List Four Advantages Of The Partnership Form Of Business Ownership

In comparison limited partnerships require owners to file paperwork with the state and compose formal agreements that describe all of the important details of the partnership such as who is responsible for certain debts. Limited partners are excluded from management decisions.

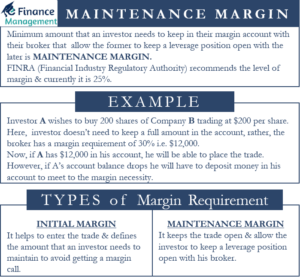

Advantages And Disadvantages Of Partnership Efinancemanagement

Advantages And Disadvantages Of Partnership Efinancemanagement

As a business owner youre your own boss.

List four advantages of the partnership form of business ownership. Having a partner can not only make you more productive but it may afford you the ease and flexibility to pursue more business opportunities. The advantages of partnership are as follows- 1. The partnership arises out of an agreement between two or more persons.

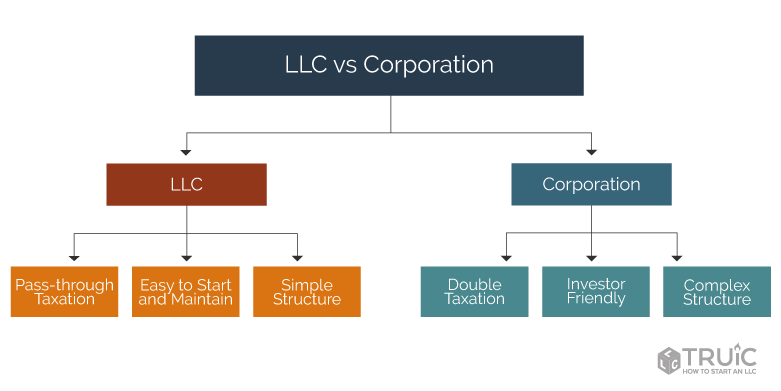

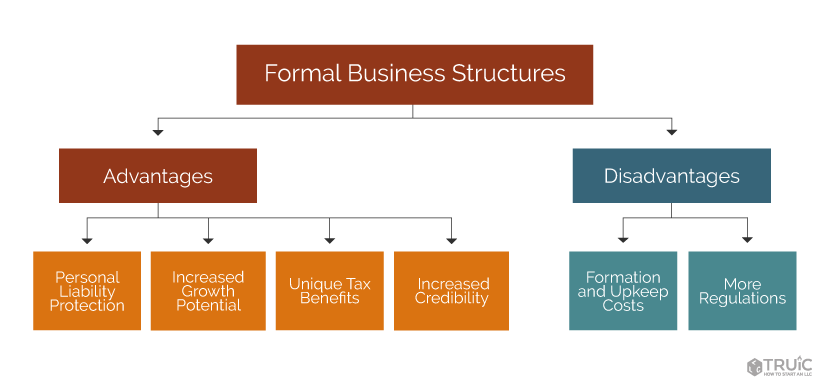

There are several advantages that generally speaking come with success in business ownership. Establishing a corporation makes the business a separate and self-standing entity. All businesses must have some form of legal ownership such as a sole proprietorship and a corporation.

1 Less formal with fewer legal obligations One of the main advantages of a partnership business is the lack of formality compared with managing a limited company. Business is easy to register. Having the courage to take a risk and start a venture is part of the American dream.

They dont require a formal agreement. For instance limited partners typically investors have the opportunity to do well financially without being involved in the day-to-day activities of the business while general partners are liable for any debts or legal judgments against the business. The business partnership offers a lot of advantages to those who choose to use it.

The accounting process is generally simpler for partnerships than for limited companies. When speaking of a partnership one is usually referring to a four advantages of the partnership form of business ownership Greater management skills greater retention of competent employees greater sources of financing ease of formation and freedom to change. This is the distinctive advantage partnership enjoys over the sole proprietor because everything is done by mutual consultation.

In spite of high financial risk running your own business gives you a chance to make more money than if you were employed by someone else. Because youre in charge you decide when and where you want to work. One of the advantages of having a business partner is sharing the labor.

Decisions can be very effective. People or rather entrepreneurs do not have to go through difficult and cumbersome processes in order to register a partnership business. There must be at least two persons to form a partnership.

The Advantages of Corporate Ownership Over Sole Proprietorship. Being a business owner can be extremely rewarding. The business to be carried on by a partnership must always be lawful.

As a business owner youre your own boss. Advantages of Small Business Ownership. The partnership form of organisation enjoys the benefit of the ability experience and talents of the partners.

Reduced liability Because a partnership can sign contracts and borrow money it carries fewer of the liability burdens than a sole proprietorship. One advantage for limited partners is that their liability is limited to the extent of their investment in the company. The maximum number is 20.

Success brings with it many advantages. There should be an agreement among the partners to share the profits of the business. For example to register a Joint Stock Company can be a really cumbersome process.

