Are Utility Companies Exempt From 1099

It is not exempt. Are utilities and insurance considered services or goods for 1099 purposes.

Http Www Bradfordtaxinstitute Com Endnotes Irm 4 19 15 Pdf

The same rule applies to farmers that make payments in connection with the trucking or.

Are utility companies exempt from 1099. The payment is for his crop. Person including a US. It would be highly unusual if not unheard of for an insurance agency to function as anything other than a corporation or a limited liability taxed as a corporation.

Privately owned colleges and privately owned universities. The primary businesses eligible for the exemption are manufacturers restaurants hotels and agriculture operations. 16041-3 c exempts payments for freight services from the general requirement for payors to issue Form 1099 to independent contractors and others with which they do business.

In general you dont have to report payments made to corporations including LLCs taxed as corporations but there are some exceptions described above. You do not have to send a 1099-MISC form to corporations nor to limited liability companies which have made an election to be treated as corporations for income tax purposes. You dont need to report payments for merchandise telegraphs telephone freight storage and other similar items.

Form 1099 is the document on which banks mutual funds and other organizations report taxable income to the IRS. Also most corporations will not be issued a Form 1099-MISC unless they have been paid 600 or more in a calendar year for certain services including medical or legal services and including gross proceeds paid to attorneys. This also applies if your landlord is the one who passes along monthly utility bills to you that arrive.

If a sole proprietor has a dba name and the payments are made out to the dba company do we use the company EIN number or the name of the sole proprietor on line 1. Or an exempt volume transferor. Thus trucking companies need not issue Form 1099s to owner-operators that are under lease for freight hauling services.

In fact on page 5 of the Form 990 Return of Organization Exempt from Income Tax there are questions that must be answered as to the number of Forms W-2 W-2G and 1099 that the Organization has filed. Use form 1099-NEC to report payments to independent contractors. Utilities are usually exempt from state supervision.

However if you do not obtain it you must file and furnish Form 1099-S. 1099-MISCELLANEOUS WHAT IS and IS NOT REPORTABLE. See the instructions for more details.

A governmental unit including a foreign government or an international organization. As a general rule a business must issue a Form 1099-MISC to each individual partnership Limited Liability Company Limited Partnership or Estate to which you. The Substitute Form W-9 is NOT valid if completed by a non-resident alien person.

Utilities such as electric gas water fuel oil coal bottled gas and other fuels. A tax-exempt organization must file required information returns such as Form 1099-MISC PDFAn organization does not withhold income tax or social security and Medicare taxes from or pay social security and Medicare taxes or federal unemployment tax on amounts it pays to an independent contractor non-employee. This includes companies who administer tests.

See the Form 1099-MISC instructions for further information. Need to determine if it is necessary to send companies providing utilities gas electric internet etc and insurance med dental retirement etc a 1099 form. Do not furnish a Form 1099-MISC to banks public utilities or tax exempt organizations.

Between 35 and 50 percent of all electricity consumers in the United States are. They are exempt from backup withholding tax which means exempt from 1099 reporting and 3 They are a US. Corporations are exempt recipients but a 1099-MISC may be required under certain circumstances.

Exemption is supported by the belief that government ownershp effectively substitutesor regulation and that local control is more sensitive to local needs. The requirements for preparing and filing information returns such as Federal Forms 1099 and W-2 apply to all businesses including Exempt Organizations. Generally if the organization pays at least 600 during the.

Non-resident alien person for IRS purpos es is any foreign entity eg foreign individual foreign company etc. Doesnt matter if the utility company pays for the crop or the company that buys his corn. Any transaction in which the transferor is a corporation or is considered to be a corporation under Regulations section 16045-4d2.

While utility bills technically count as payment when theyre rolled into your rent they dont belong on a 1099-MISC if you pay utility companies directly. The Utility Sales Tax Exemption enables businesses across a variety of industries and states to save money each month on their utility bills as well as receive a refund on the past few years of overpaid taxes.

