Do You Send 1099 To Foreign Companies

An exempt recipient is any payee that is exempt from the Form 1099 reporting requirements. You should get a form W-8BEN signed by the foreign contractor.

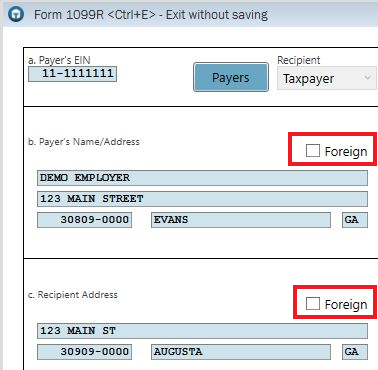

How To Enter A Foreign Address Support

How To Enter A Foreign Address Support

How can you be sure that the contractor.

Do you send 1099 to foreign companies. Source income of foreign persons for reporting requirements relating to payments to foreign. A 1099 is normally issued to individuals living in the US. In addition to issuing 1099-MISCs to all applicable companies businesses must also issue 1099-Bs to any companies foreign or domestic with which they.

And who are also citizens of the country. Instead you will need to ask the contractor to complete a Form W-8BEN. If your ad agency is a corporation you do not need to file a 1099.

Company performing services in Puerto Rico as US. If the foreign contractor is not a US. If the foreign recipient is non-exempt ie.

Citizen who performs any work inside the United States you would need to issue them a Form 1099-NEC. If they are not a citizen AND perform all of their work outside the US you are not required to issue a 1099-NEC. However they are not specific about foreign entities on that form.

By signing Form W-8BEN the foreign contractor is certifying that he or she is not a US. Also if you hire a non-US. The question that we are often asked is whether Form 1099 is still required.

The short answer is that if the foreign contractor is not a US citizen and as long as they are not located in the USA then no Form 1099 or withholding is required. Payments to foreign persons. All that the foreign contractor needs to do is to complete the basic information in Part I and sign in Part III attesting that the information is true correct and complete.

If you pay independent contractors you may have to file Form 1099-NEC Nonemployee Compensation to report payments for services performed for your trade or business. Self-employed via internet- For businesses hiring foreign individuals for work remotely or over the internet a Form 1099 is not required. See the Instructions for Form 1042-S relating to US.

It is the onus of the business owner to determine whether a contractor or vendor is a citizen. The Form W-8BEN certifies that the foreign contractor is not a US. Foreign worker providing services inside the US- It is vital for tax purposes to monitor where services are.

However foreign corporations are not issued this document. What about foreign workers. You can ask them to fill out Form W-8BEN for this purpose.

Subject to Form 1099 reporting requirements the IRS suggests that you request the recipient complete the appropriate Form W-8. No Form 1099 then needs to be filed for payments to foreign persons. If your independent worker completes all tasks in hisher country of origin and receives compensation via PayPal a Form 1099 is also not necessary.

If the following four conditions are met you must generally report a payment as nonemployee compensation. You only issue 1099s to non-corporate entities contractors consultants some LLPs and similar entities - read the specifics on the form that are US. Full text available to TIR Answer Center subscribers.

Person and the services are wholly performed outside the US then no Form 1099 is required and no withholding is required. Rules for Foreign Workers. Do I have to prepare a 1099-Misc for a foreign contractor who performed services related to a foreign rental property.

Taxpayer and all of the contracted services were performed outside the US a Form 1099 is not required. Subscribe to read full article. Person and the services are wholly performed outside the US then no Form 1099 is required and no withholding is required.

However in the US. You will most definitely report a nonemployee service provider who is a US. Any person making more than 600 per year is issued a 1099-MISC for income earned in the US.

Residents are always subject to reporting. Generate 1099-MISC reports when the vendor is a foreign entity The IRS considers a company to be a foreign entity if the company is located in a country other than the United States American Samoa Federated States of Micronesia Guam Marshall Islands Northern Mariana Islands Puerto Rico or the U. As long as the foreign contractor is not a US.

A 1099 is required for any worker who is not a US. You are required to provide 1099s for advertising services only to individuals sole proprietorships partnerships and limited liability companies. You dont have to report the money for the advertising itself since that is considered merchandise rather than a service.

So you dont have to complete 1099s for non-US. As long as the foreign contractor is not a US.

