How To File My Taxes As A Sole Proprietor

I have no idea howwhere I am supposed to pay these. Better still you can take this deduction even if you dont itemize deductions on your tax return.

How Much Does A Small Business Pay In Taxes

How Much Does A Small Business Pay In Taxes

However sole proprietors are not required to file for an EIN.

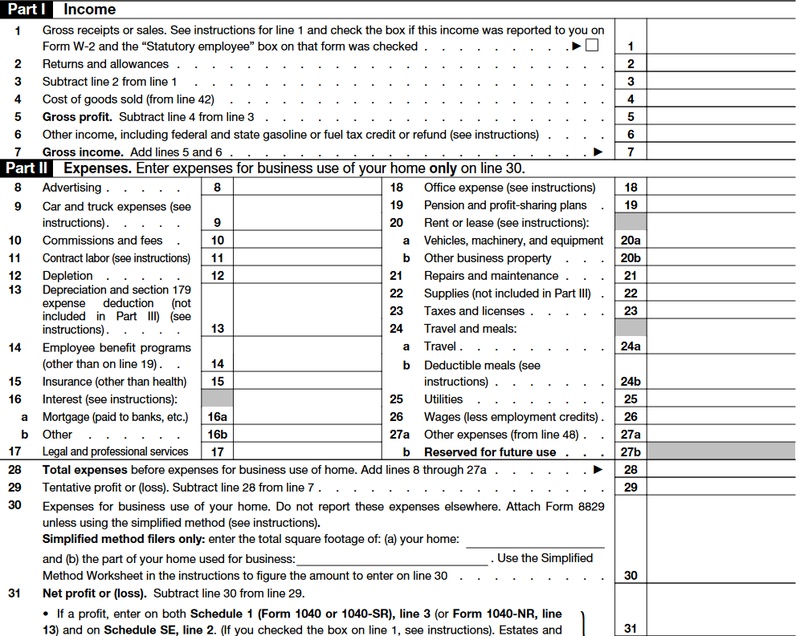

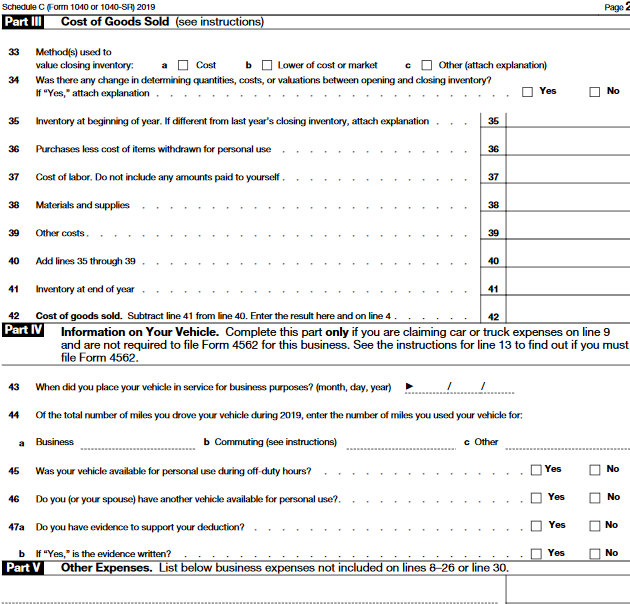

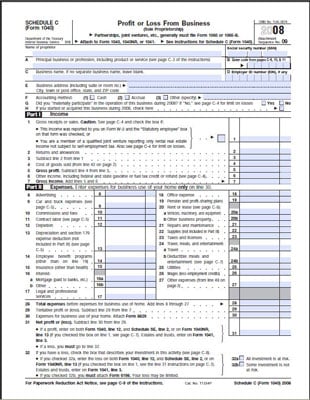

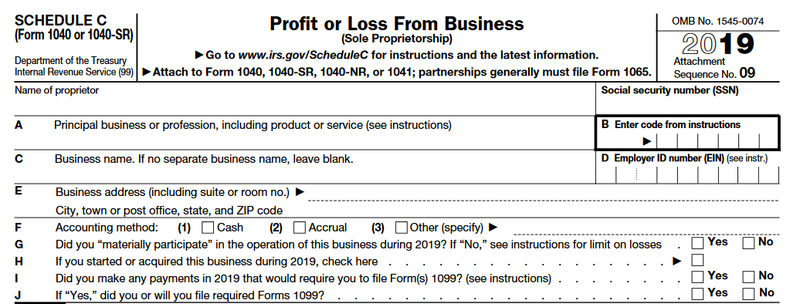

How to file my taxes as a sole proprietor. 1040 individual income tax return including a Schedule C profit or loss from an unincorporated business Self-Employment Tax. Sole proprietors use Schedule C to tell the IRS about. Form 1040 reports your personal income while Schedule C is where youll record business income.

Hi everybody I recently made a CRA business account as a sole proprietor. If you are a sole proprietor use the information in the chart below to help you determine some of the forms that you may be required to file. Sole proprietorship taxes come in a variety of forms.

The business profit is calculated and presented on Schedule C Profit or Loss from Small Business. This being said m ost sole proprietors only need to file two forms with their individual return. This is where you will input a traditional income.

Its important to note that companies dont need to apply to become sole proprietorships. Sole proprietor income tax returns deadline. When you keep your financial statements up to date and file your taxes quarterly you avoid missing vital tax savings opportunities as well as quarterly penalty taxes.

At that time the organization needs to pay the interest penalties and any remaining taxes. Ive done research and cannot seem to. How to file Self Employed Quarterly taxes CRA.

Income is reported on Schedule C which is part of the individual tax return Form 1040. 9 rows A sole proprietor is someone who owns an unincorporated business by himself or herself. Secondly theres Schedule C which reports business profit and loss.

