Do Mileage Reimbursements Count As Income

There is no required mileage reimbursement rate companies have to pay. Who pays the tax on reimbursed mileage to a 1099 independent contractor.

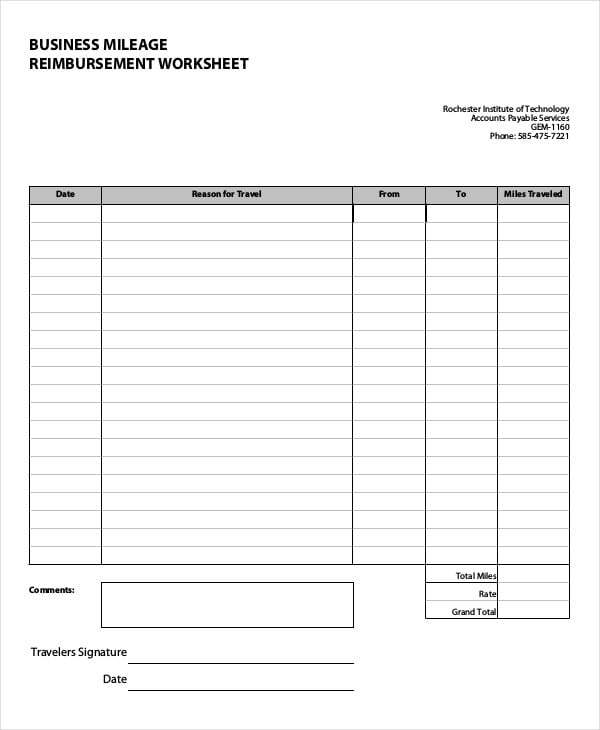

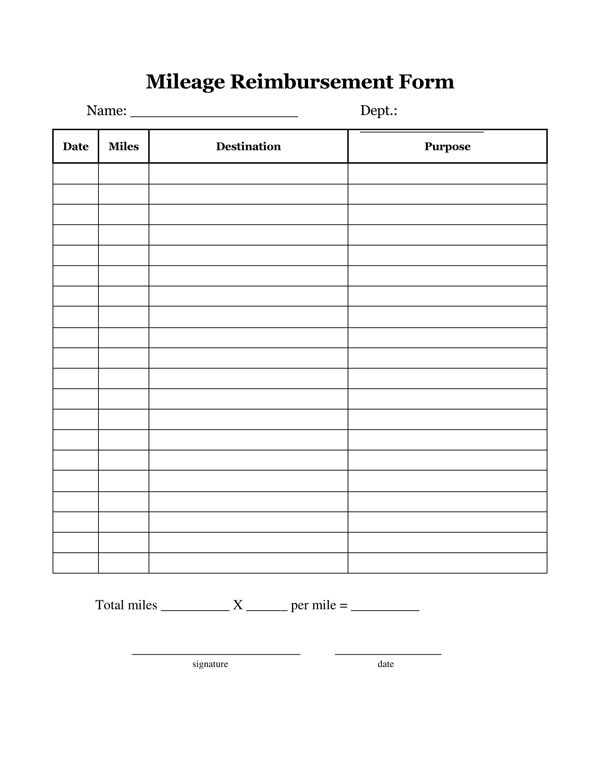

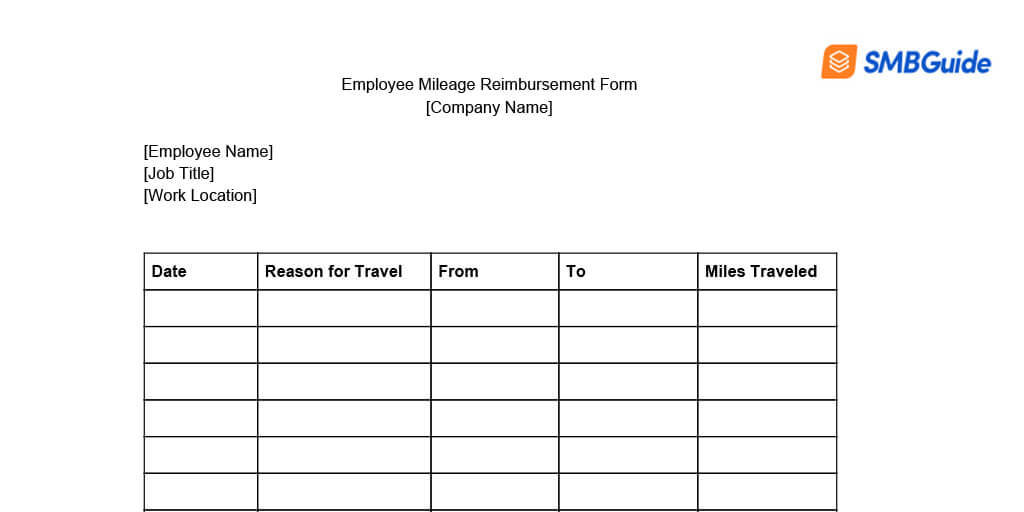

Mileage Reimbursement Form 9 Free Sample Example Format Free Premium Templates

Mileage Reimbursement Form 9 Free Sample Example Format Free Premium Templates

Many do because its a smart way to attract and retain employees.

