How Do I Create A 1099 For A Contractor

After signing in to TurboTax open or continue your return. On the Work on a Tax Return screen or Welcome to TurboTax screen scroll down to the bottom and click the blue Prepare W-21099 button.

Form 1099 Misc 2018 Tax Forms Irs Forms State Tax

Form 1099 Misc 2018 Tax Forms Irs Forms State Tax

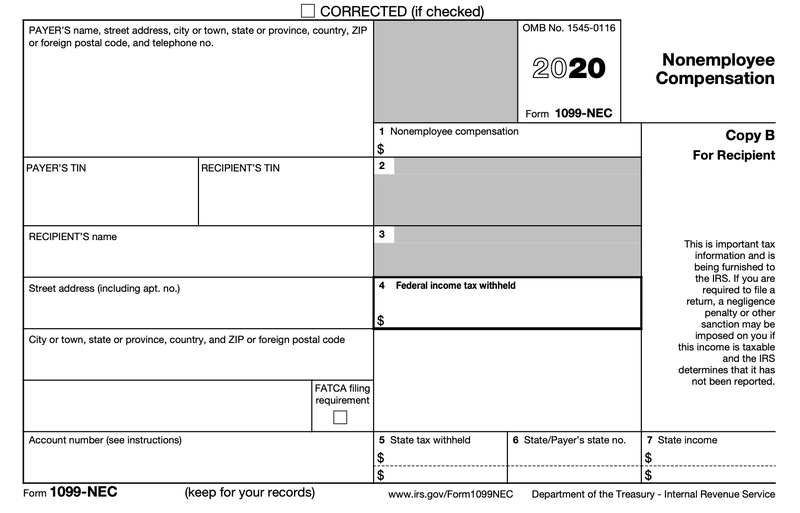

If you pay independent contractors you may have to file Form 1099-NEC Nonemployee Compensation to report payments for services performed for your trade or business.

How do i create a 1099 for a contractor. The PAYER TIN is the organizations tax identification number. This form is used by companies to report payments made in the course of a trade or business to others for services. The 1099-MISC Form generally includes.

If that happens to fall on a weekend you have until the following Monday. If the following four conditions are met you must generally report a payment as nonemployee compensation. When youre done select Add contractor.

First Steps to Becoming an Independent Contractor. You must report the same information on Copy B and send it to the contractor. Track contractor payments for 1099s.

A 1099 contractor also known as an independent contractor is a classification assigned to certain US. Annual Summary and Transmittal of US. A 1099 contractor is a person who works independently rather than for an employer.

Go to the Payroll menu then select Contractors. The deadline is Jan. The name address and taxpayer ID number of the company or individual who issued the form 3.

Copy A and Copy B. Here are six simple steps to help you prepare your 1099s while adhering to IRS guidelines and filing requirements. First understand that there are a lot of things you DONT NEED to do when starting a business.

Ensure you enter the same amount of money you paid to the contractor in Box 7 under the title Non-employee compensation. On the next screen Choose where to prepare your forms click the Online or Desktop option. If you choose to mail your 1099-NEC Copy A to the IRS be sure to include Form 1096.

While the work can be similar in nature it is important to follow the law with regard to taxes payments and the like. All of these are names used to refer to individuals who work for you but are paid outside of payroll. Select Tax Home from the left-side menu you might already be there Scroll down and select Your account.

Report payments made of at least 600 in the course of a trade or business to a person whos not an employee for services Form 1099-NEC. Why and How to Create an Independent Contractor Handbook. Instructions for TurboTax Self-Employed and TurboTax Self-Employed Live.

If you hire an independent contractor you must report what you pay them on Copy A and submit it to the IRS. Fill in your Federal Tax ID number SSN or EIN and contractors information SSN or EIN accurately. Starting at the upper left box record your organizations name as the PAYER.

The amount of income paid to you during the year in the appropriate box based on the type of income you received 4. Make sure you send the 1099-NEC to the IRS and your contractor by the last day of January. Without the tax ID the 1099-MISC can be harder to file but it is not impossible.

