How To Register A Sole Trader Company With Companies House

All you need to do is inform HMRC that youre self-employed and operating as a sole trader by registering for self-assessment. One such example involves a plumber if a plumber were to accidentally flood your house and cause damage to your property you would have grounds to sue them.

Companies And Businesses The National Archives

Yes its really free.

How to register a sole trader company with companies house. Sole traders do not need to register with Companies House. The cost of downloading a copy of a file is 2000 TTD files are in PDF format. If you are planning to trade as it is highly advisable that you register your company as dormant with Companies House.

Its possible to trade under your own name or to choose an alternative name for your sole trader business. To register as a sole trader yourself directly with HMRC you must have a government gateway account. But as a sole trader you are still required to register for self-assessment through HMRC.

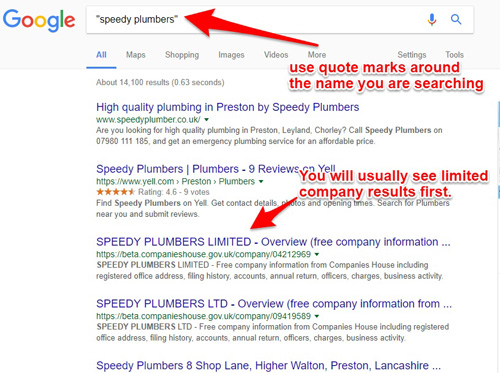

Only limited companies are required to register their companies with this governing agency. Instead they must simply register with HMRC and complete an annual Self Assessment tax return. If its a Friday night it can take until Monday help.

It typically takes around 10 days to get an activation code for the government gateway account. There are indeed some tax savings to be made by making the switch from sole trader to limited company. To set up as a sole trader you need to tell HMRC that you pay tax through Self Assessment.

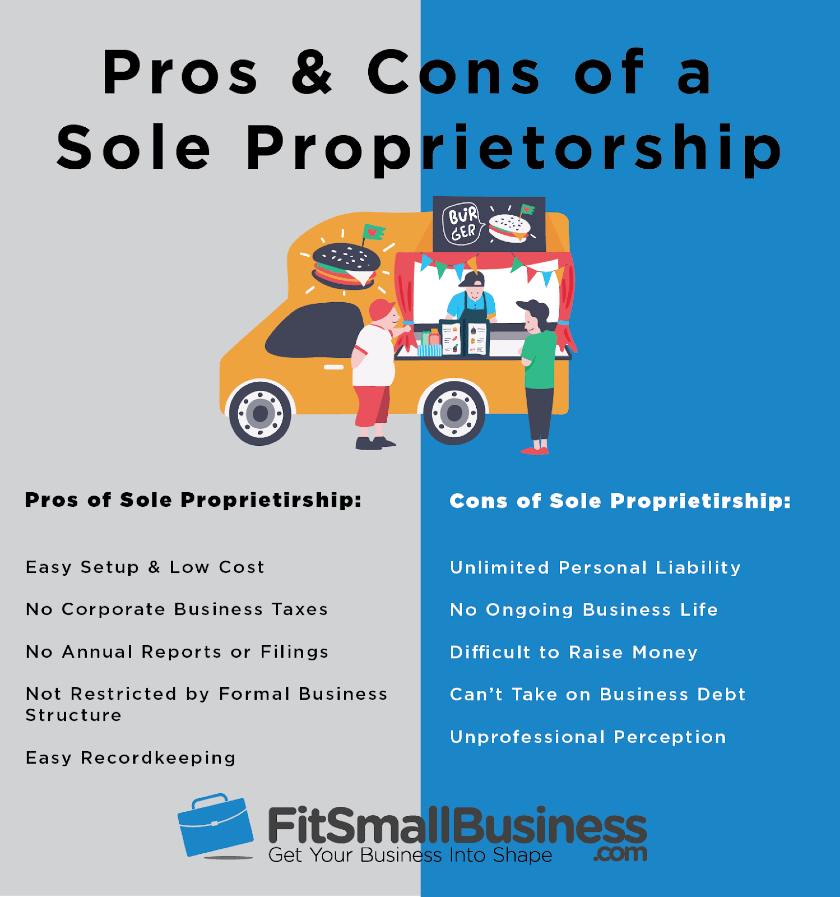

This is also true of business partnerships. You need to register as a sole trader with HM Revenue Customs HMRC. Non-limited companies are typically sole traders or partnerships and are liable for any problems encountered.