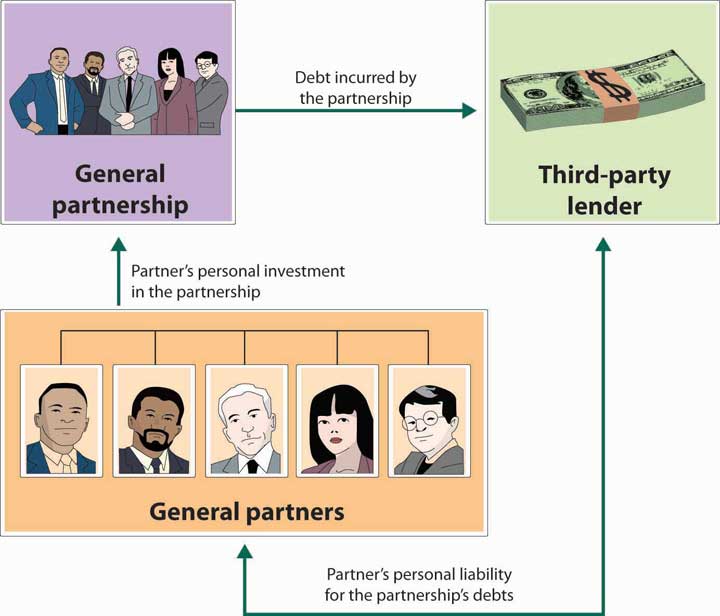

Ease of Formation 2. There are a few different types of partnerships-- general limited and limited liability partnerships -- each with its own advantages and disadvantages. One disadvantage is that limited partnerships file taxes as a separate entity though profits or losses are passed through and declared on partners personal tax returns.

Rich talent pool and strong working relationships. A limited partnership may not be registered as a limited liability partnership. Skills and recourses combined.

General partnerships allow both partners to invest in a business with 100 responsibility for any business debts. You cant get fired. THIS SET IS OFTEN IN FOLDERS WITH.

Partnership businesses are not that difficult to register and start. It might even eliminate the downside of opportunity costs.

Explore Our Sample Of Speaking Engagement Contract Template For Free Contract Template Contract Contract Agreement

Explore Our Sample Of Speaking Engagement Contract Template For Free Contract Template Contract Contract Agreement

