What Are The Three Major Legal Forms Of Organization

Perceived to be sophisticated form of business top tax bracket is lower than top individual bracket. There are three major legal forms of business organizations.

Get Our Sample Of Franchise Inquiry Letter Template Business Letter Sample Lettering Letter Templates

Get Our Sample Of Franchise Inquiry Letter Template Business Letter Sample Lettering Letter Templates

Three Basic Forms of Business Organization Sole Proprietorships.

What are the three major legal forms of organization. SOLE PROPRIETORHIP Sole proprietorship is a business owned and operated by an individual for his or her own profit. Each form has implications for how individuals are taxed and resources are managed and deployed. This is appropriate for a firm owning and operating a small scale business.

A corporation pays its own taxes before distributing profits or dividends to shareholders. There are three main forms of corporations. C-corporation S-corporation and Limited Liability Company.

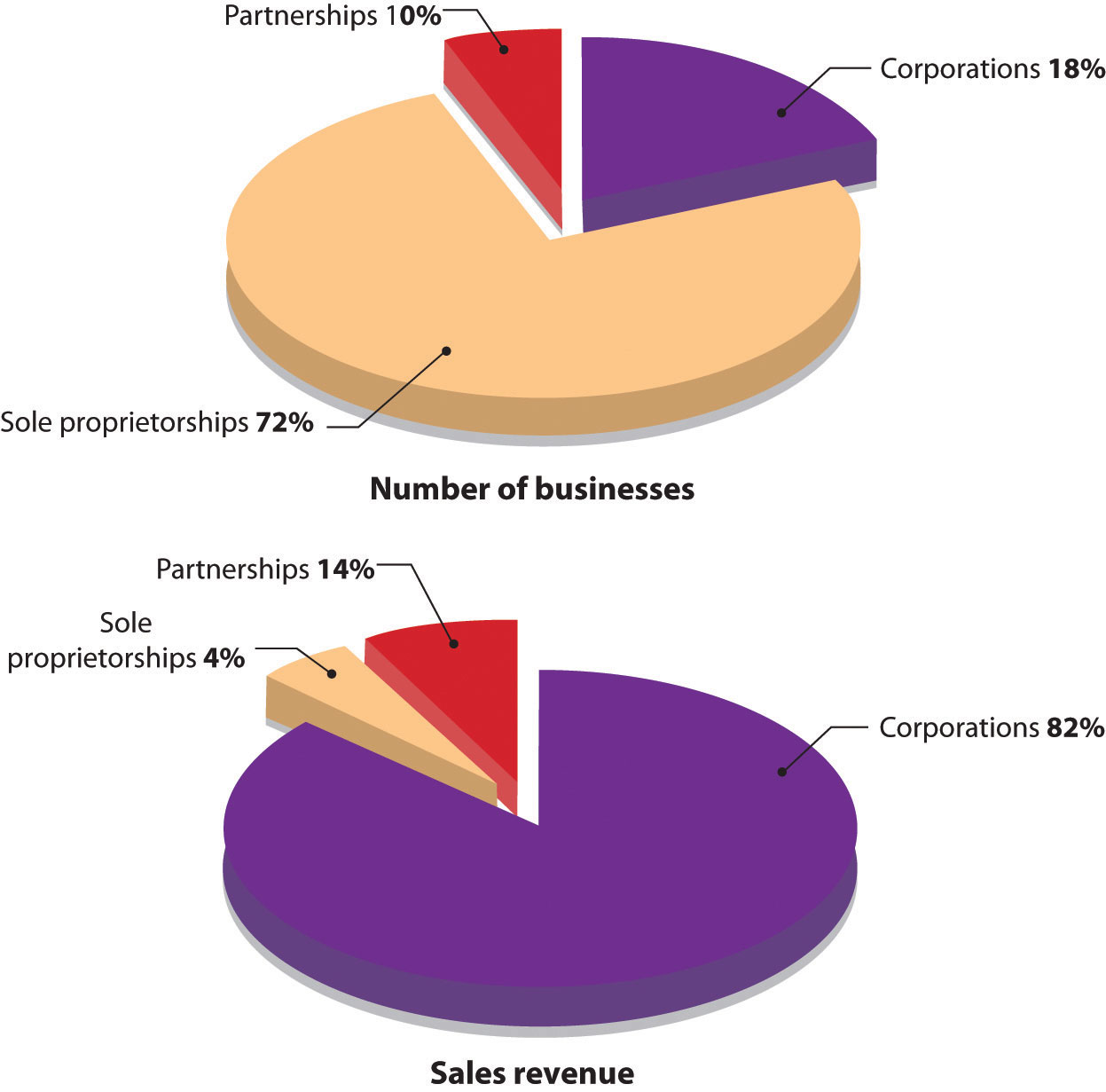

Key Takeaway The three major forms of business in the United States are sole proprietorships partnerships and corporations. Choosing the right legal structure will help you reduce personal liability access proper capital investment lower your companys tax burden and avoid unnecessary regulatory requirements. The three most common legal forms of business organization are the sole proprietorship partnership and corporation.

There are two types of corporation the S corporation and the C corporation. The owner personally manages the operations. A corporation is a business organization that acts as a unique and separate entity from its shareholders.

There are three types of corporations. Both are legal entities that are formalized with the filing of articles of incorporation with the state. A C corporation an S corporation and an LLC or limited liability corporation.

Here are the pros and cons of each type of business organization. An unincorporated business owned by one person is called a sole proprietorship. It is considered as the most common form of business ownership.

In this case the business is owned and operated by one person. Limited Liability Company LLC Corporation. An unincorporated business owned by two or more persons voluntarily acting as.

Advantages same limited liability as regular corporation state corporate income tax is lower than a regular corporation possible partial avoidance of Social Security tax.

Pin On Legal Forms And Computer Applications

Pin On Legal Forms And Computer Applications

Accounts Receivable All Accounts Living Trust Legal Forms Revocable Living Trust