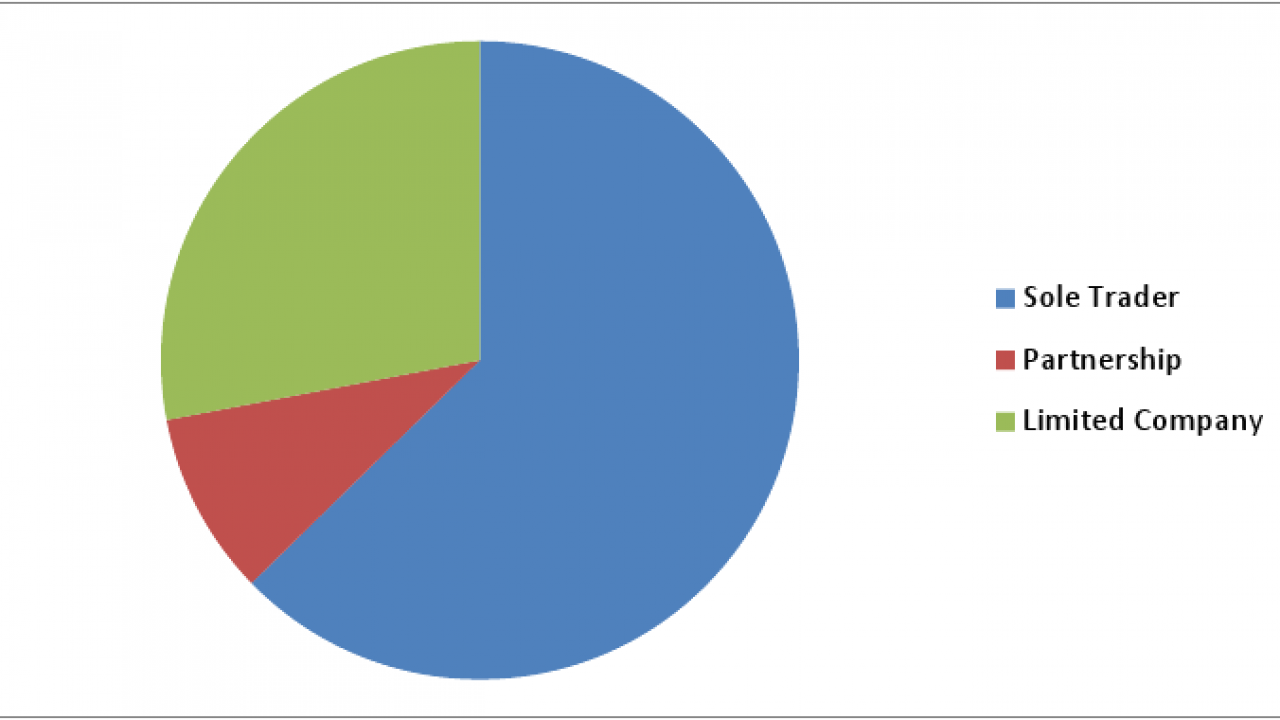

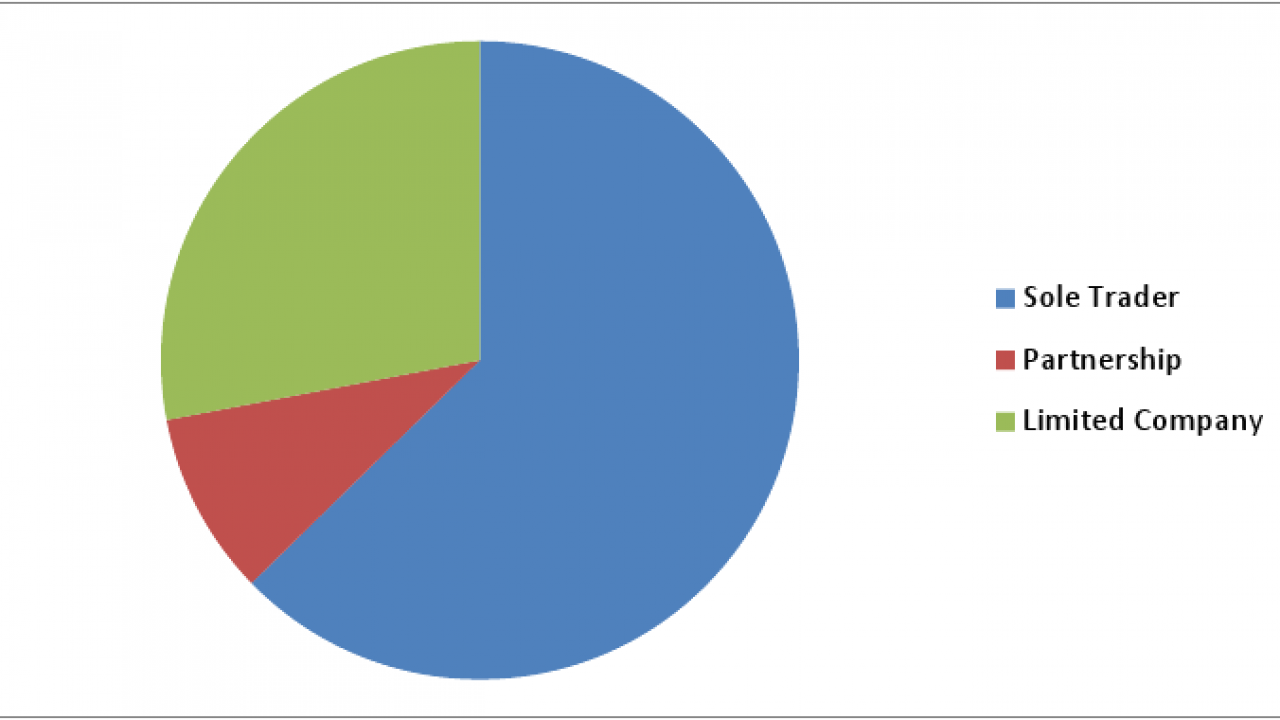

You are registering as self employed and each year you must complete a self assessment tax return. Most businesses register as a sole trader limited company or partnership. You have to then fill out all the necessary forms and processes and if anything were to go wrong youd be responsible for all correspondence to sort things out.

If youve decided to register your business with Companies House and become a limited company visit the GovUK website to do so online. If you are forming a sole trader business you are not required to register with Companies House. Once you have your government gateway account setup then you can complete the sole trader registration form.

If thats the case then you dont need to register with Companies House. You can do this online at govuk or you can ask your accountant to do this for you. Switching from sole trader to limited company could save you tax.

If you intend to trade as a sole trader you must notify HMRC. However sole trader. Registering your sole trader business.

Sole traders Its simpler to set up as a sole trader but youre personally responsible for your businesss debts. Are you a sole trader. Normally when you register with Companies House you have to supply them with a wealth of paperwork including a Memorandum of Association and your Articles of Association.

Youll need to file a tax return every year. On the other hand a non-limited company has unlimited liability. All limited companies must register with Companies House who will make the company information publicly available on their website.

Sole traders have an easier accounting job. However if youre starting a limited company or limited liability partnership LLP you are legally required to. Apply within minutes in one streamlined process.

If you do this then you will need to register your company with Companies House. Some businesses start out as sole traders and then change to operate as limited companies. The quick answer is that no a sole trader business does not need to register with Companies House.

What is Companies House. The confirmation statement confirms details such as registered office names of directors and the business activity. You dont have to register a company name or complete any Companies House forms such as the annual Confirmation Statement.

This means companies must provide the details of who their shareholders and directors are as well as file a copy. Here are the steps you need to take to complete the process. You can do this online or by post.

The company also needs to file a confirmation statement annually which updates or confirms the details held by Companies House are still correct. You can trade under your own name or you can choose our name reservation service to register your business name at Companies House while trading as a sole trader see more information in our FAQ. Registering as a sole trader Setting up a sole trader business is straightforward.

There are over 1750000 documents indexed. We pay the 12 incorporation fee on your behalf. Register for Self Assessment.

For example your name cant be the same as another registered companys. Register a limited company and open a business account all in one go for FREE. You need to register for self-assessment with HMRC after which you need to wait up to 10 days for an activation.

