What Is W8ben-e Form Used For

Which obligates Canadian Financial Institutions to provide this information. A disregarded entity is an entity that is disregarded as an entity separate.

Https Www Privatebank Citibank Com Taxinformation Docs Guidelinesw 8ben E Fatcaentityclassification Pdf

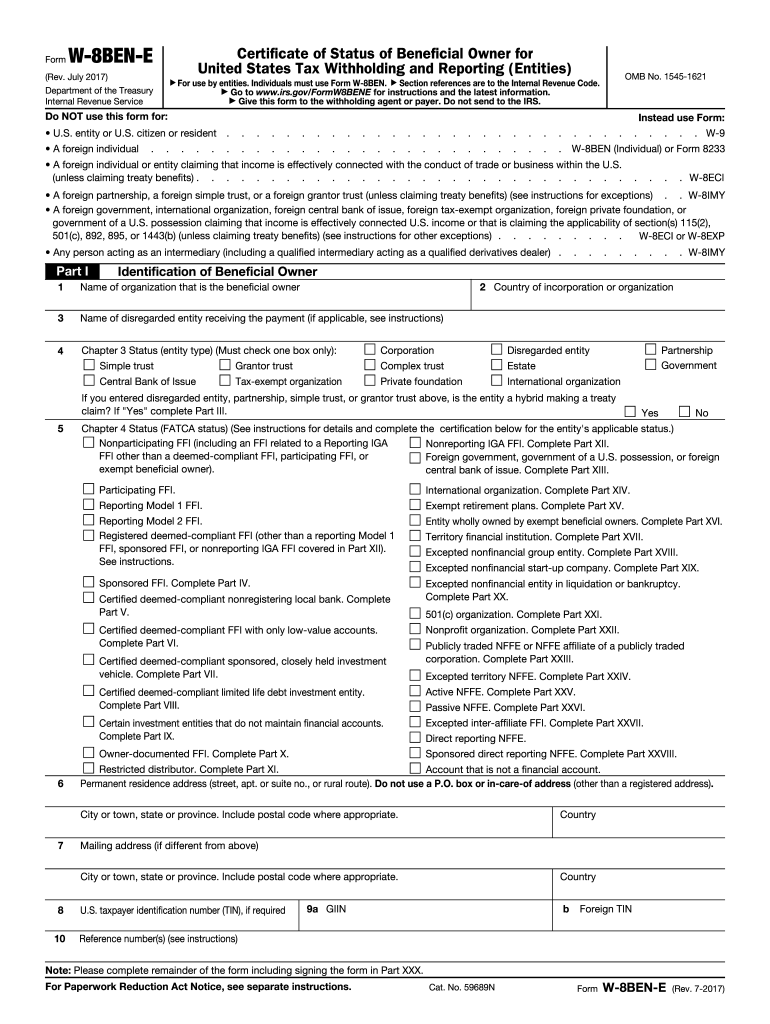

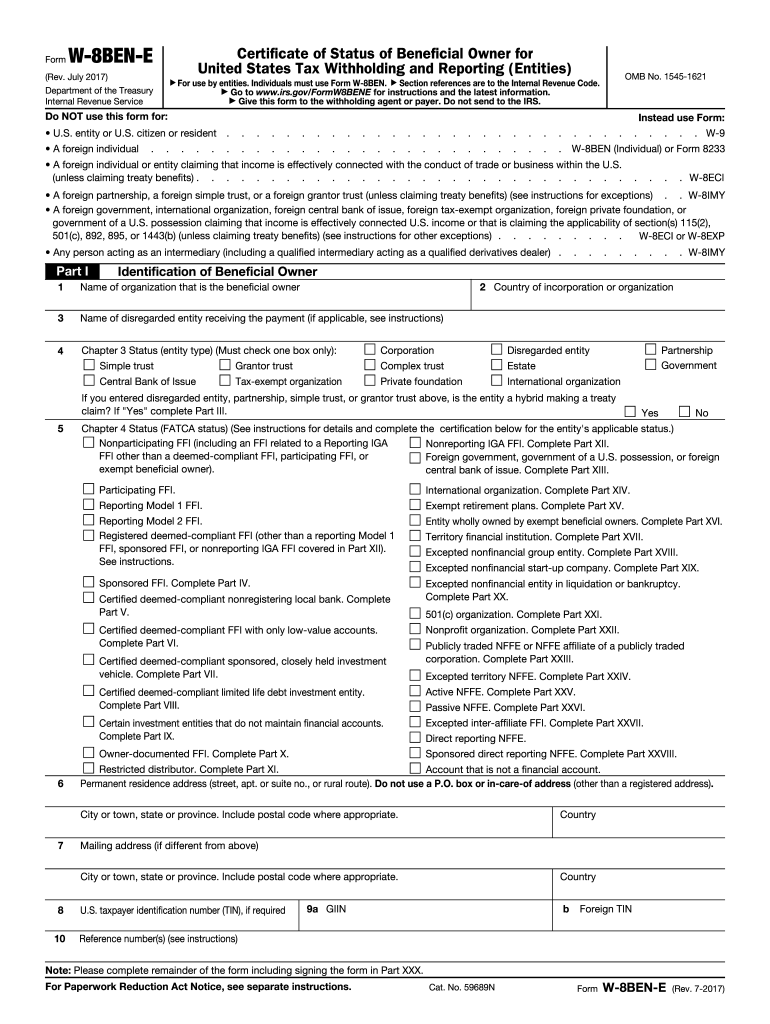

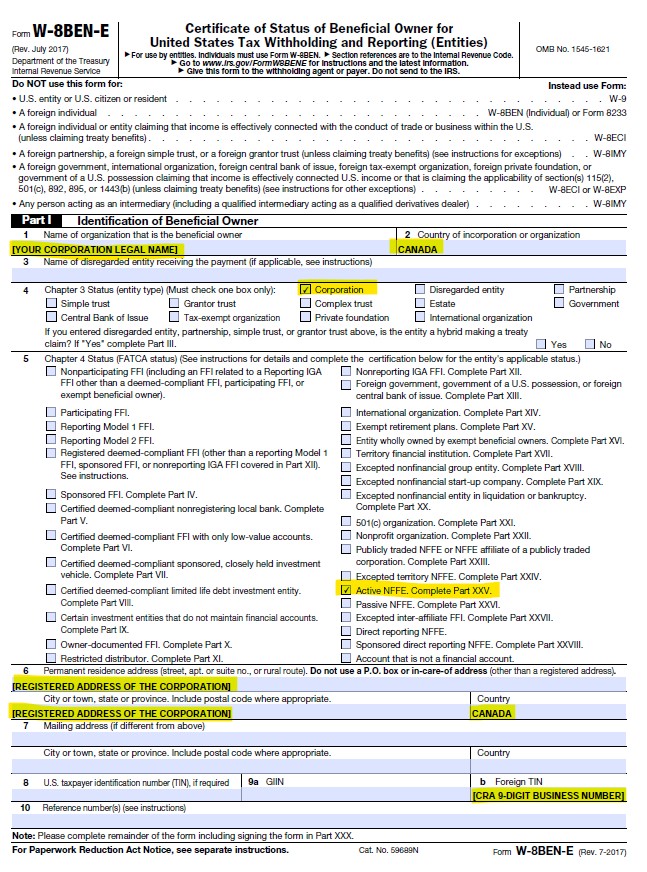

The W-8BEN-E form is used to prove that the business providing the services is indeed a foreign entity.

What is w8ben-e form used for. It is required because of an intergovernmental agreement between Canada and the US. If you make a mistake please start over using a new form. A W-8BEN form is a tax document used to certify that your country of residence for tax purposes is outside of the United States.