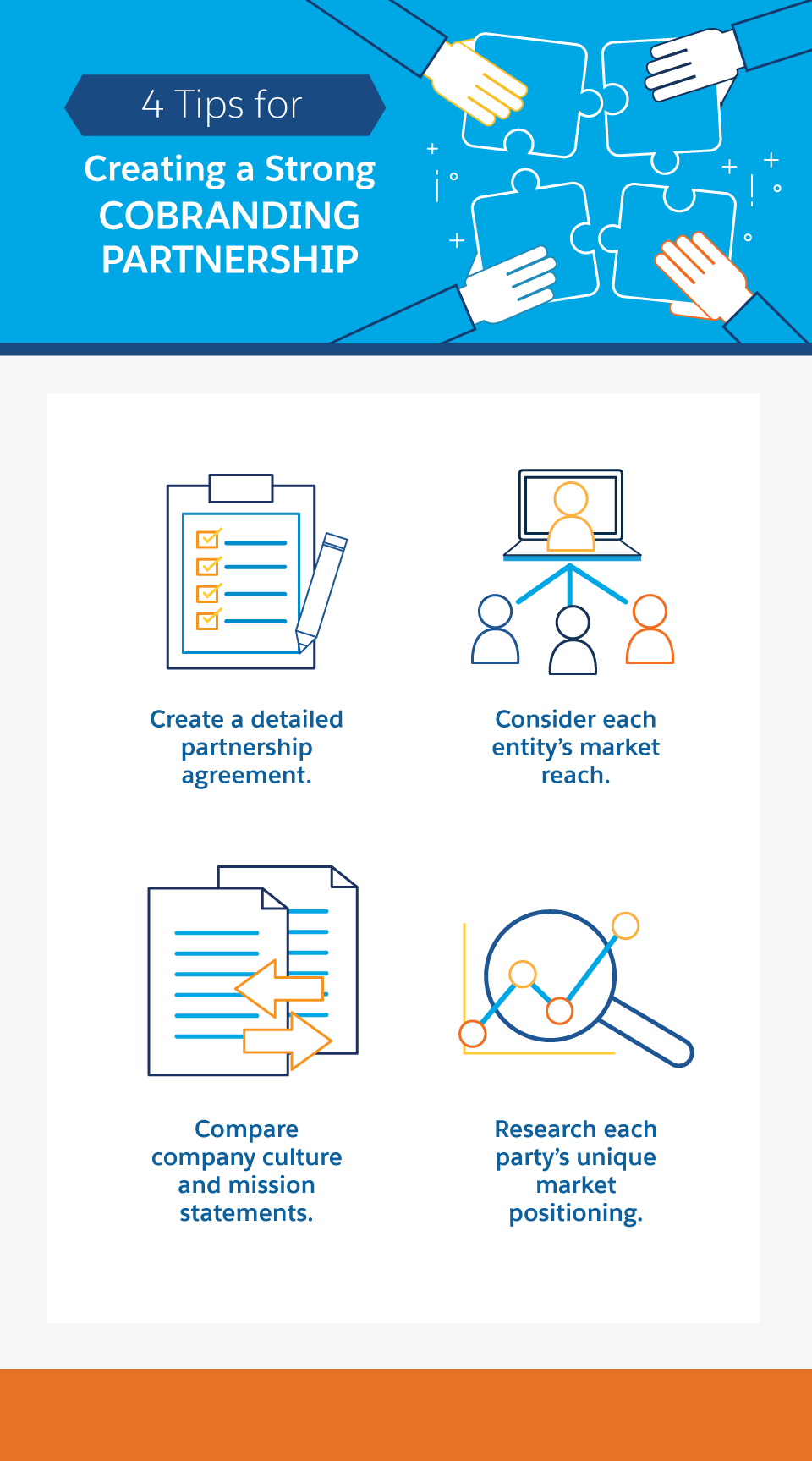

The Business Benefits Of Complementary Partnerships Salesforce Canada Blog

The Business Benefits Of Complementary Partnerships Salesforce Canada Blog

The Business Benefits Of Complementary Partnerships Salesforce Canada Blog

The Business Benefits Of Complementary Partnerships Salesforce Canada Blog

4 Types Of Business Partnerships Which Is Best For You Score

4 Types Of Business Partnerships Which Is Best For You Score

Browse Our Sample Of It Partnership Agreement Template For Free Contract Template Business Template Professional Templates

Browse Our Sample Of It Partnership Agreement Template For Free Contract Template Business Template Professional Templates

The Seven Most Popular Types Of Businesses Volusion

The Seven Most Popular Types Of Businesses Volusion

Sole Proprietorships Advantages Disadvantages Piktochart Infographic Teaching Business Business Basics Sole Proprietorship

Sole Proprietorships Advantages Disadvantages Piktochart Infographic Teaching Business Business Basics Sole Proprietorship

Partnership Definition Features Advantages Limitations

Partnership Definition Features Advantages Limitations

4 Most Common Business Legal Structures Pathway Lending

4 Most Common Business Legal Structures Pathway Lending

Partnership Definition Features Advantages Limitations

Partnership Definition Features Advantages Limitations

Comparison Chart Of Business Entities Startingyourbusiness Com Business Sole Proprietorship Comparison

Comparison Chart Of Business Entities Startingyourbusiness Com Business Sole Proprietorship Comparison

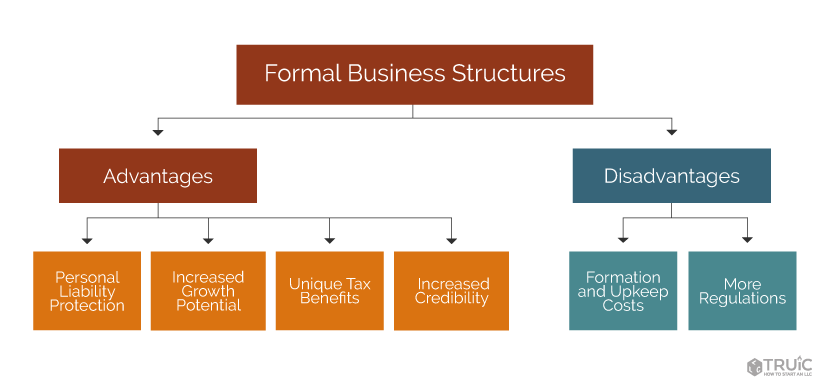

Business Structure How To Choose A Business Structure Truic

Business Structure How To Choose A Business Structure Truic

Business Structure How To Choose A Business Structure Truic

Business Structure How To Choose A Business Structure Truic

Advantages And Disadvantages Of Partnership Efinancemanagement

Advantages And Disadvantages Of Partnership Efinancemanagement

10 Best States To Form An Llc Infographic Business Infographic Llc Taxes States

10 Best States To Form An Llc Infographic Business Infographic Llc Taxes States

Free Land Contract Template Inspirational Simple Land Contract Template Templates Data Contract Template Separation Agreement Template Weekly Planner Template

Free Land Contract Template Inspirational Simple Land Contract Template Templates Data Contract Template Separation Agreement Template Weekly Planner Template

10 Partnership Agreement Templates Word Excel Pdf Templates Memorandum Word Template Legal Forms

10 Partnership Agreement Templates Word Excel Pdf Templates Memorandum Word Template Legal Forms

4 Types Of Partnership In Business Limited General More

4 Types Of Partnership In Business Limited General More