Instead you should register with HMRC to let them know they should expect an annual Self Assessment tax return from you. Alternatively you can register directly with Companies House online at a cost of 12. Limited companies dont have to make Income Tax payments on account for example but sole traders do.

Get your certificate of incorporation within hours. When youre registering a company name you must follow a set of rules as outlined on the HMRC website. You must notify HMRC within 3 months or face a fine.

Complete a simple form in 5 min Once your payment has been accepted youll be directed to fill out our short 100 online application.

A Limited Company Is A Business Structure That Offers Its Members Shareholders And Directors Limited Company Public Limited Company Limited Liability Company

A Limited Company Is A Business Structure That Offers Its Members Shareholders And Directors Limited Company Public Limited Company Limited Liability Company

Should I Be Self Employed A Sole Trader Or Run A Limited Company

Should I Be Self Employed A Sole Trader Or Run A Limited Company

Does A Sole Trader Need To Register With Companies House The Accountancy Partnership

Does A Sole Trader Need To Register With Companies House The Accountancy Partnership

Understanding Dbas And How They Can Be Dangerous For Your Small Business Incfile

Understanding Dbas And How They Can Be Dangerous For Your Small Business Incfile

Sole Proprietorship What Is A Proprietorship

Sole Proprietorship What Is A Proprietorship

How To Change Trading Name For A Sole Trader 14 Steps

How To Change Trading Name For A Sole Trader 14 Steps

Sole Traders Are The Most Common Type Of Business

Sole Traders Are The Most Common Type Of Business

Sole Trader Vs Limited Company How To Set Up A Business

Sole Trader Vs Limited Company How To Set Up A Business

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 4 Forms Of Business Ownership Introduction To Business

Pros And Cons Of A Sole Proprietorship

Pros And Cons Of A Sole Proprietorship

Uk Letterhead Legal Requirements A Quick Guide To Help You Get It Right

Uk Letterhead Legal Requirements A Quick Guide To Help You Get It Right

5 Sole Proprietorship Pros And Cons

5 Sole Proprietorship Pros And Cons

6 Steps For Switching From A Sole Proprietorship To Llc

6 Steps For Switching From A Sole Proprietorship To Llc

Ultimate Guide To Registering As A Sole Trader Thecompanywarehouse Co Uk

Ultimate Guide To Registering As A Sole Trader Thecompanywarehouse Co Uk

Ultimate Guide To Registering As A Sole Trader Thecompanywarehouse Co Uk

Ultimate Guide To Registering As A Sole Trader Thecompanywarehouse Co Uk

Ultimate Guide To Registering As A Sole Trader Thecompanywarehouse Co Uk

Ultimate Guide To Registering As A Sole Trader Thecompanywarehouse Co Uk

Ultimate Guide To Registering As A Sole Trader Thecompanywarehouse Co Uk

Ultimate Guide To Registering As A Sole Trader Thecompanywarehouse Co Uk

Company Registration Number What Is It

Company Registration Number What Is It

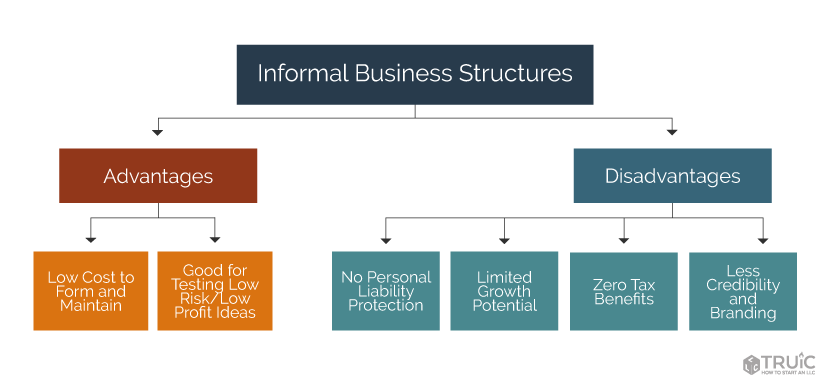

Business Structure How To Choose A Business Structure Truic

Business Structure How To Choose A Business Structure Truic