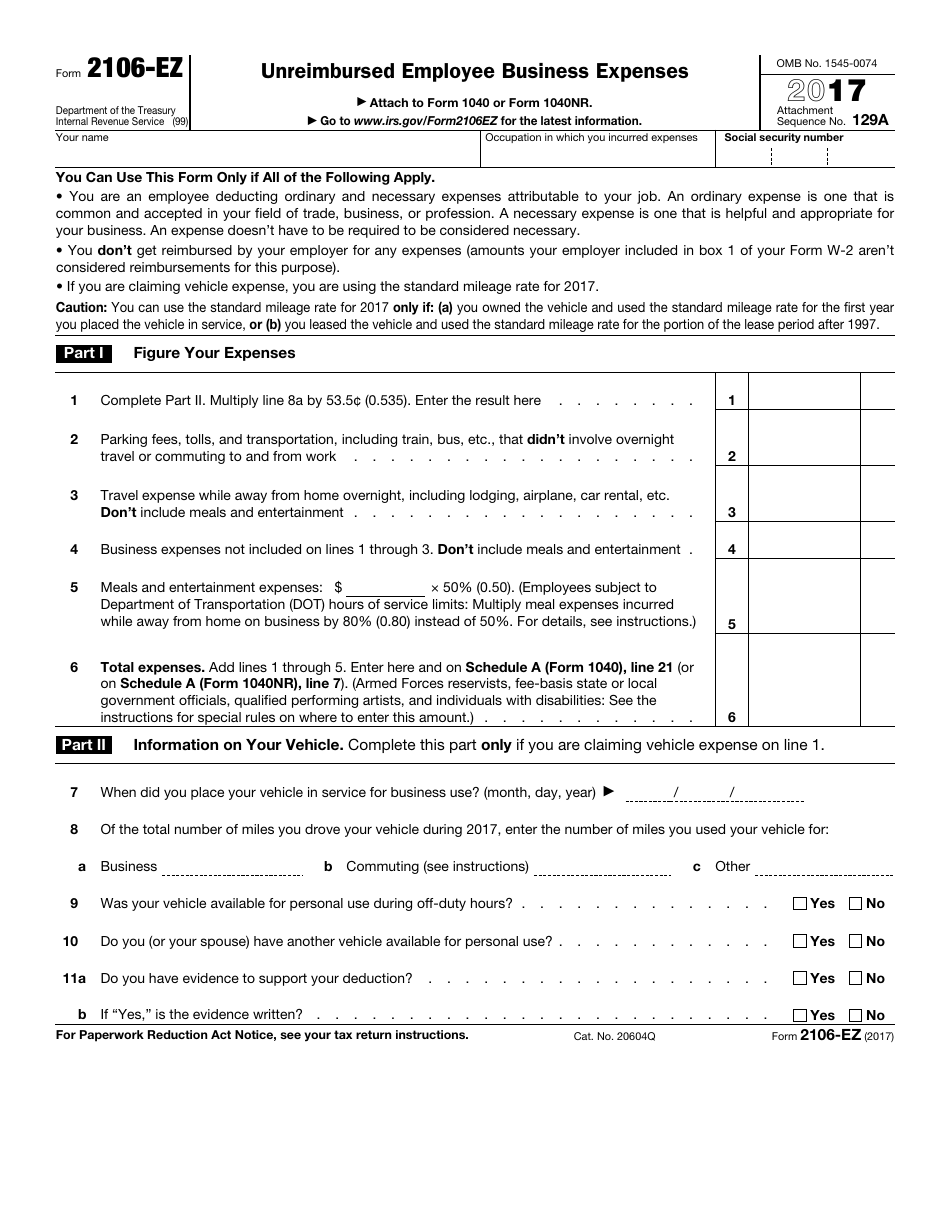

Form 2106 2020 Employee Business Expenses for use only by Armed Forces reservists qualified performing artists fee-basis state or local government officials and employees with impairment-related work expenses. Depreciation limits on vehicles. If youre claiming a deduction for work-related use of your personal vehicle you can use Form 2106-EZ as long as youre claiming the standard mileage rate for your use.