Report payments of 10 or more made in the course of a trade or business in gross royalties or payments of 600 or more made in the course of a trade or business in rents or for other specified purposes. Independent contractors consultants contract workers 1099 employees and outsourced staff. Start preparing 1099 MISC forms for independent contractors once you have bought the 1099 forms.

This is a cover sheet. Now that we have that out of the way lets talk about starting your independent contractor business. Lesa Hammond CEO ProfHire Inc.

Once you know which contractors you paid over 600 to you will need to fill out Form 1099-NEC. Beginning with tax year 2020 Form 1099-NEC replaces the previously used Form 1099-MISC for independent contractors. There are significant differences in the legalities of a contractor and employee.

Select Add a contractor. How to file a 1099 form There are two copies of Form 1099. One of the most important parts of the 1099-MISC form is the Taxpayer Identification Number TIN which makes it easy for the IRS to identify which contractor the form is for.

Your name address and taxpayer ID number 2. The 1099-MISC form must be filled out by the employer or client who hired the contractor. Enter your contractors info or select the Email this contractor checkbox so they can fill it out.

Now that you entered the contractor as a vendor you need to start tracking their payments. Before you start the 1099 process make sure you have all the correct information on your contractors and vendors. The 1099 reference identifies the tax form that businesses must file with the Internal Revenue Service IRS and it relieves the employer from the responsibility of withholding taxes from the individuals paychecks.

All About Forms 1099 Misc And 1099 K Bookkeeping Business Business Tax Business Advice

All About Forms 1099 Misc And 1099 K Bookkeeping Business Business Tax Business Advice

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

1099 Misc Independent Contractors And Self Employed Independent Contractor Contractors Tax Questions

1099 Misc Independent Contractors And Self Employed Independent Contractor Contractors Tax Questions

A 2021 Guide To Taxes For Independent Contractors The Blueprint

A 2021 Guide To Taxes For Independent Contractors The Blueprint

Small Business Tax Preparation For Independent Contractors

Instructions For Forms 1099 Misc And 1099 Nec 2020 Internal Revenue Service 1099 Tax Form Meeting Agenda Template Irs Forms

Instructions For Forms 1099 Misc And 1099 Nec 2020 Internal Revenue Service 1099 Tax Form Meeting Agenda Template Irs Forms

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Handling Your Finances As A 1099 Contractor Business Tax Independent Business Owner Finance

Handling Your Finances As A 1099 Contractor Business Tax Independent Business Owner Finance

Free Independent Contractor Agreement Templates Pdf Word Eforms

Free Independent Contractor Agreement Templates Pdf Word Eforms

1099 Misc Form 1099 Misc Tax Basics Irs Tax Forms Tax Forms Form Example

1099 Misc Form 1099 Misc Tax Basics Irs Tax Forms Tax Forms Form Example

How To Pay Contractors And Freelancers Clockify Blog

How To Pay Contractors And Freelancers Clockify Blog

1099 Nec Tax Services Accounting Firms Accounting Services

1099 Nec Tax Services Accounting Firms Accounting Services

How To File 1099 Misc For Independent Contractor

How To File 1099 Misc For Independent Contractor

Instant Form 1099 Generator Create 1099 Easily Form Pros

Instant Form 1099 Generator Create 1099 Easily Form Pros

1099 Invoice Template Beautiful Independent Contractor 1099 Invoice Template Invoice Template Invoicing Templates

1099 Invoice Template Beautiful Independent Contractor 1099 Invoice Template Invoice Template Invoicing Templates

Do You Have Independent Contractors Working For You Are You Keeping Track Of The Payments Made To Them Independent Contractor Work On Yourself Printables

Do You Have Independent Contractors Working For You Are You Keeping Track Of The Payments Made To Them Independent Contractor Work On Yourself Printables

Independent Contractor Billing Template Beautiful 6 1099 Template Excel Exceltemplates Exceltemplates Invoice Template Invoice Template Word Invoice Example

Independent Contractor Billing Template Beautiful 6 1099 Template Excel Exceltemplates Exceltemplates Invoice Template Invoice Template Word Invoice Example