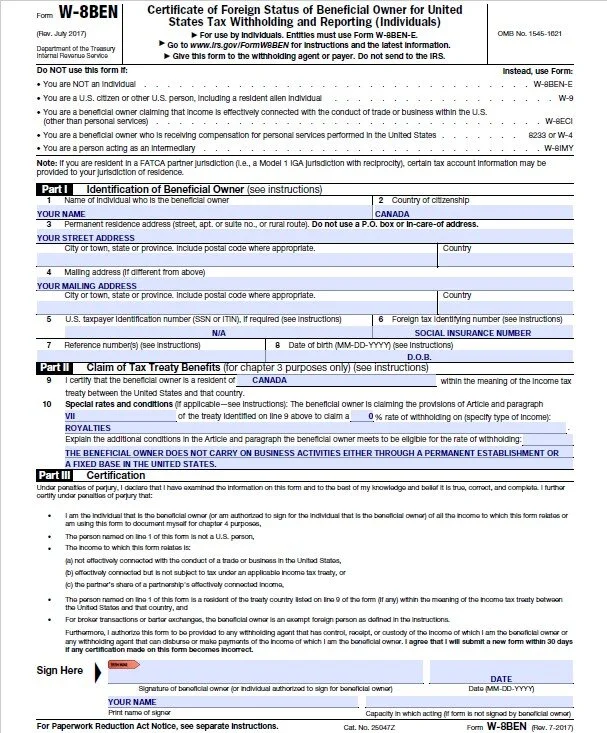

Tax reportable payment and associated Account Codes are posted at 1099-MISC and 1042-S Tax Reportable Payments. The IRS Form W-8BEN Instructions and other useful information about the Form W-8BEN can be found at the IRS website here. The official name for the W-8BEN form is the Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting Individuals.

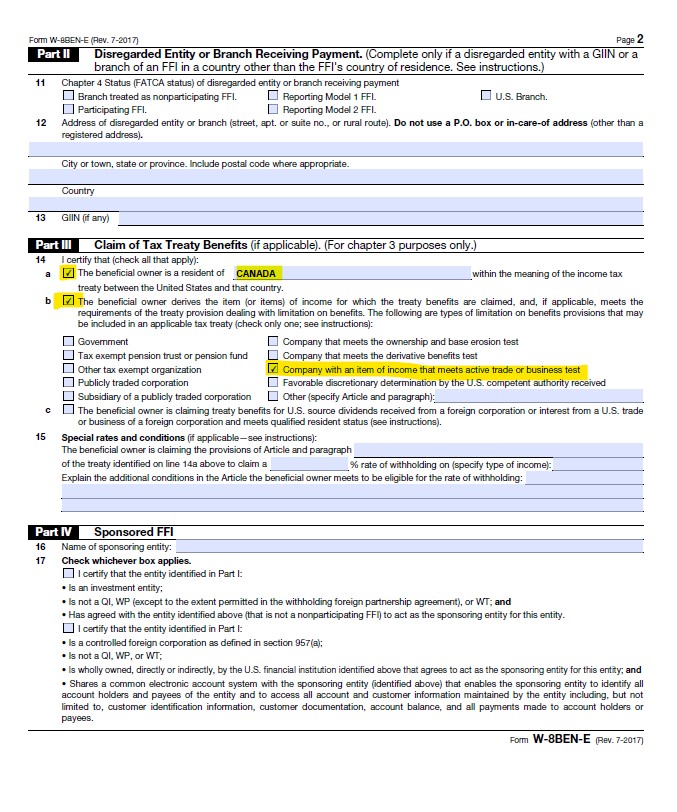

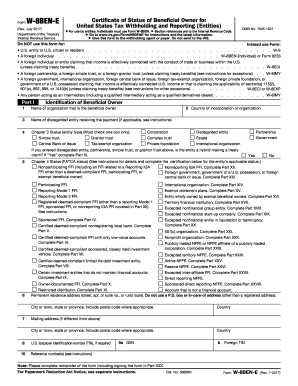

As with everything with the IRS there is most definitely a form for certification. Form W-8BEN is used by foreign individuals who receive nonbusiness income in the United States whereas W-8BEN-E is used by foreign entities who receive this type of income. The IRS defines the W-8BEN-E form as a document used by foreign entities to document their status for purposes of chapter 3 and 4 within the income taxes section of the US Internal Revenue Code.

Form W-8BEN Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting is a form that foreign individuals non-US citizens or business entities need to verify their country of residence for tax purposes. This form is issued. When Do You Need to Fill Out a W-8BEN Form.

