How To Set Up A 1099 Company

In forming a corporation prospective shareholders exchange money property or both for the corporations capital stock. How To 1099 Someone.

11 Form How To Fill Out How Will 11 Form How To Fill Out Be In The Future Irs Forms 1099 Tax Form Tax Forms

11 Form How To Fill Out How Will 11 Form How To Fill Out Be In The Future Irs Forms 1099 Tax Form Tax Forms

If youre using a 1099 employee you will first want to create a written contract.

How to set up a 1099 company. Steps to file a 1099 Employee. Select the Vendor eligible for 1099 checkbox and in the Tax ID field enter the vendors tax identification number. His actual take home is 3232250 because the payroll tax is paid up front.

SEP IRAs are attractive for the self-employed freelancers and small businesses because they are easy to set up and administer. Thats basically an effective tax rate of 18. Making sure you keep track of business income and expenses will help you know how your business is doing and you will be able to deduct those expenses from your income at tax time.

If you are a sole proprietor or single-member LLC owner you report 1099 income on Schedule CProfit or Loss From BusinessWhen you complete Schedule C you report all business income and expenses. The W-9 is where you will find the legal name address entity type and contractor EIN. As part of the 1099 process you must review address book records for your suppliers and companies to ensure that you have the necessary information and that your information meets IRS requirements.

Thus personal payments arent reportable. Setup Supplier and Company. A person is engaged in business if he or she operates for profit.

You have to either order them from the IRS or pick them up at an. If you know the company name but not the persons name leave the Company Name field blank to avoid double names on the 1099-MISC form. You can select only a main account of.

You cannot download these. You may also have state and local requirements for estimated tax paymentsSee your states individual website for. Including 1099 Income on Your Tax Return.

Go to Accounts payable Periodic tasks Tax 1099 1099 main account association. Set up a Simple Business Recordkeeping System. So Burts total tax cost is 617750 on 35000 wages.

For W-2 employees all payroll taxes are deducted automatically from the paycheck and paid to the government by the employer. Forms 1099 and W-2 are two separate tax forms for two types of workers. If they are registered as an S corporation or C corporation no 1099.

If supplier or company information is incorrect the IRS might reject the returns and impose fines for each incorrect 1099. You may need to make quarterly estimated tax payments. His internet is 360 for the year and he drives 10000 business miles.

Persons engaged in a trade or business must file Form 1099 MISC when certain payments are made. 2 Setup Supplier and Company. Make sure you have the current name address and social security numbers on file for.

The simplified employee pension plan allows 1099 workers to contribute up to 25 percent of their net earnings from self-employment or 53000. In the Main account number field select the main account to relate to a 1099 box. 1099 Rules Regulations Who must file.

Capture the information you need to support your use of legitimate business deductions. Independent contractors use a 1099 form and employees use a W-2. Ernie 1099 contractor Lets say Ernies cell phone costs 600 for the year.

Step 1 - Check Your Information. In the 1099 box code field select the box code on the 1099 form that amounts that are. Step 2 - Grab Your Forms.

Employers can contribute up to 25 of each eligible employees. Step 3 - Fill Out the Forms. Select the Additional Info tab.

For information on estimated tax payments refer to Form 1040-ES Estimated Tax for Individuals. A corporation generally takes the same deductions as a sole proprietorship to figure its taxable income. How you report 1099-MISC income on your income tax return depends on the type of business you own.

Here are some guidelines to help determine if a vendor needs to be set up as a 1099 vendor. Its not usually legally required but doing so will protect your business. For federal income tax purposes a C corporation is recognized as a separate taxpaying entity.

A corporation can also take special deductions. If you pay them 600 or more over the course of a year you will need to file a 1099-MISC with the IRS and send a copy to your contractor.

Do Llcs Get A 1099 During Tax Time Incfile

Do Llcs Get A 1099 During Tax Time Incfile

A 2021 Guide To Taxes For Independent Contractors The Blueprint

A 2021 Guide To Taxes For Independent Contractors The Blueprint

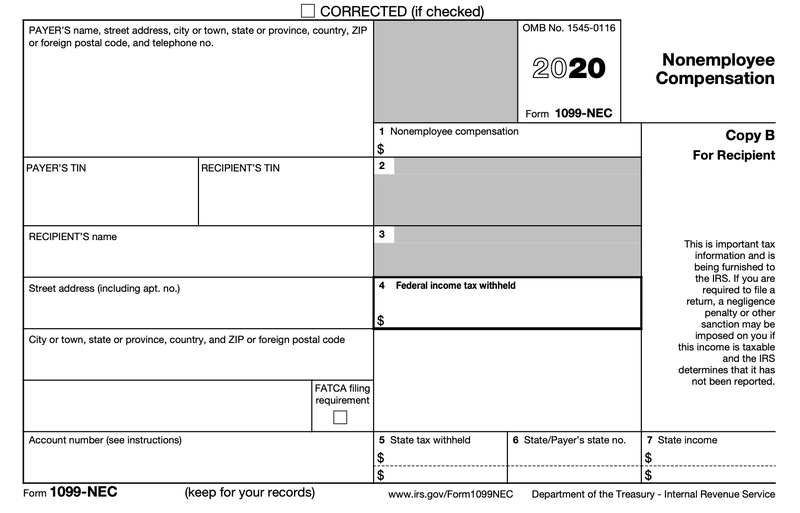

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Misc Tax Deadline Reminder 2014 Forms 1099 Business Strategy Irs Website Irs