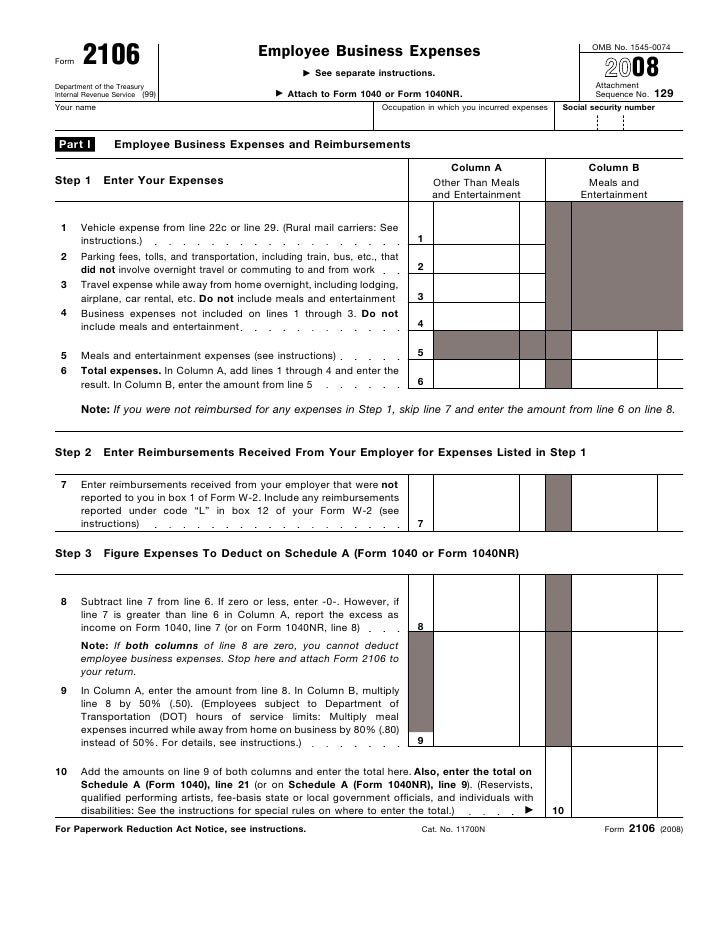

When you enter vehicle expenses for any purpose Schedule C Schedule E Form 2106 in your tax return you are asked to enter the number of miles driven for the entire year the number of miles driven for business purposes and the number of commuting miles. But if you first go home and then leave to go to your second job that cant be deducted. Youll report your miles and also answer a few questions about the vehicle on Form 2106.

When you enter vehicle expenses for any purpose Schedule C Schedule E Form 2106 in your tax return you are asked to enter the number of miles driven for the entire year the number of miles driven for business purposes and the number of commuting miles. That is commuting expenses trips from home to your first destination are not deductible. Employee Business Expenses is a tax form distributed by the Internal Revenue Service IRS used by employees to deduct ordinary and necessary expenses related to their jobs.

You enter the total of your expenses on Schedule A line 21 as a miscellaneous. You use the standard mileage rate which is 56 cents a mile at publication and must file Form 2106 along with your Form 1040. Commuting miles included on line 12.

Form 2106-EZ was a tax form distributed by the Internal Revenue Service and used by employees to deduct ordinary and necessary expenses related to their jobs. Add lines 13 and 16 and. The goal of the form is to pull out only the business miles but they want you to account for all miles.

Form 2106 Department of the Treasury Internal Revenue Service 99 Employee Business Expenses for use only by Armed Forces reservists qualified performing artists fee-basis state or local. 2106 vehicle expenses worksheet commuting miles-1 is too large. The 2020 rate for business use of your vehicle is 575 cents 0575 a mile.

Whats New Standard mileage rate. Form 2106 and its instructions such as legislation enacted after they were published go to IRSgovForms-Pubs About-Form-2106. If you qualify complete Form 2106 and include the part of the line 10 amount attributable to the expenses for travel more than 100 miles away from home in connection with your performance of services as a member of the reserves on Schedule 1 Form 1040 line 11 and attach Form 2106 to your return.

So you reverse engineer the. Add lines 13 and 16 and subtract the total from line. For example if you go directly from your day job to your evening job you can deduct the commute between those 2 job sites.

Yes the form is complicated. Claiming this rate is simple and if you drive a lot for work this method might generate a larger deduction. If you drive 36000 miles a year with 18000 miles dedicated to business use you can deduct 50 of your actual expenses.

Form 2106 2011 Page 2 Vehicle Expenses Part II Section AGeneral Information You must complete this section if you are claiming vehicle expenses a Vehicle 1 b Vehicle 2 11 Enter the date the vehicle was placed in service. See IRS Publication 463 for more information. Commuting miles plus business miles 42800 cannot exceed total miles.

You must complete Form 2106 employee business expenses to claim the deduction for commuting to a second job. The percentage is your business miles versus personal miles. Qualifying travel expenses for employees are reported on Form 2106 and are subject to.

Irs Form 2106 Download Fillable Pdf Or Fill Online Employee Business Expenses 2020 Templateroller

Irs Form 2106 Download Fillable Pdf Or Fill Online Employee Business Expenses 2020 Templateroller

Publication 463 Travel Entertainment Gift And Car Expenses Chapter 6 How To Report Completing Forms 2106 And 2106 Ez

Https Www Irs Gov Pub Irs Prior F2106 2009 Pdf

Form 2106 Employee Business Expenses

Https Www Irs Gov Pub Irs Prior F2106 1990 Pdf

Irs Form 2106 Download Fillable Pdf Or Fill Online Employee Business Expenses 2020 Templateroller

Irs Form 2106 Download Fillable Pdf Or Fill Online Employee Business Expenses 2020 Templateroller

Instructions For Form 2106 2020 Internal Revenue Service

Instructions For Form 2106 2020 Internal Revenue Service

Https Www Irs Gov Pub Irs Prior I2106 1990 Pdf

Https Www Efile Com Tax Form 2019 Federal Form 2106 Employee Business Expenses Pdf

Https Www Irs Gov Pub Irs Prior I2106 2014 Pdf

Https Www 3iscorp Com School Wp Content Uploads Pdf Courses Self Study California Module 3 Study Text Pdf

Irs Form 2106 Download Fillable Pdf Or Fill Online Employee Business Expenses 2020 Templateroller

Irs Form 2106 Download Fillable Pdf Or Fill Online Employee Business Expenses 2020 Templateroller

Form 2106ez Unreimbursed Employee Business Expenses

Form 2106ez Unreimbursed Employee Business Expenses

Irs Form 2106 Ez Download Fillable Pdf Or Fill Online Unreimbursed Employee Business Expenses Templateroller

Irs Form 2106 Ez Download Fillable Pdf Or Fill Online Unreimbursed Employee Business Expenses Templateroller

Form 2106 Employee Business Expenses

Form 2106 Employee Business Expenses