City Of Los Angeles Business License Renewal Due Date

Your cancelled check or ACH confirmation is your receipt if payment is due. The following provides links to our on-line renewal services and other information related to the tax and permit renewal processes.

Faqs Construction A Permit Los Angeles Bureau Of Engineering Permit Manuals

Faqs Construction A Permit Los Angeles Bureau Of Engineering Permit Manuals

Late payment carries a penalty of 20 per month up to 100 of the amount due.

City of los angeles business license renewal due date. Mayor Garcetti Encourages Mask Use With LA. Apply for or obtain information for a business license. 14 Filings not received by the Filing Deadline will incur delinquency penalties of 5 percent of the tax due plus 5 percent per month for the first three months of delinquency plus.

We established a Business Support Center that started on November 25 2019. Click here to view Ord. On Renew You Los Angeles Business License Today.

Once received by Office of Finance you will receive a notice of any liability due for the prior years. All companies doing business in the City of Los Angeles need to register with the City and depending on how your business is set up you may also need to register with the County State and Federal Government. Los Angeles CA 90051-3996 The renewal MUST BE POSTMARKED NO LATER THAN MIDNIGHT on March 1 2021.

Taxpayers may file their 2018 Business Tax Renewal form either by mail or electronically. Logon to my Business Tax Account - Los Angeles. LA County Treasurer and Tax Collector Attn.

The license fees for 2021-22 which were originally due on March 30 2021 will also be. The City has enacted regulatory ordinances in areas such as zoning building safety police fire hazardous material disclosure sanitation. The issuance of a TRC and the payment of the business tax do not authorize the conduct or continuance of any illegal business or of a legal business in an illegal manner within the City of Los Angeles.

Las Vegas City Hall. Proof of mailing is highly recommended. Improvements include offering telephone support email.

The Los Angeles business tax is due February 28 2018. Our efforts streamline processing of new business license applications and renewals. Registering your business is a key part of getting up and running.

The City of Culver City has partnered with HdL Companies. Culver City Business taxes are due upon receipt of the business tax certificate renewal notice which is mailed in early December of each year. 5 rows The City of Los Angeles requires that taxpayers provide a list of all of their out-of-city.

The Cannabis Procedures have been amended by Ord. Las Vegas NV 89101 Phone. Business License Section PO.

702-229-6011 TTY 7-1-1 An All-America City. The City will provide tax relief for small businesses by delaying the collection of the unified license bill. The certificate you have remains valid unless it is.

Nearly all of our taxpayer services are available on-line 24 hours 7 days a week and are listed below. LAMC Section 10419 Fees and Fines. Non-financial information such as name business address including home-based businesses mailing address etc contained in your City of Los Angeles tax and permit records is subject to public disclosure under provisions of the California Public Records Act Government Code Section 6250 et seq.

A new Business Tax Registration Certificate will not be mailed to you unless changes or corrections were required. The 2017 LABT renewal along with the required payment of tax became due on January 1 2017 and will be deemed delinquent if the filing and payment of tax 13 are not made by February 28 2017 the Filing Deadline. Pay for a business license or license in collection.

Do it by 22819 to be eligible for qualifying taxexemptions. The city provides copies of its forms for download and completion as well as access to an electronic filing system with applicable instructions on its website last accessed January 17 2018. Box 54970 Los Angeles CA 90054-0970.

To pay your Business License application fee in full by check or money order write your Business License ID on the face of the payment instrument and submit the payment along with your invoice to the following address. Business Start Date If your start date is earlier than the current calendar year you will receive a notice requesting gross receipts for each year your business has been in operations. Business Registration ApplicationsRegistration for Business Tax Registration Certificate BTRC.

Business tax becomes delinquent if not paid by the last day of February. Manage an existing business license. The due date for license fees otherwise due on March 31 2020 is extended to November 1 2021.

If youre 1 of the recipients save time renew online.

Tobacco Retailer S Permit Los Angeles Office Of Finance

How To Register For A Btrc Los Angeles Office Of Finance

How To Register For A Btrc Los Angeles Office Of Finance

Legal Cannabis Retailers Los Angeles Office Of Finance

Legal Cannabis Retailers Los Angeles Office Of Finance

Basic Business License Renewal Overview Dcra

Basic Business License Renewal Overview Dcra

How To Register For A Btrc Los Angeles Office Of Finance

How To Register For A Btrc Los Angeles Office Of Finance

Business Tax Extensions Prepayment Required Los Angeles Office Of Finance

Http File Lacounty Gov Sdsinter Dmh 1060012 Fy19 20sdpinstructionsandforms Pdf

Online Business Tax Renewals Efiling Los Angeles Office Of Finance

Online Business Tax Renewals Efiling Los Angeles Office Of Finance

Http Labavn Org Contracts Documents 1838 21063 1 20systems 20it 20rfp 20final Pdf

Renewal Notice Instructions Finance Department City Of Santa Monica

Online Taxpayer Services Los Angeles Office Of Finance

Online Taxpayer Services Los Angeles Office Of Finance

Hazardous Materials El Segundo Fire Department

Renewal Notice Instructions Finance Department City Of Santa Monica

Ab 63 Sb 1146 Tax Discovery Los Angeles Office Of Finance

Ab 63 Sb 1146 Tax Discovery Los Angeles Office Of Finance

Efiling Business Tax Renewals Los Angeles Office Of Finance

Efiling Business Tax Renewals Los Angeles Office Of Finance

Don T Get Penalized File For Your La Business Tax Creative Artist Exemption 47 Blog Afm Local 47

Business Tax Information Faq Los Angeles Office Of Finance

Business Tax Information Faq Los Angeles Office Of Finance

Online Taxpayer Services Los Angeles Office Of Finance

Online Taxpayer Services Los Angeles Office Of Finance

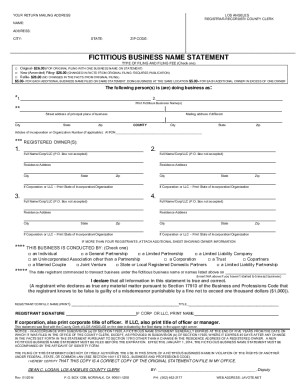

Dba Los Angeles Fill Out And Sign Printable Pdf Template Signnow

Dba Los Angeles Fill Out And Sign Printable Pdf Template Signnow