What Is The Dividends Received Deduction Dividendinvestor Com

What Is The Dividends Received Deduction Dividendinvestor Com

What To Do If You Receive An Irs Notice Cp2100 Or Cp2100a

What To Do If You Receive An Irs Notice Cp2100 Or Cp2100a

Https Sfsd Mt Gov Sab Resources 1099 M G And Nec Training 2020 Pdf

Https Sfsd Mt Gov Sab Resources 1099 M G And Nec Training 2020 Pdf

What To Do If You Receive An Irs Notice Cp2100 Or Cp2100a

What To Do If You Receive An Irs Notice Cp2100 Or Cp2100a

Https Www Irs Gov Pub Irs Prior I1040 2001 Pdf

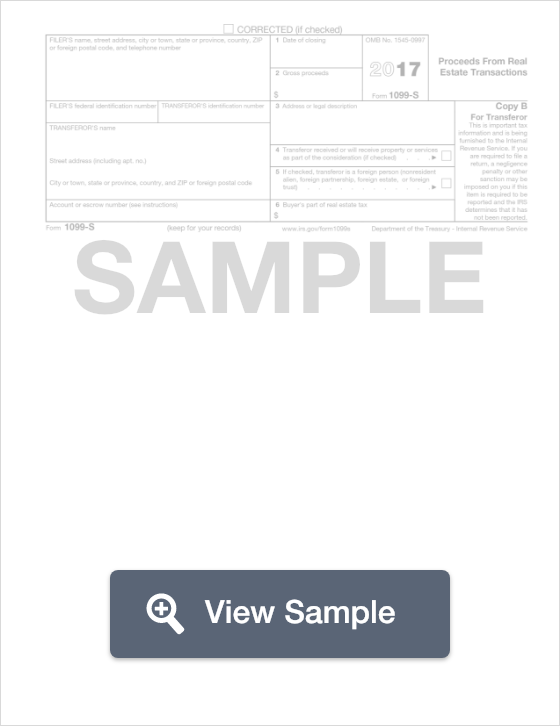

Irs Form 1099 S Real Estate Transactions Your Taxes Formswift

Irs Form 1099 S Real Estate Transactions Your Taxes Formswift

Blank Usa Template Pdf Printable Download Wikidownloadcom How Blank Pay Stub Template Word It Works Create A Pay St Templates Excel Templates Payroll Template

Blank Usa Template Pdf Printable Download Wikidownloadcom How Blank Pay Stub Template Word It Works Create A Pay St Templates Excel Templates Payroll Template

Https Www Ksrevenue Org Pdf Pub1540 Pdf

Https Sfsd Mt Gov Sab Resources 1099 M G And Nec Training 2020 Pdf

Https Coronavirus Nebraska Gov Assets Programfrequentlyaskedquestions Pdf

1099 Rules For Landlords And Small Businesses Robergtaxsolutions Com

Https Sfsd Mt Gov Sab Resources 1099 M G And Nec Training 2020 Pdf

What To Know About Filing A Business Tax Extension Businessnewsdaily Com Tax Extension Tax Refund Tax Exemption

What To Know About Filing A Business Tax Extension Businessnewsdaily Com Tax Extension Tax Refund Tax Exemption

Https Www Irs Gov Pub Irs Irbs Irb20 32 Pdf

Https Sfsd Mt Gov Sab Resources 1099 M G And Nec Training 2020 Pdf

Https Sfsd Mt Gov Sab Resources 1099 M G And Nec Training 2020 Pdf

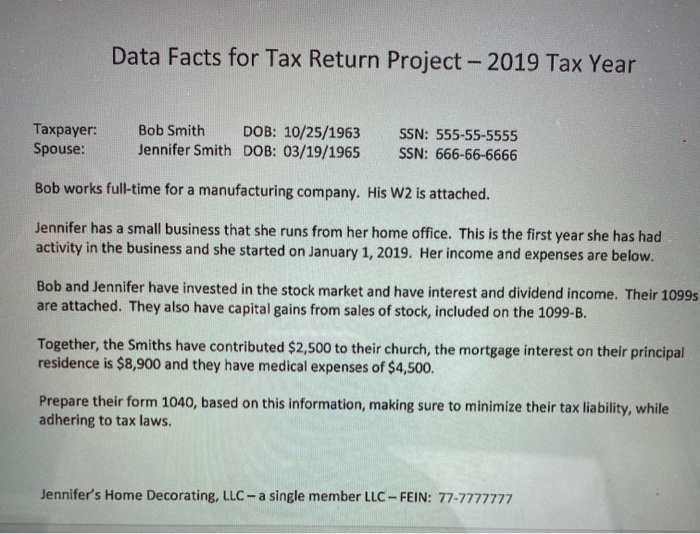

Data Facts For Tax Return Project 2019 Tax Year Chegg Com

Data Facts For Tax Return Project 2019 Tax Year Chegg Com

.jpg.aspx) General Welfare Exclusion Q A Bdo Insights May 2020

General Welfare Exclusion Q A Bdo Insights May 2020