W8 Form Uk Business

Filling out the W8 form. It is most likely because you are invoicing as an individual rather than company.

Australian Writer American Publisher W 8ben Tax Form Irs Gov State Tax Teachers College

Australian Writer American Publisher W 8ben Tax Form Irs Gov State Tax Teachers College

Section references are to the Internal Revenue Code.

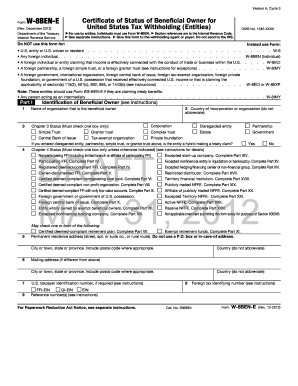

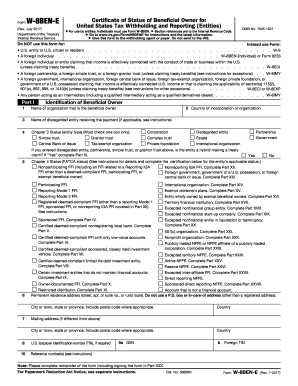

W8 form uk business. Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting Entities For use by entities. Entities must use Form W-8BEN-E. Please take care when you are completing your Form W8-BEN as we are unable to accept any forms that have had amendments made to them.

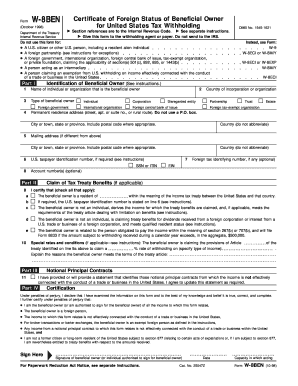

Andygambles UKBF Ace Full Member - Verified Business 2633 690 W8-BEN form is so they do not have to withhold tax from you in the US. This allows your customer to pay the full value of your invoices and not withhold tax. If you do not provide this form the withholding agent may have to withhold at the 30 rate under chapters 3 and 4 backup withholding rate or the rate applicable under section 1446.

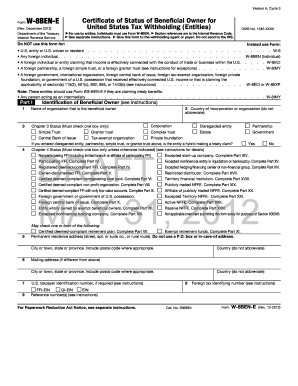

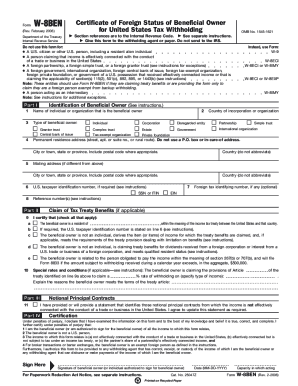

Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting Individuals For use by individuals. You should provide the following no credit score or tax returns needed- Employment verification letter- Two recent pay stubs that verify the salary claims in the EV letter- Two most recent bank statements that show a reasonable amount of cash- Photo ID in the form of a passport or visaGenerally the above should be plenty but it does depend on the landlordThe landlord will likely have you fill out a W8 form. Individuals must use Form W-8BEN.

The ITO will provide these forms after review of the Business Visitor Questionnaire. Or by foreign business entities who make income in the US. CALL ME I WILL HELP YOU 0207 112 1530 PARITYFX IS A DELIVERABLE FX BUSINESS BUT I HAVE KNOWLEDGE OF THESE FORMS SO I AM HAPPY TO HELP YOU DAVID ROSENBERG.

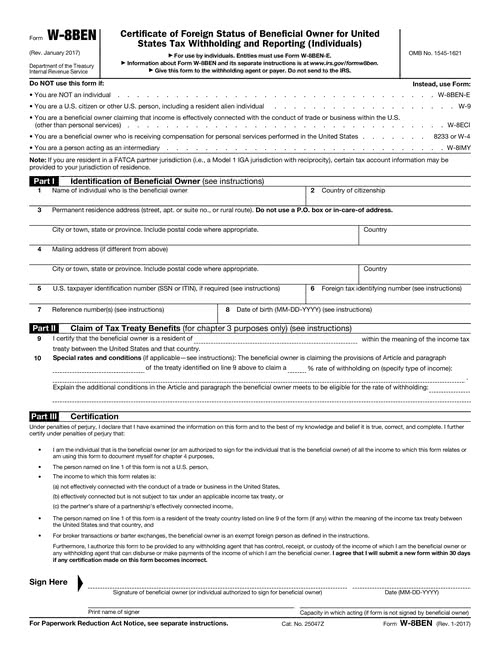

These instructions supplement the instructions for Forms W-8 BEN W-8 BEN-E W-8 ECI W-8 EXP and W-8 IMY. A W-8 form is a grouping of tax forms specifically for non-resident aliens and foreign businesses who have either worked in or earned income in the US. These tax forms are only used by foreign persons or entities certifying their foreign status.

For instructions and the latest information. It declares the applicants status as a non-resident alien or foreign national and informs financial companies that they will be taxed differently than a resident. July 2017 Department of the Treasury Internal Revenue Service.