Form 1099 Misc Tax Deadline Reminder 2014 Forms 1099 Business Strategy Irs Website Irs

1 Tips For Work From Home Taxes W 9 1099 Vipkid Example Youtube Working From Home Work From Home Business Online Tutoring

1 Tips For Work From Home Taxes W 9 1099 Vipkid Example Youtube Working From Home Work From Home Business Online Tutoring

Instant Form 1099 Generator Create 1099 Easily Form Pros

Instant Form 1099 Generator Create 1099 Easily Form Pros

An Employer S Guide To Filing Form 1099 Nec The Blueprint

An Employer S Guide To Filing Form 1099 Nec The Blueprint

Independent Contractor Billing Template Beautiful 6 1099 Template Excel Exceltemplates Exceltemplates Invoice Template Invoice Template Word Invoice Example

Independent Contractor Billing Template Beautiful 6 1099 Template Excel Exceltemplates Exceltemplates Invoice Template Invoice Template Word Invoice Example

Form Irs 1099 Misc 2013 Irs Forms Irs Form

Form Irs 1099 Misc 2013 Irs Forms Irs Form

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Downloadable 1099 Tax Forms Printable 1099 Form 2018 Word Image 510 Printable Pages 1099 Tax Form Business Letter Template Simple Cover Letter Template

Downloadable 1099 Tax Forms Printable 1099 Form 2018 Word Image 510 Printable Pages 1099 Tax Form Business Letter Template Simple Cover Letter Template

1099 Form 2016 News Irs Forms 1099 Tax Form Tax Forms

1099 Form 2016 News Irs Forms 1099 Tax Form Tax Forms

Independent Contractor Expenses Spreadsheet Business Tax Deductions Business Tax Small Business Tax Deductions

Independent Contractor Expenses Spreadsheet Business Tax Deductions Business Tax Small Business Tax Deductions

1099 Form Fillable 1099 Misc Tax Basics Irs Forms 1099 Tax Form Tax Forms

1099 Form Fillable 1099 Misc Tax Basics Irs Forms 1099 Tax Form Tax Forms

1099 K What S The Deal With This New Tax Form Small Business Tax Business Tax Tax Forms

1099 K What S The Deal With This New Tax Form Small Business Tax Business Tax Tax Forms

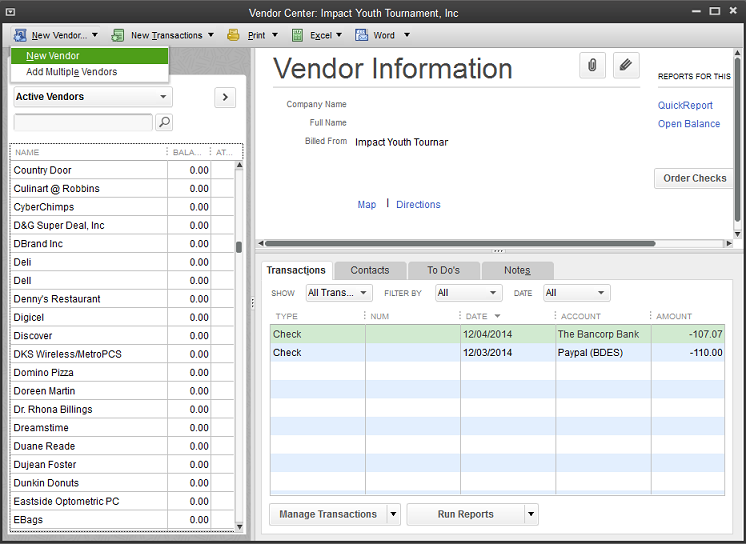

How To Setup Vendors For 1099 In Quickbooks For Windows

How To Setup Vendors For 1099 In Quickbooks For Windows

1099 Forms Free Download 1099 Forms Free Driverlayer Search Engine Irs Forms 1099 Tax Form Tax Forms

1099 Forms Free Download 1099 Forms Free Driverlayer Search Engine Irs Forms 1099 Tax Form Tax Forms

Track Payments To 1099 Contractors Quickbooks Online Accounting Software Quickbooks

Track Payments To 1099 Contractors Quickbooks Online Accounting Software Quickbooks