Technically the form is referred to as a Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting Individuals. W-8BEN-E- Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting Entities A Form W-8BEN-E must be completed correctly without any alterations. This guide is intended for use in completing a Form W-8BEN-E February 2014 version to document the foreign status and the FATCA status of a legal entity that is not a US.

If you are a corporation partnership or another business entity youll use Form W-8BEN-E. The W-8BEN is an IRS form used to report the status of a foreign non-resident alien NRA for certain US tax withholding. If the entity filing the Form W-8BEN-E is the single owner of a disregarded entity use line 10 to identify the disregarded entity by name and thereby associate the Form with an account held by the disregarded entity.

It does not apply to payments made to US persons. This form is much longer due to information required by the Foreign Account Tax Compliance Act FATCA for foreign entities. Form W-8 BEN-E is used by foreign entities to document their status for purposes of chapter 3 and chapter 4 as well as other code provisions.

Use Form W-8BEN-E for ScholarshipFellowship Grants if a tax treaty exemption applies. While the W-8BEN form and the W-8BEN-E require very similar information the W-8BEN-E form is a bit lengthier and requires a detailed description about the foreign business entity. When the payor of the income has the W-8BEN on file the payor will be apprised that the payee is a non-US person and will undertake its withholding duties.

The W-8BEN-E is a form from the United States tax collection agency the Internal Revenue Service IRS. W-8BEN is used by foreign individuals who acquire various types of income from US. The W-8BEN-E is the equivalent of the W-9 for used for US.

Form W8BEN US tax return and Foreign Nationals This type of non-resident tax is withheld by the source of the income or payor. All foreign non-US businesses that are receiving payment from an American company must fill out the W-8BEN-E form. Persons have no responsibility to complete any such form.

The payor also referred to as the withholding agent has the responsibility of deducting and withholding that tax from your income and paying it. Form W-8BEN is applicable only for individuals or sole proprietors. Current Revision Form W-8 BEN-E PDF Information about Form W-8 BEN-E Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting Entities including recent updates related forms and instructions on how.

The treaty must include a provision for ScholarshipFellowship Grants. Instead they must complete Form W-9. Foreign persons complete one of the forms in the Form W-8 series eg W-8BEN W-8BEN-E W-8ECI W-8EXP and W-8IMY.

W-8BEN for Nonresident Aliens Post-Expatriation W-8BEN. If you are a non-US person that does business in the US Form W-8BEN will establish your foreign status and allow you to claim tax exemption or reduced tax rates on US-sourced income. Do not use liquid paper or any other correctional tool.

Chapter 3 applies only to payments made to a payee that is a foreign person.

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa

How To Complete A W 8 Ben E Form Caseron Cloud Accounting

How To Complete A W 8 Ben E Form Caseron Cloud Accounting

How To Fill W 8ben E Tax Form Private Limited India Uk Canada Australia

How To Fill W 8ben E Tax Form Private Limited India Uk Canada Australia

How To Fill W8ben E Form As A Company 2018 Youtube

How To Fill W8ben E Form As A Company 2018 Youtube

W 8ben E Form Instructions For Canadian Corporations Cansumer

W 8ben E Form Instructions For Canadian Corporations Cansumer

Irs W 8ben E 2017 Fill And Sign Printable Template Online Us Legal Forms

Irs W 8ben E 2017 Fill And Sign Printable Template Online Us Legal Forms

Filing Of W 8ben E By Canadian Service Provider With A Sample

Https Www Phillipcapital Com Au Files Pcau Phillipcapital Guide On Completing W 8ben E Trust Pdf

Filing Of W 8ben E By Canadian Service Provider With A Sample

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa

W 8ben E Fill Out And Sign Printable Pdf Template Signnow

W 8ben E Fill Out And Sign Printable Pdf Template Signnow

W 8ben Form Instructions For Canadians Cansumer

W 8ben Form Instructions For Canadians Cansumer

Filing Of W 8ben E By Canadian Service Provider With A Sample

Https Events Iofm Com Conference Fall Wp Content Uploads Sites 4 2017 09 Mon 1100 Makingsenseformsw9w8 M Couch Pdf

Form W8 Instructions Information About Irs Tax Form W8

Form W8 Instructions Information About Irs Tax Form W8