How To Calculate Business Mileage Uk

Simply add your current location - postcode or place - into the A category and details of your destination into the B category. So to calculate your mileage deduction youd multiply your mileage as follows.

Why Property Taxes Are The Complicated Game Of Uk Residential Market Property Tax Property Inheritance Tax

Why Property Taxes Are The Complicated Game Of Uk Residential Market Property Tax Property Inheritance Tax

Subtract the received MAP from the approved amount you should have received.

How to calculate business mileage uk. Enter your route details and price per mile and total up your distance and expenses. If your employer pays you a car mileage allowance which is taxed you do not need to make an adjustment to the business mileage incurred. The above method of reclaiming VAT on fuel and mileage can also be used if youre voluntarily registered for VAT and trading under the VAT turnover threshold.

You dont need to submit your records for either method when filing your tax return. If youve travelled under 10000 miles in the current tax year you can use this simple calculator to work out how much you can claim back in expenses for your trip. This gives you 4500.

Multiply business miles driven by the rate. The mileage rates were different before the 2010-2011 tax years. Been on a business trip lately.

Add up the Mileage Allowance Payments you have received throughout the year. Multiply the remaining 1000 by the current AMAP rate of 25p. Multiply business miles travelled with the simplified expenses rate for the whole tax year.

For the 2020 tax year the standard mileage rate is. For your quick reference below is a Distance Chart or Distance Table of distances between some of the major cities in UK. Keep a record of the business mileage you have travelled throughout the tax year.

Know the 2021 mileage deduction rate. The overall driving distance will be displayed in miles and kilometres and the driving time will also be shown. Determine if you can use the standard mileage rate.

The distance between cities of UK is calculated in kilometers kms miles and nautical miles. Multiply the first 10000 by the current AMAP rate of 45p. Youve driven 11000 business miles over the year.

So youd calculate your mileage deduction as follows. Instead of keeping records of all receipts and then separating business and personal use you can simply claim 45p per mile or 25p for mileage over 10000 on business mileage. This is exactly the same approach to calculating the business mileage as the one used for employees driving their own cars.

Not all business owners can use the standard mileage method. Include the amount in your total expenses on your Self Assessment tax return. Determine if you can use the standard mileage rate.

Janine has driven 12000 business miles over the year so she can can claim 5000 10000 x 045 2000 x 025 5000. Calculating mileage for taxes using the standard method is a three-step process. Add up the number of business miles you have travelled.

How to Calculate Your Self-Employed Mileage Claim for Taxes To work out the amount of mileage you can deduct against your taxes youll need to. Since the amount is more than 2500 youll have to complete a self-assessment tax return to claim the deduction. Routes are automatically saved.

To calculate the approved amount multiply your employees business travel miles for the year by the rate per mile for their vehicle. HMRC guidelines define travel between your home and your regular permanent place of employment as a non-work journey making it ineligible to be included as part of your business mileage. Add up your business mileage for the whole year.

To deduct business mileage using the standard mileage rate multiply the actual business miles driven by the standard mileage rate published by the Internal Revenue Service IRS for the tax year the driving occurred. How to calculate your business mileage deduction. Multiply the number of miles in Step 1 by the HMRC mileage allowance rate per mile.

Multiply the first 10000 by the current AMAP rate of 45p. This gives you 250. Business mileage refers to journeys you undertake in the course of your work with the exception of your regular commute.

UK Distance Chart Distance Table. The rates are as follows updated quarterly. This gives you 4500 Multiply the remaining 1000 by.

Keep accurate records of your business mileage. 10000 miles x 45p 4500 1000 miles x 25p 250 Total you can claim 4750. There is bad news for bicycle riders.

10000 x 45 5000 x 25 This means your total mileage deduction for 2017 18 would be 5750. The current car mileage allowances are 45p per mile for the first 10000 business miles and 25p per mile from that 10000 mile mark. Distance in miles gives you the mileage between cities by this UK mileage calculator.

The mileage calculator is easy to use.