Do mileage reimbursements count as income. As to employer reimbursement of mileage expenses if you submit a report of actual business trips and mileage then I would not count the reimbursement as income. However if you receive a set amount every month and do not have to submit reports then I would consider the amounts as income. Yes in general any money you pay an independent contractor is their income.

Microsoft Word - Can Social Security or Social Services count TRIP mileage reimbursements as incomedocx Author. It depends on your employers reimbursement arrangement based on the two IRS allowable accountable and non-accountable plans. The following types of earnings income or losses do not count as earnings from employment or self-employment under the earnings test.

Since an independent contractor is deemed to have their own business that expense is theirs to deduct. Comply with IRS Rules. There is no law that says employers have to offer mileage reimbursement.

A reimbursement that results in a taxable benefit to the individual under the Income Tax Act the ITA is in reality remuneration or income of the individual. Mileage accrued when driving to and from doctor visits the pharmacy and the hospital can all count toward a medical deduction. You can claim 17.

You may also be able to claim a tax deduction for mileage in a few other specific circumstances including if youre an armed forces reservist qualified performance artist or traveling for charity work or medical reasons. For example if an employer reimburses an employee for mileage at more than the standard mileage rate then the excess is taxable income. The IRS hasnt set any official mileage reimbursement rules.

Reimbursements made at the standard Internal Revenue Service rate are not considered income so they are not subject to tax. Answer The mileage tax deduction rules generally allow you to claim 0575 per mile in 2020 if you are self-employed. Is mileage reimbursement required by law.

As income the payment is not subject to the GSTHST and hence not eligible for purposes of determining an input tax credit ITC or rebate entitlement under the Act. Unsubstantiated reimbursements should appear as taxable income paid by the employer on the employees W-2 Form. However you can use any work-related expenses that one paid reimbursed or not as.

Unsubstantiated reimbursements can also cause the IRS to disallow deducted expenses from the employers tax return. N Earned income tax credit EITC refund payments received on or after January 1 1991 including advanced earned income credit payments 26 USC. Care or reimbursement for costs incurred for such care under the Child Care and Development Block Grant Act of 1990 42 USC.

12122017 74334 AM. Reimbursements based on the federal mileage rate arent considered income making them nontaxable to your employees. In addition if any expenses are paid in excess of IRS limitations then the excess is taxable income.

In the past if you had unreimbursed business expenses such as mileage you could deduct it on your federal tax return if it exceeded 2 of your adjusted gross income AGI. For 2020 the federal mileage rate is 0575 cents per mile. Nonetheless states like California and Massachusetts do have a mileage reimbursement rate rule.

Payments to an employee as reimbursement or allowance for moving expenses if they are not counted as. You just needed to itemize your deductions. If one is paid more than 600 in a year from a company that company should issue you and the IRS a Form 1099 which will include all payments to you including reimbursement.

The non-accountable plan counts the money as income. If its not an accountable plan the mileage reimbursement can count as taxable wages.

Policy Considerations For Mileage Reimbursement I T E I Fyle

Policy Considerations For Mileage Reimbursement I T E I Fyle

5 Mileage Reimbursement Form Templates For Word And Excel

5 Mileage Reimbursement Form Templates For Word And Excel

How To Record Mileage Help Center

How To Record Mileage Help Center

![]() 25 Printable Irs Mileage Tracking Templates Gofar

25 Printable Irs Mileage Tracking Templates Gofar

The Basics Of Employee Mileage Reimbursement Law Companymileage

The Basics Of Employee Mileage Reimbursement Law Companymileage

How Much To Reimburse For Employee Mileage Timesheets Com

How Much To Reimburse For Employee Mileage Timesheets Com

What Do Most Companies Pay For Mileage Reimbursement

What Do Most Companies Pay For Mileage Reimbursement

Your Comprehensive Guide To 2019 Irs Mileage Reimbursement

Your Comprehensive Guide To 2019 Irs Mileage Reimbursement

Mileage Reimbursement For Employees Considered Taxable Wages

Mileage Reimbursement For Employees Considered Taxable Wages

Business Mileage Tracking Log Business Plan Template Free Daycare Business Plan Mileage Tracker

Business Mileage Tracking Log Business Plan Template Free Daycare Business Plan Mileage Tracker

Is A Car Allowance Or Mileage Reimbursement Taxable Income

Is A Car Allowance Or Mileage Reimbursement Taxable Income

Is A Car Allowance Or Mileage Reimbursement Taxable Income

Is A Car Allowance Or Mileage Reimbursement Taxable Income

Federal Tax Laws On Mileage Reimbursement Turbotax Tax Tips Videos

Federal Tax Laws On Mileage Reimbursement Turbotax Tax Tips Videos

Is A Mileage Reimbursement Taxable

Is A Mileage Reimbursement Taxable

How To Reimburse Employees For Mileage Expenses Car Allowance Vs Mileage Reimbursement

How To Reimburse Employees For Mileage Expenses Car Allowance Vs Mileage Reimbursement

2019 Volunteer Mileage Rates And Irs Reimbursement Guidelines

2019 Volunteer Mileage Rates And Irs Reimbursement Guidelines

Taxes On Employee Expense Reimbursement Taxact Blog

Taxes On Employee Expense Reimbursement Taxact Blog

Mileage Reimbursement For Employees Info Free Download

Mileage Reimbursement For Employees Info Free Download

Business Mileage The Holy Grail Of Tax Deductions

Business Mileage The Holy Grail Of Tax Deductions