Advantages Of A Limited Partnership Form Of Small Business Ownership

Business is likely to continue for a long time. This makes it much easier for new businesses or investment projects to raise money because nothing scares away potential investors more than the idea of being personally liable for a companys mistakes.

How To Choose The Best Legal Structure For Your Business Pros Cons Business Structure Small Business Management Business Venture

How To Choose The Best Legal Structure For Your Business Pros Cons Business Structure Small Business Management Business Venture

He or she isnt personally liable and unless the limited partner has done something as an individual to make him or her liable he or she.

Advantages of a limited partnership form of small business ownership. One of the biggest advantages for a limited partner in the Limited Partnership is the fact that he or she only faces limited liability. Single or Sole Proprietorship 2. Lets take a look at the advantages of a limited partnership.

However arguably the most significant advantage of a Limited Partnership is the limited liability that is afforded to the Limited Partners. The main advantage for limited partners is that their personal liability for. However you do not have the right to make operational decisions.

This business structure accounts for the largest number of businesses but the lowest amount of revenue. Having a partner can not only make you more productive but it may afford you the ease and flexibility to pursue more business opportunities. As the name states owners and managers have limited personal liability for business debts whereas individuals assume full.

The difference is that the limited partners in the relationship get to share in the profits and losses but they do not have to participate in the business. As a general partner you own and operate the business with personal liability. The sole proprietorship is the oldest simplest and cheapest form of business ownership.

It might even eliminate the downside of opportunity costs. Each partner files the profits or losses of the business on his or her own personal income. As with a general partnership the profits and losses in a limited partnership flow through the business to the partners all of whom are taxed on their personal income tax returns.

This form of business is a hybrid of other forms because it has some characteristics of a corporation as well as a partnership so its structure is more flexible. Starting their ice cream business as a partnership was inexpensive and let them combine their limited financial resources and. Starting their ice cream business as a partnership was inexpensive and let them combine their limited financial resources and use their diverse skills and talents.

As a limited partner you invest your money resources or properties in the business. One of the advantages of having a business partner is sharing the labor. One of the key benefits of forming a limited partnership is that limited partners typically cant lose more money than they invest hence the term limited.

A partnership is two or more people voluntarily operating a business as co-owners for profit. Limited partnerships like The Book Nook hold several advantages especially for limited partners like Ben and Bob. The sharing of the losses helps reduce the burden it brings for each partner.

If the business goes bankrupt or is sued the limited partner is only liable up to his investment in the business and the businesss assets. FORMS OF BUSINESS OWNERSHIP 1. You also do not have personal liability for any business debts.

Some advantages of an LLC include. For example if a business organized as a Limited Partnership is sued and a judgment is issued the personal assets of the Limited Partners are protected from seizure. While the partnership form of ownership is viewed negatively by some it was particularly appealing to Ben Cohen and Jerry Greenfield.

View FORMS-OF-BUSINESS-OWNERSHIPpptpptx from BSBA 47583685 at Bulacan State University Malolos. Limited Partnership and Partnership with Limited Liability Limited means that most of the partners have limited liability to the extent of their investment as well as limited input regarding management decisions which generally encourages investors for short term projects or for investing in capital assets. While the partnership form of ownership is viewed negatively by some it was particularly appealing to Ben Cohen and Jerry Greenfield.

This is the choice for most small businesses. Another advantage of the partnership business is the fact that in the event of a loss the losses are shared among the partners. Businesses as partnerships do not have to pay income tax.