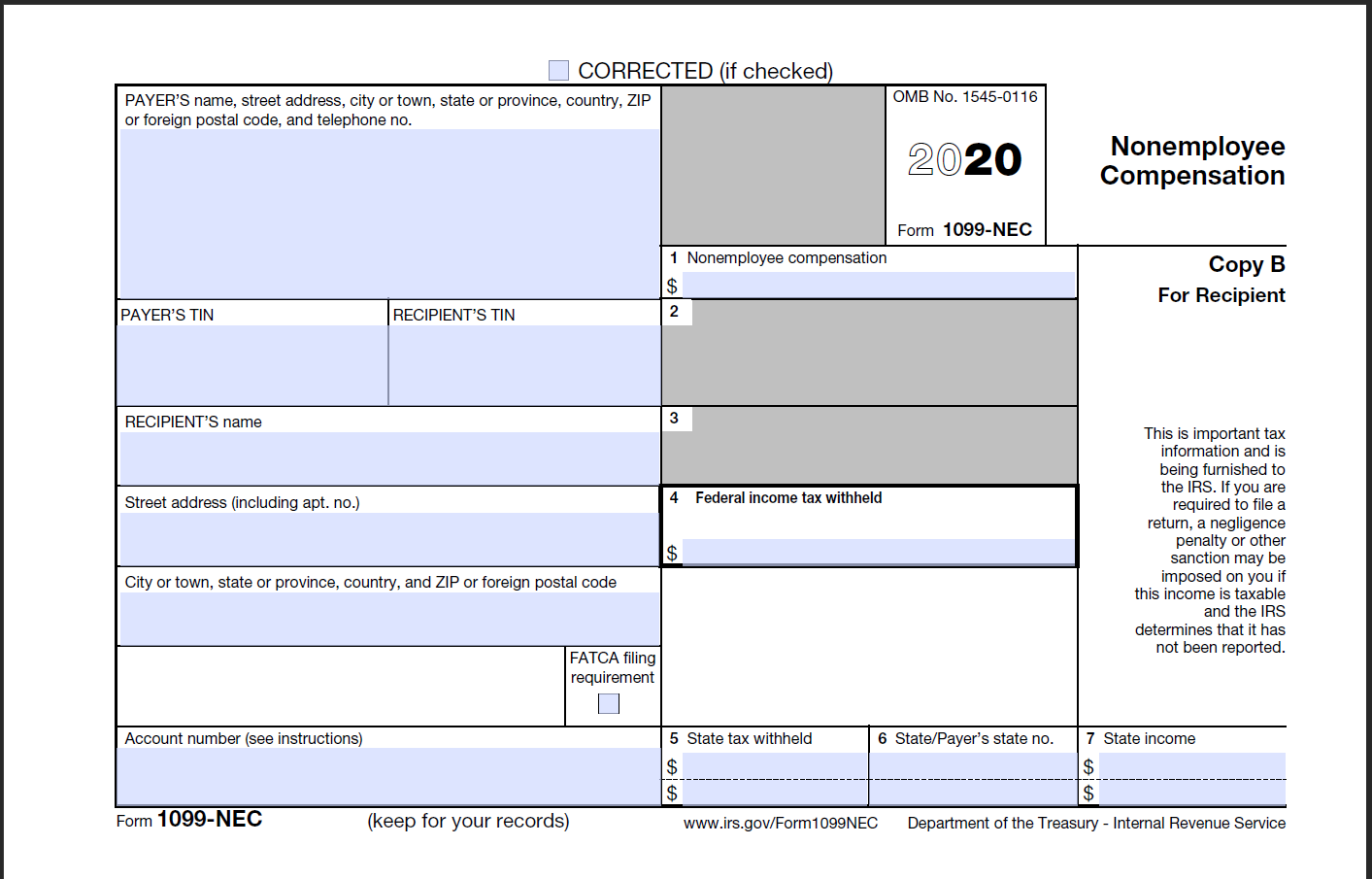

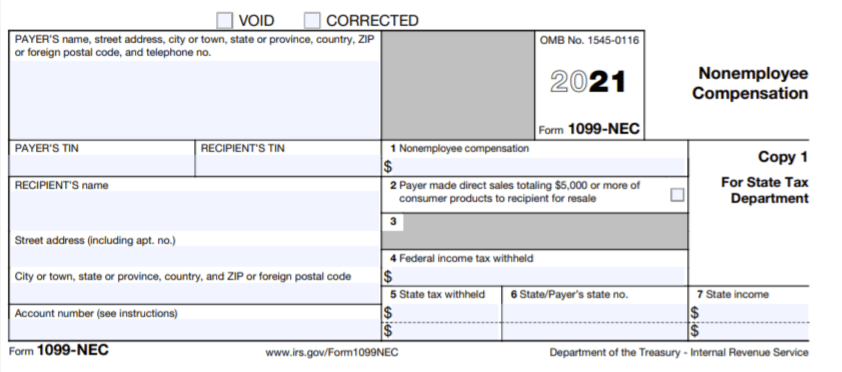

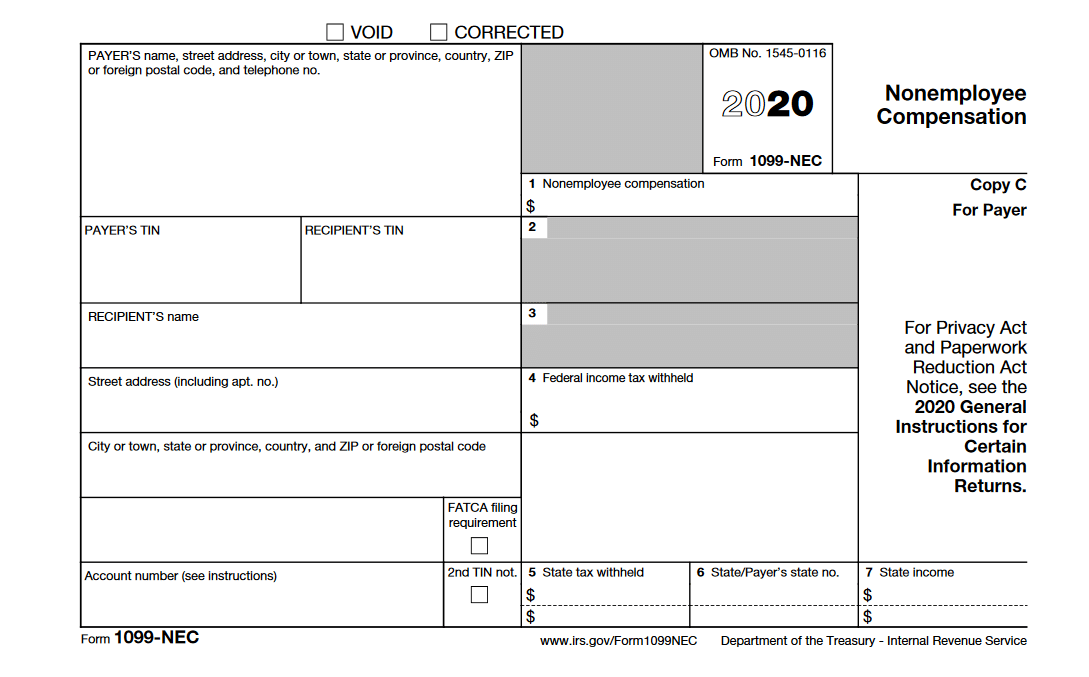

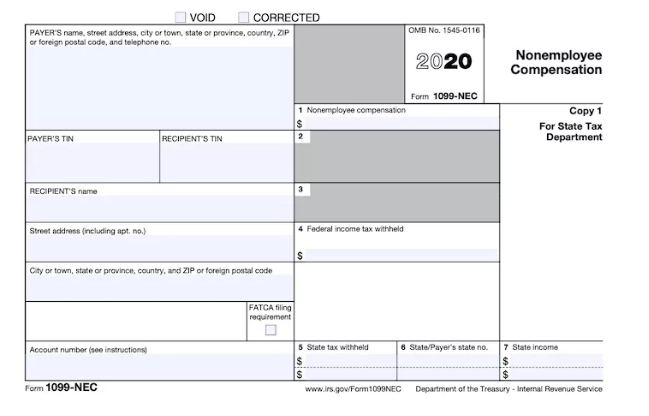

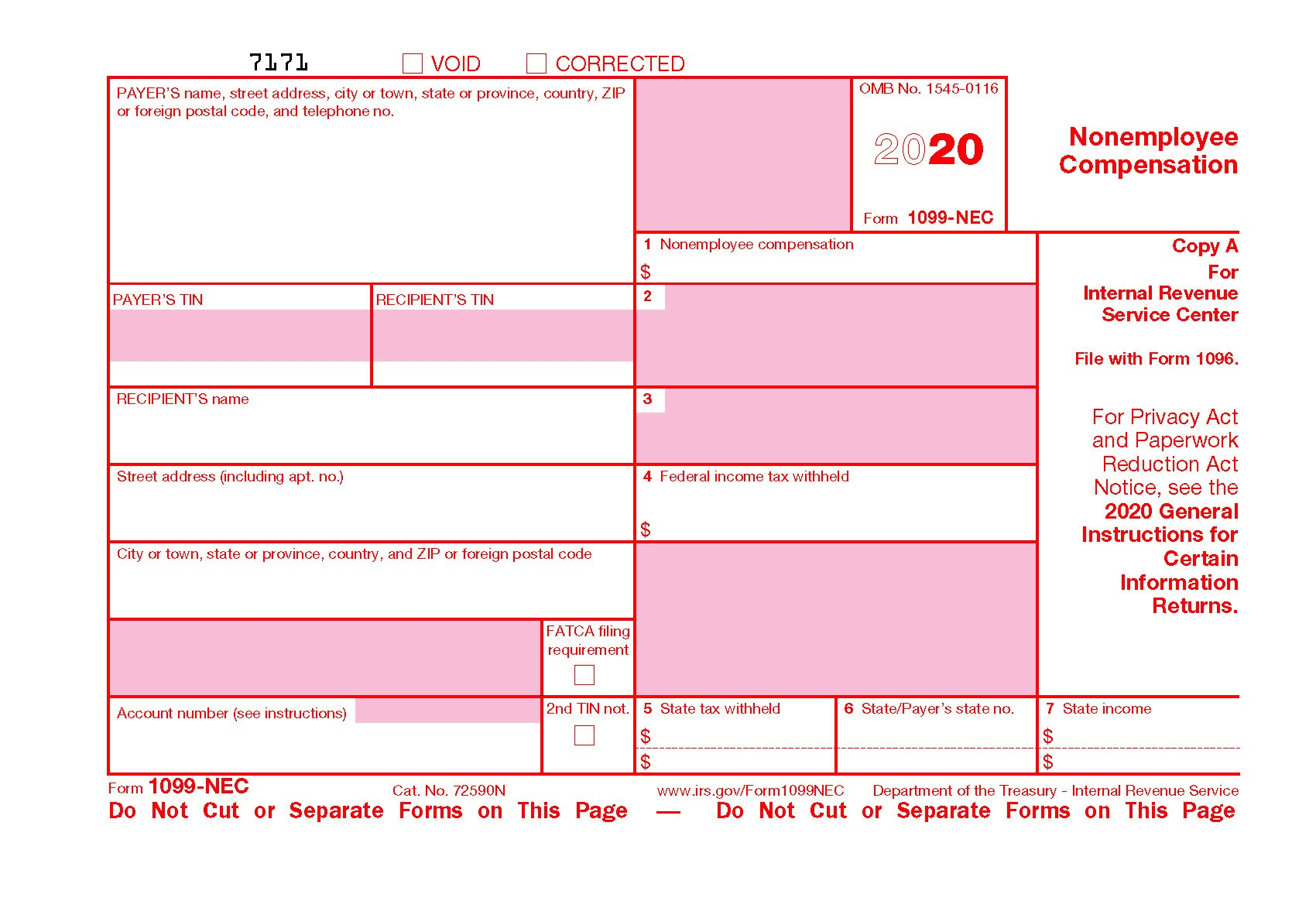

Will I Receive A 1099 Nec 1099 Misc Form Support

Will I Receive A 1099 Nec 1099 Misc Form Support

Fast Answers About 1099 Forms For Independent Workers 1099 Tax Form Fillable Forms Irs Forms

Fast Answers About 1099 Forms For Independent Workers 1099 Tax Form Fillable Forms Irs Forms

How To Fill Out A 1099 Nec Box By Box Guide On Filling Out The Form

How To Fill Out A 1099 Nec Box By Box Guide On Filling Out The Form

What Is Form 1099 Nec For Nonemployee Compensation Blue Summit Supplies