Essentially the W-8 form is a self-certification form that you can provide your customer to declare that you as an entity an individual or an incorporated business are not US taxpayers and are not subject to US tax. What is a W-8 Form. Sections that are relevant to your company and information to provide.

Tax rates if applicable and withholding process. What is a W-8 Form. Certificate of Foreign Persons Claim That Income Is Effectively Connected With the Conduct of a Trade or Business in the United States 0717 09162017 Inst W-8ECI.

Assessing whether you are eligible to pay the withholding tax or not. If you are a company in the UK getting paid by a company in the US you need to fill in this form to avoid the US government withholding 30 of your income. Give Form W-8BEN to the person requesting it before the payment is made to you credited to your account or allocated.

July 2017 Department of the Treasury Internal Revenue Service Certificate of Foreign Status of Beneficial Owner for United. A W-8BEN and Form 8233 are both usually required in the event that a treaty benefit is being claimed for services income. In this tutorial you will learn How to Complete the W-8BEN-E Form for Business Entities.

4 Does anyone know any UK service that can just take care of this process as I need it done really quickly. Form W8 W 8BEN or W8 form is used by non-resident aliens who do work andor make income in the US. Notice of Expatriation and Waiver of Treaty Benefits 1109 07172012 Form W-8ECI.

2 conditions must be met. July 2017 Department of the Treasury Internal Revenue Service. If you are an individual in the UK getting paid by a company in the US you need to fill in the simpler W-8BEN form which is a lot less scary.

W-8 forms are Internal Revenue Service IRS forms that foreign individuals and businesses must file to verify their country of residence for tax purposes and certify that they qualify for a lower. For general information and the purpose of each of the forms described in these instructions see those forms and their accompanying instructions About Form W-8 BEN Certificate of Foreign. A new W-8BEN and Form 8233 must be provided each calendar year the tax treaty is claimed.

In a previous tutorial I showed you how to complete the W-8BEN for. If you do make a mistake you will need to complete a new form. If youre a legal citizen of the United States at no point will you have to worry about filling out the form.

What Is A W 8 Form The Dough Roller

What Is A W 8 Form The Dough Roller

W 8 Forms Collected By Stripe Stripe Help Support

W 8 Forms Collected By Stripe Stripe Help Support

Formulario W 8ben Como Preencher Cdbaby Pro Nando Ramos Youtube Irs Gov State Tax Business Administration

Formulario W 8ben Como Preencher Cdbaby Pro Nando Ramos Youtube Irs Gov State Tax Business Administration

W 8ben Form Pdf Fill Out And Sign Printable Pdf Template Signnow

W 8ben Form Pdf Fill Out And Sign Printable Pdf Template Signnow

Form W8 Instructions Information About Irs Tax Form W8

Form W8 Instructions Information About Irs Tax Form W8

Irs W 8ben Form Template Fill Download Online Free Pdf

Irs W 8ben Form Template Fill Download Online Free Pdf

How To Complete A W 8 Ben E Form Caseron Cloud Accounting

How To Complete A W 8 Ben E Form Caseron Cloud Accounting

Irs Form W8 Ben Pdf Fill Out And Sign Printable Pdf Template Signnow

Irs Form W8 Ben Pdf Fill Out And Sign Printable Pdf Template Signnow

Tax Form W8ben Step By Step Guide Envato Author Help Center Tax Forms Irs Gov Step Guide

Tax Form W8ben Step By Step Guide Envato Author Help Center Tax Forms Irs Gov Step Guide

Thoughts On Form W 8ben E For Companies Selling Software Licenses Gonnalearn Com

Thoughts On Form W 8ben E For Companies Selling Software Licenses Gonnalearn Com

What W8 Form For A Uk Charity Fill Online Printable Fillable Blank Pdffiller

What W8 Form For A Uk Charity Fill Online Printable Fillable Blank Pdffiller

How To Complete W 8ben E Form For Business Entities Youtube

How To Complete W 8ben E Form For Business Entities Youtube

W8 Ben Form Fill Online Printable Fillable Blank Pdffiller Tax Forms Form Irs

W8 Ben Form Fill Online Printable Fillable Blank Pdffiller Tax Forms Form Irs

How To Fill In A W8ben Form If You Re In The Uk And Trading In The Usa

How To Fill In A W8ben Form If You Re In The Uk And Trading In The Usa

Aussie New To Zazzle Need Help Setting Up Au Br Ca Es Fr Nd Nz Pt Sv Uk Irs Gov Irs Forms Instructional Design

Aussie New To Zazzle Need Help Setting Up Au Br Ca Es Fr Nd Nz Pt Sv Uk Irs Gov Irs Forms Instructional Design

Primer Zapolneniya Nalogovoj Formy W 8ben Dlya Shuterstok Shutterstock Irs Gov State Tax Business Administration

Primer Zapolneniya Nalogovoj Formy W 8ben Dlya Shuterstok Shutterstock Irs Gov State Tax Business Administration

W 8ben E Fill Out And Sign Printable Pdf Template Signnow

W 8ben E Fill Out And Sign Printable Pdf Template Signnow