Templates Limited Partnership Agreement Templates Hunter Limited Partnership Agreement Partnership

Templates Limited Partnership Agreement Templates Hunter Limited Partnership Agreement Partnership

Best Gst Registration At Kolkata Business Insurance Professional Liability Income Tax Return

Best Gst Registration At Kolkata Business Insurance Professional Liability Income Tax Return

How To Create Private Limited Company Private Limited Company Limited Liability Company Company

How To Create Private Limited Company Private Limited Company Limited Liability Company Company

Investment Partnership Agreement Template

Investment Partnership Agreement Template

A Limited Liability Company Llc Is A Unique Business Entity That Combines The Taxation Benefits Of A P Limited Liability Company Unique Business Business Tax

A Limited Liability Company Llc Is A Unique Business Entity That Combines The Taxation Benefits Of A P Limited Liability Company Unique Business Business Tax

Limited Liability Partnership Limited Liability Partnership Limited Partnership Partnership

Limited Liability Partnership Limited Liability Partnership Limited Partnership Partnership

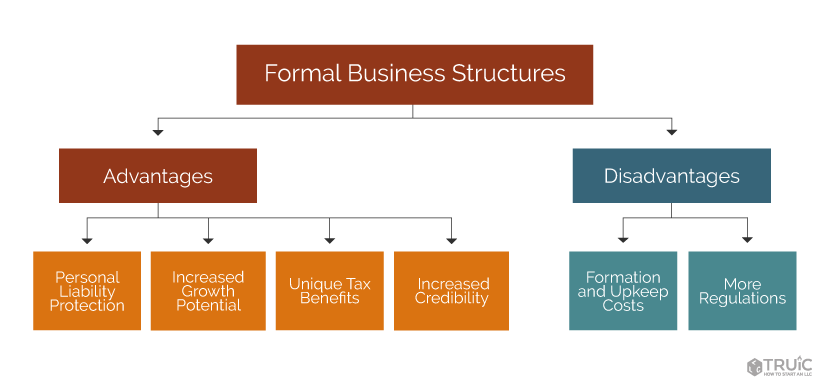

Business Structure How To Choose A Business Structure Truic

Business Structure How To Choose A Business Structure Truic

Choosing A Business Structure Infographic Business Structure Small Business Start Up Infographic Marketing

Choosing A Business Structure Infographic Business Structure Small Business Start Up Infographic Marketing

Business Ownership Structure Types Business Structure Business Basics Business Ownership

Business Ownership Structure Types Business Structure Business Basics Business Ownership

4 Types Of Partnership In Business Limited General More

4 Types Of Partnership In Business Limited General More

Llp Registration Online Limited Liability Company Partnership India Limited Liability Partnership General Partnership Limited Liability Company

Llp Registration Online Limited Liability Company Partnership India Limited Liability Partnership General Partnership Limited Liability Company

Limited Partnership Lp Definition

Limited Partnership Lp Definition

Grow Your Small Business With Easy Steps Brittany Killins Small Business Management Business Investment Small Business

Grow Your Small Business With Easy Steps Brittany Killins Small Business Management Business Investment Small Business

What Is Difference Between Corporation Llc Limited Partnership And Sole Proprietorship In C Sole Proprietorship Limited Partnership Limited Liability Company

What Is Difference Between Corporation Llc Limited Partnership And Sole Proprietorship In C Sole Proprietorship Limited Partnership Limited Liability Company

How Should You Incorporate Your Business Here S A Cheat Sheet Infographic Legal Business Startup Infographic Business Law

How Should You Incorporate Your Business Here S A Cheat Sheet Infographic Legal Business Startup Infographic Business Law

Llp Registration Fees And Procedure Infographic Limited Liability Partnership Limited Partnership Liability

Llp Registration Fees And Procedure Infographic Limited Liability Partnership Limited Partnership Liability

Sole Proprietorships Advantages Disadvantages Piktochart Infographic Teaching Business Business Basics Sole Proprietorship

Sole Proprietorships Advantages Disadvantages Piktochart Infographic Teaching Business Business Basics Sole Proprietorship

What Everyone Ought To Know About Limited Liability Partnership Registration Infographic Limited Liability Partnership Liability Private Limited Company

What Everyone Ought To Know About Limited Liability Partnership Registration Infographic Limited Liability Partnership Liability Private Limited Company

Free Business Partnership Agreement Template Business Partnership Contract Template Good Essay General Partnership

Free Business Partnership Agreement Template Business Partnership Contract Template Good Essay General Partnership