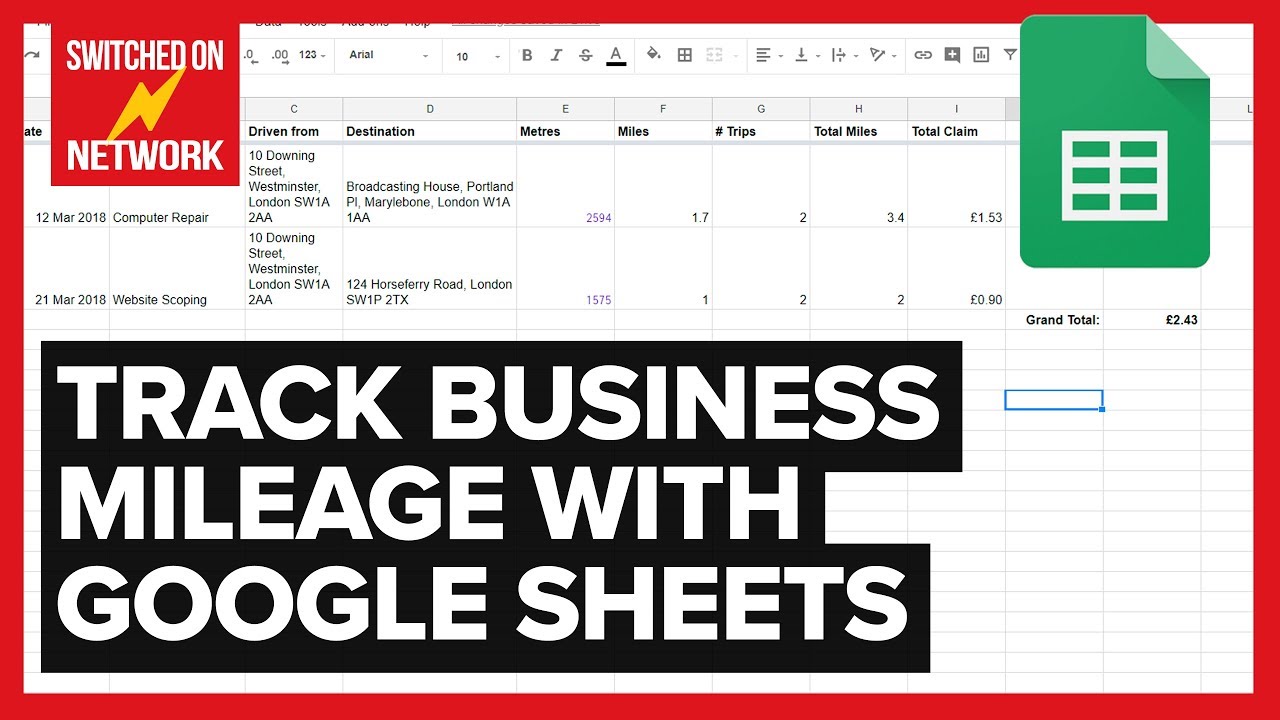

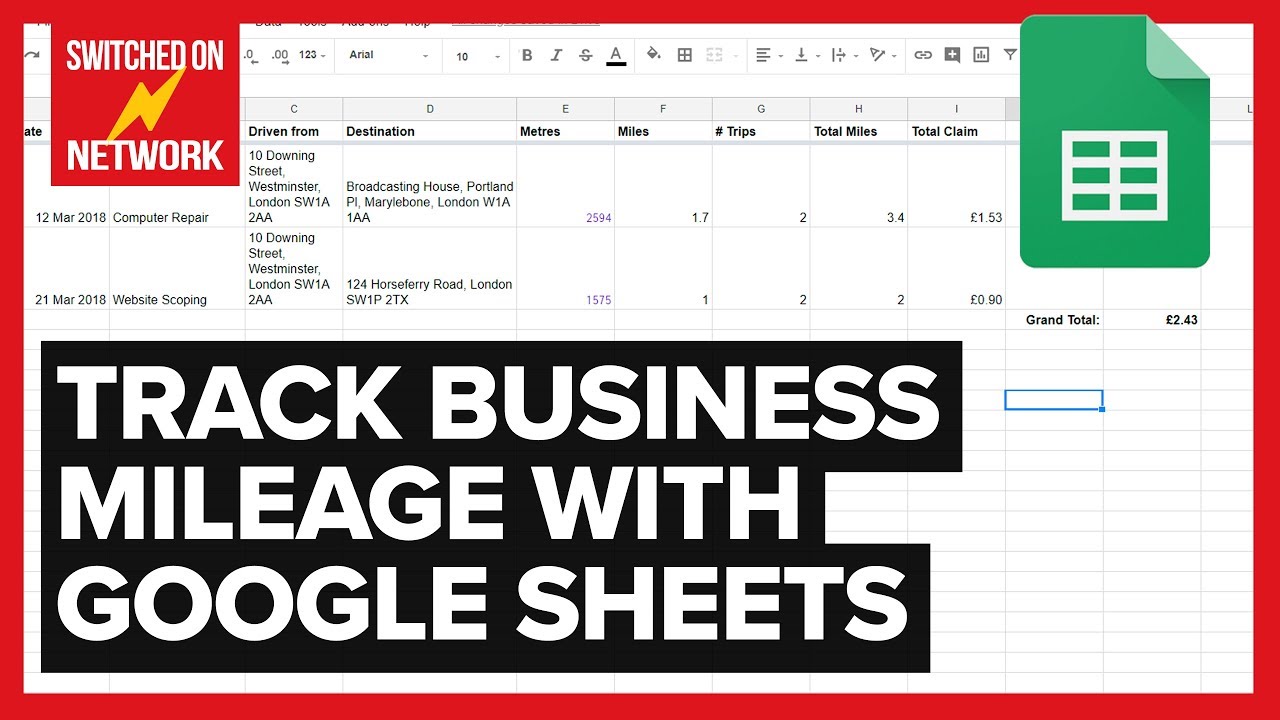

How To Calculate Track Your Business Mileage Automatically With Google Sheets Youtube

How To Calculate Track Your Business Mileage Automatically With Google Sheets Youtube

Business Mileage Tracking Log Business Plan Template Free Daycare Business Plan Mileage Tracker

Business Mileage Tracking Log Business Plan Template Free Daycare Business Plan Mileage Tracker

Free Mileage Log Template For Taxes Track Business Miles Mileiq Uk

Free Mileage Log Template For Taxes Track Business Miles Mileiq Uk

Doc Pdf Free Premium Templates Mileage Tracker Printable Mileage Tracker Mileage Log Printable

Doc Pdf Free Premium Templates Mileage Tracker Printable Mileage Tracker Mileage Log Printable

How To Claim Business Mileage Why It S Ok For The Business

How To Claim Business Mileage Why It S Ok For The Business

Page Not Found Ehomedesign Mileage Log Printable Mileage Tracker Mileage

Page Not Found Ehomedesign Mileage Log Printable Mileage Tracker Mileage

Sole Trader Bookkeeping Spreadsheet Goselfemployed Co Spreadsheet Bookkeeping Business Checklist

Sole Trader Bookkeeping Spreadsheet Goselfemployed Co Spreadsheet Bookkeeping Business Checklist

Business Mileage Chart Mileage Chart Chart Mileage

Business Mileage Chart Mileage Chart Chart Mileage

Mileage Spreadsheet For Taxes In 2021 Mileage Chart Blog Business Plan Template Business Plan Template

Mileage Spreadsheet For Taxes In 2021 Mileage Chart Blog Business Plan Template Business Plan Template

