How To Get A Non Ssa 1099 Form

You can conduct the automated services 24 hours a day. Notice 703 guides you through summing up three income sources.

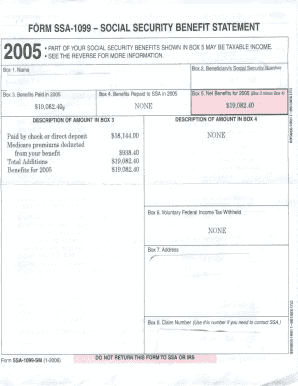

Ssa 1099 Fill Out And Sign Printable Pdf Template Signnow

Ssa 1099 Fill Out And Sign Printable Pdf Template Signnow

To enter go to.

How to get a non ssa 1099 form. My Social Security account at wwwsocialsecuritygovmyaccount. The SSA-1099 is sent by the Soc Sec Adm. To enter Form SSA-1099.

Calling us at 1-800-772-1213 TTY 1-800-325-0778 Monday through Friday 800 am 700 pm. Contacting your local Social Security office. Taxpayer received an SSA-1099 showing his social security number in box 2 and his ex-wifes social security number in box 8.

24 hours a day 7 days a week. At the prompt indicate that youre requesting a replacement SSA-1099. If you received social security benefits but were not issued an SSA-1099 you can request a copy from the Social Security Administration.

People who receive Supplemental Security Income SSI do not need a form SSA-1099 or an SSA-1042s. SSI and Medicare enrollees can instead request a proof of benefits letter from the SSA by logging into their account and requesting a paper copy of the form. If you did not receive your SSA-1099 or have misplaced it you can get a replacement online if you have a My Social Security account.

This amount flows to Form 1040 line 20a. That seems a bit odd as it would be easy enough to fake a 1099. We hope this helps.

Youll be able to access your form and save a printable copy. Proceeds from Real Estate Transactions 1099-SA. Will send you form SSA-1042S instead.

Just note that you cant request a replacement form SSA-1099 or SSA-1042S for 2019 until after February 1. Box 5 is box 3 less box 4. Click on Federal Taxes Personal using Home and Business Click on Wages and Income Personal Income using Home and Business Click on Ill choose what I work on if shown Scroll down to Retirement Plans and Social Security.

Enter any Medicare premiums paid code 13 If applicable. Distributions from an HSA Archer MSA or. A replacement SSA-1099 or SSA-1042S is typically available for the previous tax year after February 1.

On Social Security SSA-1099 RRB-1099 click the. A replacement SSA-1099 or SSA-1042S is generally available for the previous tax year after February 1. Youll get the additional 1200 and 500 payments this year only if you register soon with the IRS or file a federal income tax return.

Income - Select My Forms. They only one that is tough to fake is SSA-1099 because they dont make. Between Form SSA-1099 and Notice 703 a worksheet that is included with your SSA-1099 you should have all the information you need.

Where do I enter Form SSA-1099 information for Form 1040. You also may be able to request a replacement SSA-1099 by using our automated telephone service at 1-800-772-1213. Sign in to your account and click the link for Replacement Documents.

If you currently live in the United States and you need a replacement form SSA-1099 or SSA-1042S simply go online and get an instant printable replacement form with a. 1099-R RRB-1099 RRB-1099-R SSA-1099 - Distributions from pensions annuities retirement IRAs Social Security etc. If you live outside of the United States and you need a replacement form SSA-1099 or SSA-1042S please contact your nearest Federal Benefits Unit.

Form SSA-1099 is used to report any Social Security benefits that you may have collected during the year. If you need the form contact the social security administration. Taxpayers generally receive Form SSA-1099 in January.

Call us tollfree at 1-800-772-1213 or at our TTY number of hearing. Distributions from Pensions Annuities Retirement plans IRAs or Insurance Contracts 1099-S. Go to Screen 141 Miscellaneous Income.

Check out our Frequently Asked Questions web page on how to obtain a replacement 1099. Each year you receive a Form SSA-1099 from the Social Security Administration showing the amount of. They have been divorced for over 10 years.

Enter the amount from box 5 in Social security benefits SSA-1099 box 5 code 2. The wife age 68 applied for and started receiving benefits in 2019 based on the ex-husbands. If you have questions or need help understanding how to request your replacement SSA-1099 or SSA-1042S online call our toll-free number at 1-800-772-1213 or visit your Social Security office.

This amount flows to Schedule A line 1. Scenario 5 Youre retired and receive Social Security benefits. SSA Once youve created the account you can request the request form.

They were married for over 10 years as well. Any 1099 form other than SSA-1099 that was issued to you. I prepare returns for both of them.

If you currently live in the United States and you need a replacement form SSA-1099 or SSA-1042S simply go online and request an instant printable replacement form with a my Social Security account at wwwsocialsecuritygovmyaccount. If you are deaf or hard of hearing call our toll-free TTY number 1-800-325-0778 between 800 am. There is no non form.

Ssa 1099 Form Page 1 Line 17qq Com

Ssa 1099 Form Page 1 Line 17qq Com

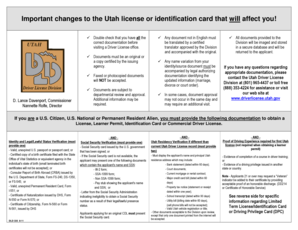

Non Ssa 1099 Form California Vincegray2014

Non Ssa 1099 Form California Vincegray2014

Non Ssa 1099 Form Page 1 Line 17qq Com

Non Ssa 1099 Form Page 1 Line 17qq Com

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Social Security 1099 Forms Vincegray2014

Social Security 1099 Forms Vincegray2014

Non Ssa 1099 Form Page 1 Line 17qq Com

Non Ssa 1099 Form Page 1 Line 17qq Com

/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png) Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Non Ssa 1099 Form California Vincegray2014

Non Ssa 1099 Form California Vincegray2014

Social Security 1099 Form 2017 Vincegray2014

Social Security 1099 Form 2017 Vincegray2014

Non Ssa 1099 Form Page 1 Line 17qq Com

Non Ssa 1099 Form Page 1 Line 17qq Com

Non Ssa 1099 Form Page 1 Line 17qq Com

Non Ssa 1099 Form Page 1 Line 17qq Com

Non Ssa 1099 Form Fill Online Printable Fillable Blank Pdffiller

Non Ssa 1099 Form Fill Online Printable Fillable Blank Pdffiller

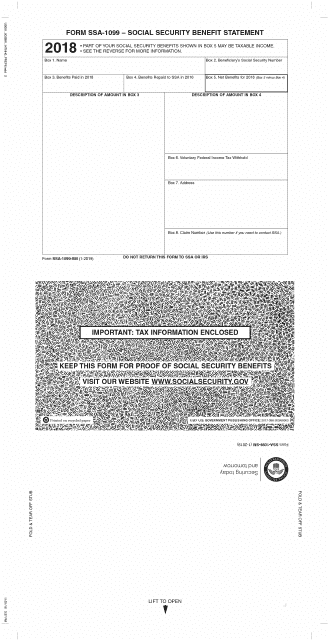

Form Ssa 1099 Download Printable Pdf Or Fill Online Social Security Benefit Statement 2018 Templateroller

Form Ssa 1099 Download Printable Pdf Or Fill Online Social Security Benefit Statement 2018 Templateroller

Non Ssa 1099 Form Page 1 Line 17qq Com

Non Ssa 1099 Form Page 1 Line 17qq Com

1099 Form California Vincegray2014

1099 Form California Vincegray2014

Social Security 1099 Forms Vincegray2014

Social Security 1099 Forms Vincegray2014