Accounts Receivable All Accounts Living Trust Legal Forms Revocable Living Trust

Types Of Businesses Overview Of Different Business Classifications

Types Of Businesses Overview Of Different Business Classifications

Top 12 Llc Advantages And Disadvantages Corporate Direct Limited Liability Company Business Organization Business Format

Top 12 Llc Advantages And Disadvantages Corporate Direct Limited Liability Company Business Organization Business Format

4 Types Of Partnership In Business Limited General More

4 Types Of Partnership In Business Limited General More

Free Lease Agreement Forms Real Estate Forms Lease Agreement Lease Agreement Free Printable Real Estate Forms

Free Lease Agreement Forms Real Estate Forms Lease Agreement Lease Agreement Free Printable Real Estate Forms

Types Of Business Structures Sole Proprietorship Llc More

Types Of Business Structures Sole Proprietorship Llc More

Major Legal Factors Affecting Business Entrepreneurship Articles Factors Business

Major Legal Factors Affecting Business Entrepreneurship Articles Factors Business

Partnership Agreement Template Sample Agreement Partnership Business Template

Partnership Agreement Template Sample Agreement Partnership Business Template

Will And Testament Sample Will And Testament Last Will And Testament Estate Planning Checklist

Will And Testament Sample Will And Testament Last Will And Testament Estate Planning Checklist

Chapter 31 Entrepreneurs And Sole Proprietorships Business Law Corporate Social Responsibility Social Institution

Chapter 31 Entrepreneurs And Sole Proprietorships Business Law Corporate Social Responsibility Social Institution

4 Most Common Business Legal Structures Pathway Lending

4 Most Common Business Legal Structures Pathway Lending

Legal Writing Lawyerist Editing Checklist Legal Documents Legal Nurse Consultant

Legal Writing Lawyerist Editing Checklist Legal Documents Legal Nurse Consultant

The Seven Most Popular Types Of Businesses Volusion

The Seven Most Popular Types Of Businesses Volusion

Executive Director Evaluation Survey Form Performance Appraisal Self Evaluation Employee Employee Evaluation Form

Executive Director Evaluation Survey Form Performance Appraisal Self Evaluation Employee Employee Evaluation Form

Get Our Example Of Nonprofit Collaboration Agreement Template Benefit Corporation Agreement Non Profit

Get Our Example Of Nonprofit Collaboration Agreement Template Benefit Corporation Agreement Non Profit

Sale Agreement Free Printable Documents Purchase Agreement Real Estate Contract Rental Agreement Templates

Sale Agreement Free Printable Documents Purchase Agreement Real Estate Contract Rental Agreement Templates