Convert Liters Per 100 Kilometers To Miles Per Gallon Uk Liter Gallon Gas Mileage

Convert Liters Per 100 Kilometers To Miles Per Gallon Uk Liter Gallon Gas Mileage

Mileage Log Form For Taxes Inspirational Free Mileage Log Templates Blog Business Plan Template Business Plan Template Mileage

Mileage Log Form For Taxes Inspirational Free Mileage Log Templates Blog Business Plan Template Business Plan Template Mileage

How To Calculate Tonnage Tax Shipping Company Accounting Tax

How To Calculate Tonnage Tax Shipping Company Accounting Tax

Daily Mileage Worksheet Printable Worksheets And In Gas Mileage Expense Report Template Great Cretive Templates Professional Templates Gas Mileage Mileage

Daily Mileage Worksheet Printable Worksheets And In Gas Mileage Expense Report Template Great Cretive Templates Professional Templates Gas Mileage Mileage

Spreadsheet Free Gas Mileage Log Template Great Sheet Uk For With Regard To Gas Mileage Expense Report Template Mileage Free Gas Templates

Spreadsheet Free Gas Mileage Log Template Great Sheet Uk For With Regard To Gas Mileage Expense Report Template Mileage Free Gas Templates

Calculateme Com Calculate Just About Everything Area Of A Circle Calculator Gas Mileage

Calculateme Com Calculate Just About Everything Area Of A Circle Calculator Gas Mileage

Calculate Business Mileage Using Hmrc S Rates For 2018 Mileiq Uk

Calculate Business Mileage Using Hmrc S Rates For 2018 Mileiq Uk

Mileage Tax Deduction Tracking Log 2019 Tax Deductions Mileage Deduction

Mileage Tax Deduction Tracking Log 2019 Tax Deductions Mileage Deduction