Lets take an in-depth look at each of these forms. Report income or loss from a business you operated or a profession you practiced as a sole proprietor. If you have employees tack on.

The process is an annual process for. Tax and Return filing is less complicated. Although tax laws are subject to change regularly its still up to you to properly figure your estimated tax.

How to File Quarterly Taxes for a Sole Proprietor. One of the main tax advantages of running a sole proprietorship is that you can deduct the cost of health insurance for yourself your spouse and any dependents. What Self-Employed Sole Proprietors Need to Do at Tax Time As a self-employed sole proprietor you must claim your business income and expenses on your personal 1040 return by filing a Schedule C Business Income and Expenses.

First youre gonna have to fill out some forms. As we explained as a sole proprietor youll report and pay income tax on your businesss profitand youll do so by filing additional forms with your personal return Form 1040. Also use Schedule C to report wages and expenses you had as a statutory employee.

Sole proprietors file need to file two forms to pay federal income tax for the year. Report farm income and expenses. In addition to filing a personal tax return Form 1040 youll have to file Schedule C Profit or Loss from Business Sole Proprietorship which is a two-page schedule of Form 1040 that looks like this.

Fewer taxes is one of the notable advantages of sole proprietorship business. Sole proprietors report business income with form 1040 and Schedule C profit or loss form. Because the government considers a sole proprietorship and its founder to be the same entity sole proprietors must file their annual tax payments by submitting an IRS Form 1040.

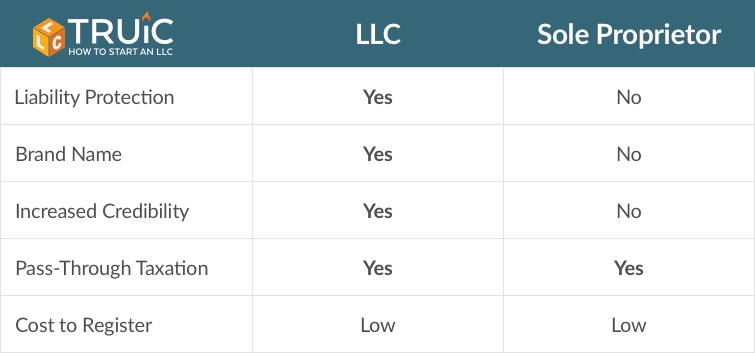

However if you are the sole member of a domestic limited liability company LLC you are not a sole proprietor if you elect to treat the LLC as a corporation. When setting up my account I chose to make quarterly CPPtax contributions. Schedule F 1040 or 1040-SR Profit or Loss from Farming.

How Sole Proprietors Pay Income Tax. A sole proprietorship is taxed through the personal tax return of the owner on Form 1040. Firstly theres Form 1040 which is the individual tax return.

Other types of business organizations need to have an Employer Identification Number EIN with the IRS. File it with Form 1040 or 1040-SR 1041 1065 or 1065-B. Your Form 1040 documents your personal income while your Schedule C outlines your business income and expenses.

The Federal Tax Forms For A Sole Proprietorship Dummies

The Federal Tax Forms For A Sole Proprietorship Dummies

What Is Form 941 And How Do I File It Ask Gusto

What Is Form 941 And How Do I File It Ask Gusto

-(1).jpg?sfvrsn=0) Single Member Llc Vs Sole Proprietorship Bizfilings

Single Member Llc Vs Sole Proprietorship Bizfilings

How To File Your Small Business Taxes Free Checklist Gusto

How To File Your Small Business Taxes Free Checklist Gusto

Tax Deductions And Write Offs For Sole Proprietors Fifth Third Bank

Tax Deductions And Write Offs For Sole Proprietors Fifth Third Bank

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

-(1).jpg?sfvrsn=0) Single Member Llc Vs Sole Proprietorship Bizfilings

Single Member Llc Vs Sole Proprietorship Bizfilings

Sole Proprietor Tax Forms Everything You Ll Need In 2021 The Blueprint

Sole Proprietor Tax Forms Everything You Ll Need In 2021 The Blueprint

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png) Schedule C Profit Or Loss From Business Definition

Schedule C Profit Or Loss From Business Definition

Sole Proprietorship Vs Llc A Guide To Tax Benefits Liabilities

Sole Proprietorship Vs Llc A Guide To Tax Benefits Liabilities

Business Taxes Llc Vs Sole Proprietorship

Business Taxes Llc Vs Sole Proprietorship

A Guide To Filling Out And Filing Schedule C For Form 1040 The Blueprint

A Guide To Filling Out And Filing Schedule C For Form 1040 The Blueprint

What Is A Schedule C Tax Form H R Block

What Is A Schedule C Tax Form H R Block

Sole Proprietor Tax Forms Everything You Ll Need In 2021 The Blueprint

Sole Proprietor Tax Forms Everything You Ll Need In 2021 The Blueprint

The Federal Tax Forms For A Sole Proprietorship Dummies

The Federal Tax Forms For A Sole Proprietorship Dummies

Sole Proprietor Tax Forms Everything You Ll Need In 2021 The Blueprint

Sole Proprietor Tax Forms Everything You Ll Need In 2021 The Blueprint

6 Steps For Switching From A Sole Proprietorship To Llc

6 Steps For Switching From A Sole Proprietorship To Llc

Sole Proprietorship Or S Corp Independent Contractor Tax Advisors

Sole Proprietorship Or S Corp Independent Contractor Tax Advisors

Sole Proprietorship Vs Llc A Guide To Tax Benefits Liabilities

Sole Proprietorship Vs Llc A Guide To Tax Benefits Liabilities