What Is Form 1099 Nec For Nonemployee Compensation Blue Summit Supplies

Form 1099 Nec Requirements Deadlines And Penalties Efile360

Form 1099 Nec Requirements Deadlines And Penalties Efile360

Interest Income Form 1099 Int What Is It Do You Need It

Interest Income Form 1099 Int What Is It Do You Need It

An Employer S Guide To Filing Form 1099 Nec The Blueprint

An Employer S Guide To Filing Form 1099 Nec The Blueprint

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Change To 1099 Form For Reporting Non Employee Compensation Ds B

Change To 1099 Form For Reporting Non Employee Compensation Ds B

Filing 1099s Who Gets One Capforge

Filing 1099s Who Gets One Capforge

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Looking For The New Form 1040 Tax Forms Irs Tax Forms Income Tax

Looking For The New Form 1040 Tax Forms Irs Tax Forms Income Tax

Do I Need To File 1099s Deb Evans Tax Company

Do I Need To File 1099s Deb Evans Tax Company

Do I Have To Prepare A 1099 Nec For A Foreign Contractor Amy Northard Cpa The Accountant For Creatives

Do I Have To Prepare A 1099 Nec For A Foreign Contractor Amy Northard Cpa The Accountant For Creatives

Here Is The Difference Between The Form 1099 Nec And Form 1099 Misc Forbes Advisor

Here Is The Difference Between The Form 1099 Nec And Form 1099 Misc Forbes Advisor

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It